Project 1

1. Project 1

1.2. Page 2

Project 1: The Worksheet

What Do I Need to Know?

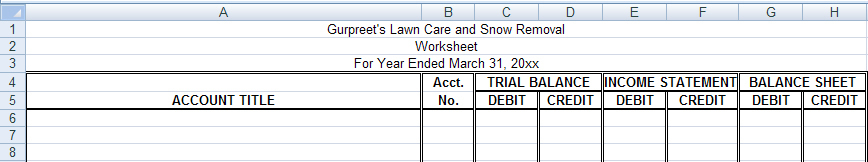

Accountants generally use an eight-column worksheet to have the space to include as much information as possible; however, a six-column worksheet will be used throughout this project to present this new concept to you as simply as possible.

This training room will concentrate on the first two columns, which are for the trial balance. You completed a trial balance at the end of FIN1020. The trial balance on a worksheet is very similar. In fact, most businesses would do the trial balance section on the worksheet to make sure that debits equaled credits in their ledger, before they would do a formal trial balance.

Like the formal trial balance, the worksheet has a heading that describes who, what, and when. The only difference is the “when” line. The worksheet will calculate the profit or loss a business has experienced for a certain period of time, called a fiscal period. This could be a month, a quarter of a year (three months), half of a year (six months), or a year. So, the fiscal period needs to be indicated in the “when” line of the worksheet.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Note: The year 20xx refers to the current year in this course.

All of the account titles, numbers, and the balances in the debit and credit columns from the general ledger are transferred into this first section of the worksheet. It is advisable to include all of the accounts (even those with no balances), so that nothing is missed.

Why Is This Important?

In FIN1020, when you completed a trial balance, you checked that all of the debits equaled the credits. It is also important to do this in the worksheet to make sure that your ledger is in balance, or that the debits equal credits, before you can determine if a profit or a loss was made by the business. You also want to make sure that all of your balances are correct before you extend them to the rest of the worksheet, which you will be doing in Training Room 2.

What Do I Need to Do?

Step 1: Open Worksheet Template, and save it in your course folder as “Gurpreet’s Worksheet.”

Step 2: Enter the heading for the worksheet for the year ended March 31, 2016. Make sure it describes the “who,” “what,” and “when.”

Step 3: Open Gurpreet’s Ledger, and save this in your FIN1030 folder as “Gurpreet’s Ledger.”

Step 4: Refer to Gurpreet’s Ledger, and copy all the account titles and account numbers into the worksheet under the Account Title and Acct. No. columns. Also copy in the last account balance in each ledger account to the appropriate debit and credit columns in the trial balance section of the worksheet. Remember to include all of the accounts, even those with no balances, so that nothing is missed.

It may be easier for you to work with both worksheets on the screen. View Viewing Side by Side for instructions on how to view these two files on the screen at the same time. If you need to access this information later, it is available in the course Toolkit.

Step 5: Add the total debits and credits, and make sure they are equal. Remember that you can select both columns and add them at the same time by using the AutoSum icon.

View Adding Multiple Columns for instructions on how to add multiple columns using AutoSum. If you need to access this information later, it is available in the course Toolkit.

Step 6: If the totals are equal, place a single line above the totals and a double line under the totals.

For instructions on how to draw these lines, view Double Ruling. If you need to access this information later, it is available in the course Toolkit.

If your totals are not equal, you have copied something incorrectly from the ledger. Check that you put the final balance in the proper debit or credit column and add again.

You can check your answers using Gurpreet’s Completed Worksheet.

If you made any errors, you need to correct them and save the corrected worksheet as you will be using it in the next training room.