Project 2

1. Project 2

1.2. Page 2

Project 2: Financial Statements

What Do I Need to Know?

Have you ever heard the expression, “It takes money to earn money”?

If a business wants to earn money, it has to spend money. A business may need to buy a computer, rent office space, or invest in equipment so that it can operate. Depending on the type of business, there will be other expenses that will have to be paid out before money comes in. For example, Gurpreet had to shovel a sidewalk for a customer before the customer would pay him. To do that, he had to buy a shovel, pay for the gas to travel to the customer’s home, and have the right clothes for the weather.

Money is put into a business or invested with the intention of being able to earn more money.

© 2009 Jupiterimages Corporation

Revenue refers to the earnings that a business will make from activities, while expenses are costs incurred by a business for the purpose of generating revenue. Both are shown on the income statement. The accounts that appear on the income statement are considered temporary accounts because they are only open for the fiscal period, and then they are closed. Closing out accounts will be discussed in detail in Project 3.

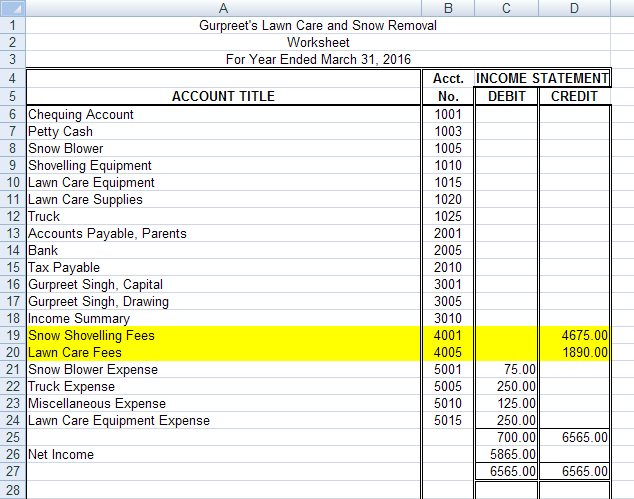

The completed worksheet for Gurpreet’s Lawn Care and Snow Removal prepared in Project 1 is shown below. The shaded portion of the worksheet is the section used to prepare the income statement and is the section that we will concentrate on in this training room.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Why Is This Important?

The income statement columns of the worksheet are the rough work needed to complete a formal income statement or a statement showing the amount of net income (profit) or net loss that a business has had during the time period indicated in the heading portion of the worksheet.

Two Generally Accepted Accounting Principles are in effect here. Do you know what they are?

6. The Time Period Concept

The Time Period Concept says that accounting takes place over specific time periods known as fiscal periods. These fiscal periods are of equal length and are used when measuring the financial progress of a business.

7. The Matching Principle

The Matching Principle states that each expense item related to revenue earned must be recorded in the same accounting period as the revenue it helped to earn. If this is not done, the financial statements will not measure the results of the company’s operations fairly.

What Do I Need to Do?

To complete the income statement, you need to complete the following steps.

1. Heading

The heading of the income statement follows the same format as for the other financial statements you have studied so far.

- who: the name of the business

- what: the name of the document

- when: the date of the fiscal period

Note that the date of an income statement must cover a period of time, such as “For the Month Ended September 30, 20xx,” or “For the Quarter Ended March 31, 20xx,” or “For the Year Ended December 31, 20xx.” (Note: The word the does not appear in all of the financial statements in this course, but you should add the word when you do your work.) This is important information. If the net income for a company is $12 000, it is vital to know if that income was earned over one month, three months, or twelve months. The heading of Gurpreet’s income statement would look as follows:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

