Project 2

1. Project 2

1.7. Page 2

Project 2: Financial Statements

What Do I Need to Know?

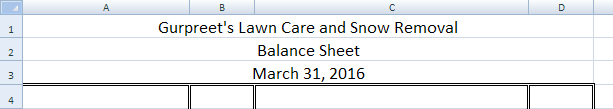

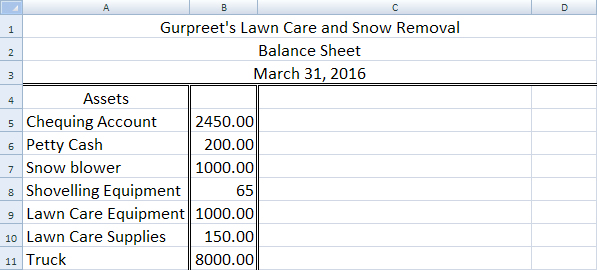

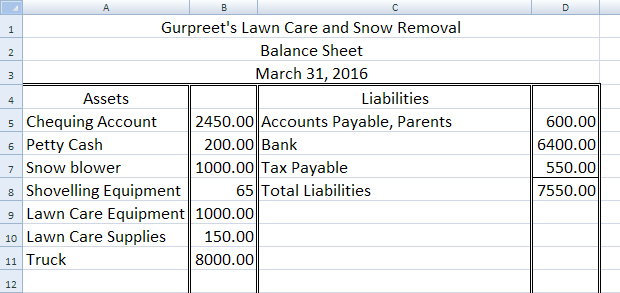

The shaded portion of the worksheet is the section used to prepare the balance sheet, as shown here in this sample completed worksheet for Gurpreet’s Lawn Care and Snow Removal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Why Is This Important?

The balance sheet columns of the worksheet are the rough work needed to complete a formal balance sheet or a statement showing the financial position on a specific date. They indicate the account balances at the end of the fiscal period.

© James Steidl/shutterstock

What Do I Need to Do?

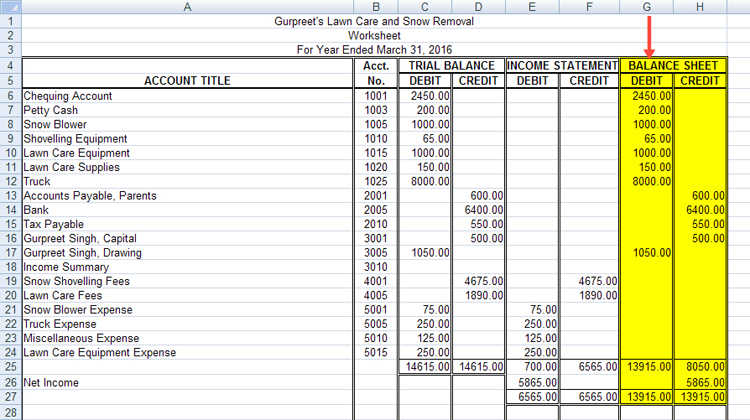

You are already familiar with how to do a balance sheet from your work in FIN1020, so this part will be review.

To complete the balance sheet, you need to complete the following steps.

1. Heading

The name of the company is written first, then the name of the statement, and finally the date the statement is prepared. This follows the same format as for the income statement.

- who: the name of the business

- what: the name of the statement

- when: date of the statement (as of a specific day)

Remember that the statement date on the balance sheet is for a point in time (one date only) and does not cover a period of time like the income statement. You may use “As at…” in the date line or simply the date alone.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Keep in mind that the date must be written in full as this is a formal statement. To refresh how to do this, view Changing the Date. This resource is also available in the Toolkit if you need it for review.

2. Assets Section

The figures for the assets section are obtained from the balance sheet debit column of the worksheet.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The account titles are listed in the same order as they appear on the worksheet. The total of the left side of the balance sheet must be written on the same line as the total of the right side of the balance sheet. Don’t calculate or write the total assets line until the totals for the liabilities and owner’s equity lines have been determined.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

3. Liabilities Section

The amounts for the liabilities section of the balance sheet are taken from the balance sheet credit column of the worksheet.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The liability accounts are written on the right-hand side of the balance sheet in the same order as shown on the worksheet. A single rule is drawn across the amount column under the amount of the last liability. The amount of the total and the words Total Liabilities complete this section.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

4. Owner’s Equity Section

The amount for the owner’s equity section of the balance sheet, or the owner’s capital, must be calculated and is not simply copied as in the asset and liability sections.

Recall from FIN1020 that assets – liabilities = capital.

