Project 1

1. Project 1

1.5. Page 2

Training Room 2: Analyzing Transactions

What I Need to Know

T-accounts are partial skeletons of ledger account forms, showing the account title and the debit and credit sides of the account. View “T-Account” to see the T structure.

Why Is This Important?

T-accounts are used for rough work to help you analyze business transactions. They are also used by accountants to plan complex journal entries, before entering the transaction in the journal of the business. They are called T-accounts, because these forms are in the shape of a T, with debits on the left and credits on the right. T-accounts help ensure that you are always recording the same debit amount as the credit amount for each transaction. The value of this will become apparent as you analyze daily business transactions.

What Do I Need to Do?

First we need to do a little review from FIN1015.

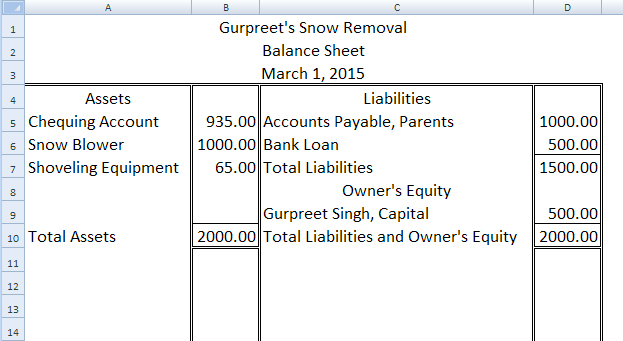

Take a look at Gurpreet’s beginning balance sheet below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The accounts on the left side of the balance sheet—assets—have debit balances. The accounts on the right side of the balance sheet—liabilities and capital—have credit balances.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

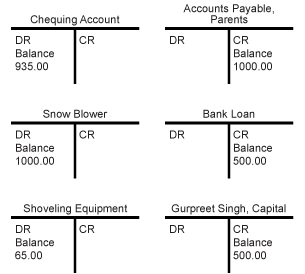

The T-accounts for Gurpreet's beginning balances are on the right.

If you add all the numbers under debits (DR), you will see that they equal the total of the numbers under credits (CR).

The balance side of each type of account never changes. Assets may get bigger or smaller, but they will always have a debit balance. Liabilities and capital may get bigger or smaller, but they will always have a credit balance. See “Left = Right Example 2” for a visual look at this concept.

Each transaction conducted by a business affects the accounting equation. For instance, any cash received or spent will change the total assets. Take a look at “Accounting Equation.”

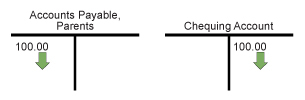

The balance sheet totals have changed, but the left side still equals the right side. The T-accounts for this transaction are as follows:

Both of these accounts have decreased. Gurpreet now owes his parents less money, so the amount owed, or the liability account that is going down, is a debit, on the left side of the T-account. An asset that is going down is a credit, on the right side of the T-account.

Let’s review.

© ktsdesign/3924820/Fotolia

Remember that in the balance sheet, assets are on the debit (left) side, so that is the balance side for assets. The balance side is always the increase side. Therefore, an asset going down would be on the opposite side—a credit. The chequing account going down is a credit.

The same is true for liability accounts. Liabilities are on the credit (right) side of the balance sheet, so that is the balance side for liabilities. The balance side is always the increase side. Therefore, a liability going down would be on the opposite side—a debit. The accounts payable, parents account going down is a debit.

Debits must always equal credits, so the amount on one side must always be the same as the amount on the other side.

Let’s try analyzing a couple of transactions together, and then you can do some practice before you go on to the Time to Work assignments.

© Alexey Afanasyev/8176652/Fotolia

Transaction 1

Gurpreet bought a new snow blower for his business for $600.00. You need to think through the question steps to decide which account to debit and which account to credit. Work through “Question Steps” now.

Transaction 2

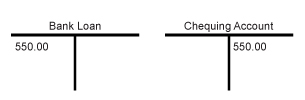

Gurpreet gave the bank $550.00 to repay some of his loan.

Do you remember the steps to record this?

This should become automatic as you work through more transactions. You might want to print the following Transaction Analysis Steps for easy reference. These steps are also available in the Toolkit for future reference.

Step 1: Which accounts are affected? (refer to the account titles and place on the T-accounts)

Step 2: What types of accounts are these?

Step 3: What does the T look like for this type of account? (refer to

Analyzing the Balance Sheet in Tips and Tricks in the Toolkit)

Step 4: Are these accounts increasing or decreasing?

Step 5: Are these accounts debits or credits?