Project 1

1. Project 1

1.9. Page 2

Training Room 3: Analyzing Temporary Capital Accounts

What I Need to Know

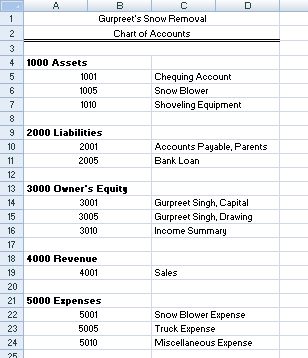

So far, we have looked at using T-accounts to help analyze the permanent accounts of a business—Assets, Liabilities, and Capital. This training room will show you how to analyze transactions affecting the temporary Capital accounts of Income Summary, Drawing, Revenue, and Expenses that you added to the chart of accounts of the ledger in FIN1015.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

These accounts are called temporary, because they are only open for the duration of a fiscal period. At the end of the fiscal period, the amounts in these accounts will be transferred into the permanent Capital account. A fiscal period is any period of time over which earnings are measured, such as one month, six months, one year, or whatever time period the business wants to measure. You will learn about how these accounts are transferred at the end of the fiscal period in FIN1030.

© Andrzej/10549781/Fotolia

Why Is This Important?

A business must keep a record of all expenses and revenues to evaluate if it is making money or losing money, and to be aware of exactly how it is spending its money. This awareness will allow the business to try to reduce expenses and make decisions to help maximize its profits.

What Do I Need to Do?

Let’s take a closer look at these types of transactions to see how to record them in the temporary Capital accounts.

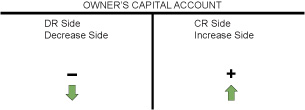

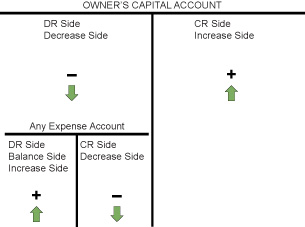

Recall the T-account for Capital below.

Revenue

Revenue is any money the business makes from its operations, such as sales from customers. This results in an increase to Capital. As you noticed in the last training room, the business could also have an increase in Capital if the owner decides to invest money into the business. By having this recorded separately, it is easy to see how profitable sales have been. The T-account for Revenue is exactly the same as the T-account for Capital.

© Alexey Afanasyev/8176652/Fotolia

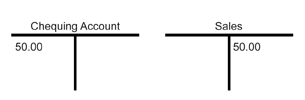

For example, Gurpreet received $50.00 from his first customer, which he quickly deposited into his chequing account. What do you think the T-account looks like now?

Step 1: Which accounts are affected? (refer to the account titles and place on T-accounts)

Step 2: What types of accounts are these?

Step 3: What does the T look like for this type of account? (refer to

Analyzing the Balance Sheet in Tips and Tricks in the Toolkit)

Step 4: Are these accounts increasing or decreasing?

Step 5: Are these accounts debits or credits?

Notice that both of these accounts increased, but there is only one debit and one credit.

Expenses

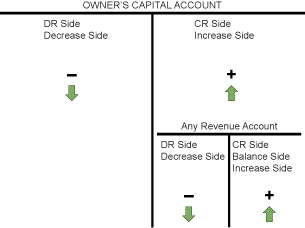

The Expense accounts are used to track the money spent to keep the business operating. The more money spent on an item, the less Capital a business will have—or less profit.

An expense will decrease the Owner’s Capital. Therefore, it is on the decrease, or debit, side of the Capital account. This becomes the balance side for temporary Expense accounts. Expenses are added on the debit side. At the end of the fiscal period this total expense debit will be transferred to the owner’s permanent Capital account—decreasing Capital.

© Alexey Afanasyev/8176652/Fotolia

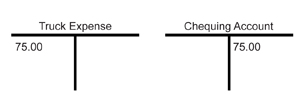

For example, let’s assume that Gurpreet used $75.00 from his chequing account to pay for gas for his truck. The two accounts that will be affected are the Chequing account and Truck Expense, since gas is part of the expense of driving a truck. What would these T-accounts look like?

Step 1: Which accounts are affected? (refer to the account titles and place on T-accounts)

Step 2: What types of accounts are these?

Step 3: What does the T look like for this type of account? (refer to

Analyzing the Balance Sheet in Tips and Tricks in the Toolkit)

Step 4: Are these accounts increasing or decreasing?

Step 5: Are these accounts debits or credits?

Again, debits equal credits—the left side equals the right side of the T-account.

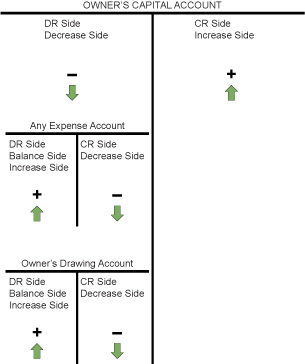

Drawing

The owner’s Drawing account is any money that the owner withdraws for personal use. The owner has the right to take out as much money as she or he wants—after all, she or he is the owner. This withdrawal decreases Capital and is treated exactly the same as an expense. You can think of it as the owner’s salary expense.

GAAP

1. The Business Entity Concept

The Business Entity Concept provides that the accounting for a business or organization be kept separate from the personal affairs of its owner, or from any other business or organization. This means that the owner of a business should not place any personal assets on the business balance sheet. The balance sheet of the business must reflect the financial position of the business alone.

© Alexey Afanasyev/8176652/Fotolia

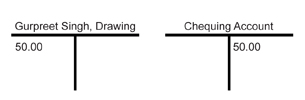

For example, if Gurpreet wanted to go out for dinner and a movie, he could withdraw $50.00 from his Chequing account. What would the T-account for this transaction look like?

Step 1: Which accounts are affected? (refer to the account titles and place on T-accounts)

Step 2: What types of accounts are these?

Step 3: What does the T look like for this type of account? (refer to

Analyzing the Balance Sheet in Tips and Tricks in the Toolkit)

Step 4: Are these accounts increasing or decreasing?

Step 5: Are these accounts debits or credits?

Income Summary

Income Summary is a temporary account used to store the total revenue, expenses, and profit/loss of a business. This account is only used at the end of the fiscal period when completing the closing entries for a business. The Income Summary account is not used until FIN1030 and will be discussed in more detail at that time.