Project 1

1. Project 1

1.14. Page 3

Training Room 4: Journalizing Transactions

Time to Practise

Open Gurpreet’s General Journal and save this in your FIN1020 Course Folder as Gurpreet’s General Journal.

Journalize the following three transactions for Gurpreet, using the source documents below.

You may wish to draw the T-accounts for each transaction on a piece of paper to help you analyze the transaction or you can use T-Accounts Template. Remember that these are rough forms to help you sort through which accounts are debited and which are credited. As you get more familiar with this process, you may be able to skip drawing the T-accounts, at least for some of the more common transactions. Accountants often use T-accounts to sort out difficult or unusual transactions.

However, no matter how experienced a person is in entering transactions, the same steps must be thought through to determine which account is debited and which account is credited. Refer to the Transaction Analysis Steps if you need to refresh your memory.

Step 1: Which accounts are affected? (refer to the account titles and place on T-accounts)

Step 2: What types of accounts are these?

Step 3: What does the T look like for this type of account? (refer to Analyzing the Balance Sheet in Tips and Tricks in the Toolkit)

Step 4: Are these accounts increasing or decreasing?

Step 5: Are these accounts debits or credits?

You may also wish to refer to the Analyzing Transactions chart, available in the Toolkit.

When you have finished journalizing the three transactions, click on “Check your answers” at the end of this practice segment to see if your journal is correct. Be sure to save these transactions to update Gurpreet’s journal, since you will be using this in the next training session.

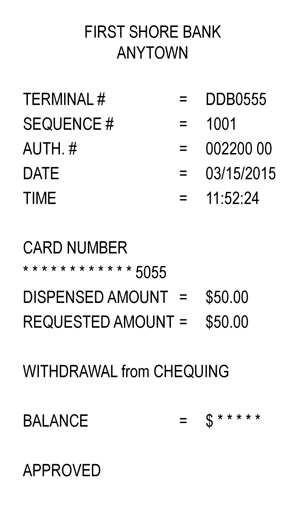

- On March 6, Gurpreet bought gas for his truck and used his debit card to withdraw money from his chequing account. Use the source document Debit Card—gas for truck.

Note that using a debit card is a credit to your account. A bank is a business and looks at this type of transaction from its perspective. The bank considers you a liability, and they owe you the money you have deposited. When you withdraw money, this is a debit to the bank's liability (or the amount owed to you) and a credit to the bank’s cash, since their money would be reduced. The term debit card comes from the bank, and is not to be confused with how you are entering the transactions for a business.

Gurpreet will also receive records from his bank for any transactions; therefore, he has those records as proof of the transaction. He will keep any transaction slips to check his bank record.

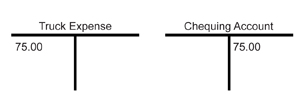

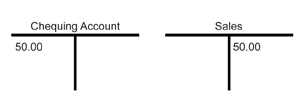

Recall the T-accounts you created for this in the last section.

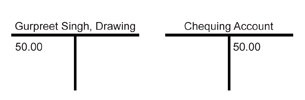

- On March 10, Gurpreet withdrew $50.00 from his chequing account for his personal use.

Check your T-accounts before entering this transaction in the journal.

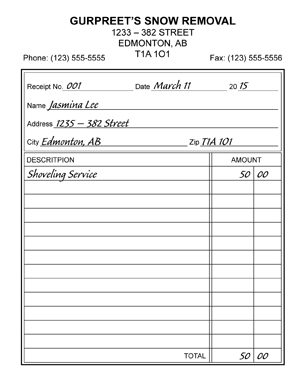

- On March 11, Gurpreet received $50.00 cash from his first customer for removing snow, and deposited the money in his chequing account.

Use Receipt No. 001 for the source document. Gurpreet wrote the following receipt in duplicate, one copy for his customer and one copy for his own records.

Check your T-accounts before you enter this transaction in the journal.

When you have completed the three transactions, check your answers.

Did you remember to enter the debit first and to indent the credits?

Did you remember to include the source document for each transaction and indent the source document?

Note that you can select these two amount columns and perform an auto sum to check that your debits equal your credits.

Did you remember to save your work? You will need this journal for the next training room.

Open General Journal Tempate, and save it as Gurpreet’s Journal Page 2. You will also need this journal in the next training room.

Using journal page 2, complete the following transactions for Gurpreet’s business for the rest of March. All revenue is put into the bank in the chequing account.

March 16: Received $200.00 from snow removal service, Receipt No. 002

March 17: Paid $50.00 for gas and oil for the snow blower, Cheque #002

March 20: Received $150.00 from snow removal, Receipt No. 003

March 22: Paid the bank $100.00 of amount owed, Cheque #003

March 24: Paid $75.00 for gas for his truck, Cheque #004

March 24: Received $100.00 from snow removal, Receipt No. 004

March 28: Paid his parents $100.00 of the amount owed, Cheque #005

To check your work, go to Gurpreet's Journal Page 2 Answer.

More Practice

Further journalizing practice is available for you below.

Note that a Chequing account is considered the same as cash, since the cash in the bank is readily available.

Open a new General Journal Template, and save the form as pr1-tr4-p (stands for Project 1, Training Session 4, Practice, which is the file naming format used for this course).

Using the account titles from Fine Fashions Chart of Accounts, journalize the following transactions for July on page 2 of a general journal.

July 1 |

Paid $2000 for rent, Cheque #100 |

5 |

Received $1000 for Sales, Receipt No. 020 |

7 |

Paid $1500 to F. Fisher for amount owed, Cheque #101 |

8 |

Received $3500 for Sales, Receipt No. 021 |

10 |

Paid $500 to repair store equipment, Cheque #102 |

10 |

Paid $400 for utilities, Cheque #103 |

16 |

Owner invested $3000 in the business, Memo #40 |

21 |

Sold old store equipment and received $1000, Receipt No. 022 |

25 |

Purchased supplies for $200.00, Cheque #104 |

29 |

Charged A/P L. Ritchie Company $2000.00 for supplies, Purchase Order #001 |

To check your work, go to Fine Fashions Journal Page 2 Answer.