What would Gurpreet’s total capital be?

![]()

12865.00 – 7550.00 = 5315.00

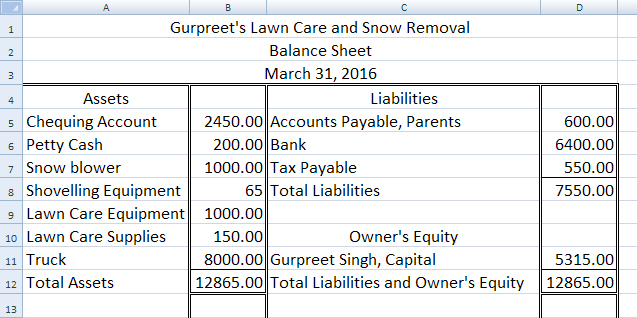

Gurpreet’s completed balance sheet would be:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Arrange it so that the final line Total Liabilities and Owner’s Equity is on the same line as Total Assets.

Remember to put a total line above all totals and a double rule under the last numbers to show that the statement is in balance and completed.

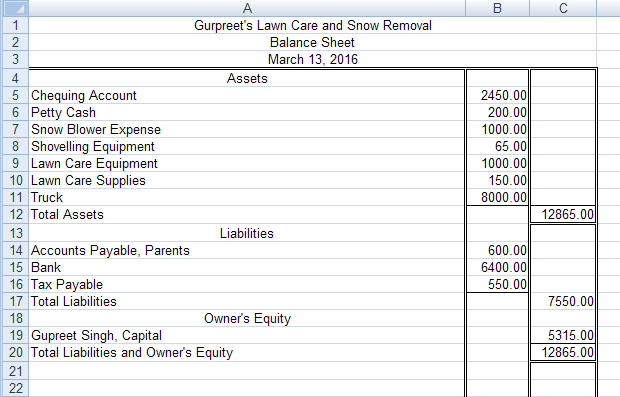

Some businesses prefer to use the report form to format the balance sheet, as you may recall when you were searching the Internet to compare balance sheets of various businesses in FIN1015. The report form presents the same information except that it lists the assets first and the liabilities and owner’s equity next in vertical arrangement as in the example below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Why Is This Capital Different from the Capital on the Worksheet?

The amount of the capital on the worksheet is the capital from the beginning of the year. You need to add the net income and subtract any drawing that the owner withdrew to update the capital at the end of the year. The capital account will be updated in Project 3 to reflect these changes.

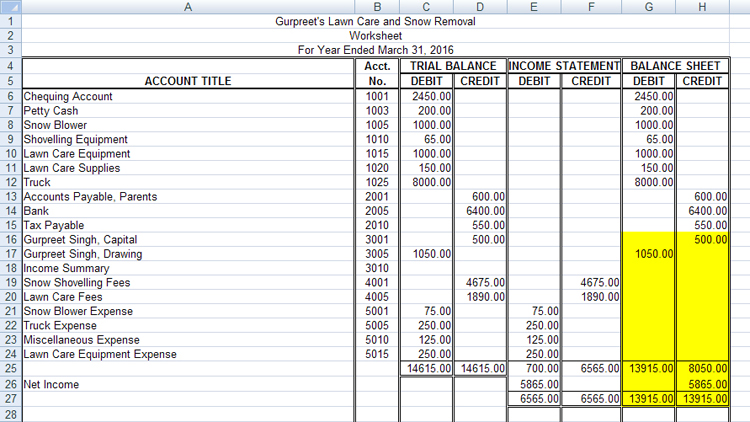

Let’s use the information from owner’s equity to calculate capital another way. Use the information from the balance sheet section of the worksheet below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

| Owner’s Capital March 31, 2015 | 500.00 |

| Add: Net Income | 5865.00 6365.00 |

| Subtract: Drawing | 1050.00 |

| Owner’s Capital March 31, 2016 | 5315.00 |

Important Note: Notice that this number is the same as when you subtracted liabilities from assets. This is a good way to double check that you have calculated the correct capital. Some businesses prefer to show all of these details on a balance sheet as follows:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The important thing is to have the correct capital amount. We will be doing a statement of owner’s equity to show these details in the next training room, so it is only necessary to show the ending capital on one line of the balance sheet in this training room.

You may want to refer to the Balance Sheet Rubric, which includes a checklist of what belongs in the balance sheet to help you complete your Time to Practise and Time to Work.

A Balance Sheet Exemplar is also available for your reference. These two items are also available for you to access in the Toolkit.