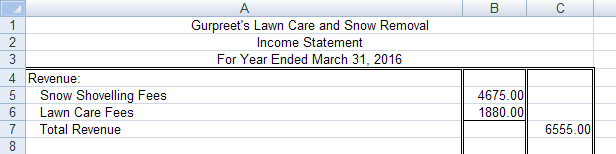

2. The Revenue Section

The amounts for the revenue section of the income statement are taken from the income statement credit column of the worksheet.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Simply title the section Revenue, and on the next line write the name of the revenue account(s) followed by the amount(s). Note how the account names are indented from the revenue title. The amounts of the revenue accounts are listed in the first column (the sub-total column) with a total line after the last amount. The words Total Revenue are written on the line beneath the last revenue account title and the amount of the total revenue is written in the second column. The second column is for totals only.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

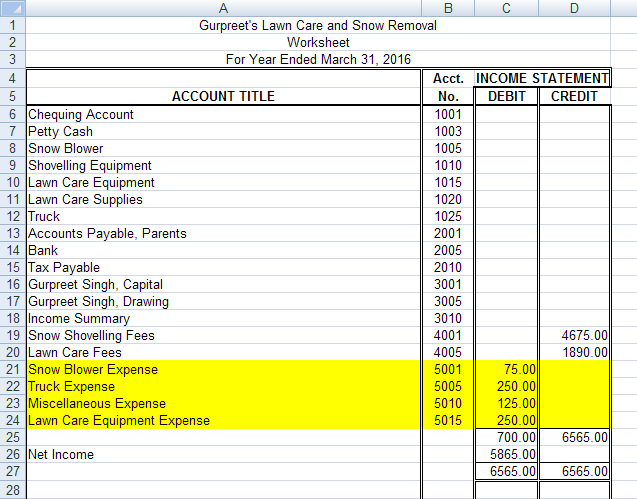

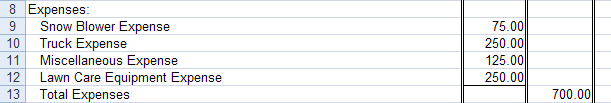

3. The Expenses Section

The amounts for the expenses section of the income statement are taken from the income statement debit column of the worksheet. Title the section Expenses, and on the next line list the expenses in the same order that they appeared in the worksheet. Note how the expense account names are indented from the expense title. The amounts of the expense items are listed in the first column (the sub-total column). The words Total Expenses are written on the line beneath the last expense account title and the amount of the total expenses is written in the second column.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The Net Income (or Net Loss) Section

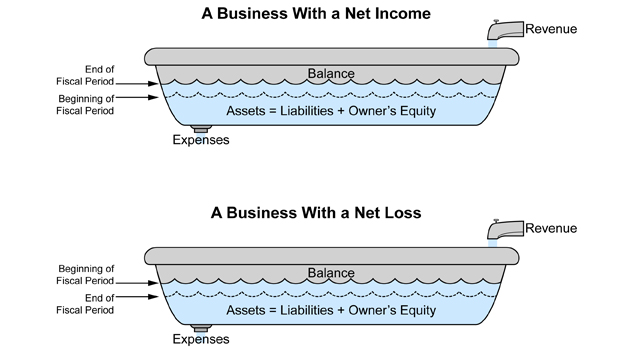

The net income or net loss section is used to calculate the net income or net loss by subtracting the expenses from the revenue. If more revenue is coming into a business than expenses being paid out, there is a net income. If more expenses are being paid out than revenue coming in, there is a net loss.

Important Note: The amount of the net income shown on the income statement should agree with the amount of the net income recorded on the worksheet. To see an example, view Gurpreet’s Net Income Section on Income Statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Notice that in the second column (the total column) there are only three numbers: total revenue, total expenses, and the difference between the two, in this case the net income. These are the most important numbers in this statement, and, by having them all in the same column, they are easy to find. These three numbers will indicate whether there was a net income or a net loss.

There are references available for you below to assist with the Time to Practise and the Time to Work sections of this training room.

To review how to complete an income statement using Excel®, watch the video Income Statement. This item is also available in the Toolkit for your reference.

Use the current year for all of the practices and assignments.

You may also refer to the following Income Statement Rubric, which includes a checklist of what belongs in the income statement.

An Income Statement Exemplar is also available for your reference.

These tools are also available in the Toolkit.