Project 4

1. Project 4

1.8. Page 3

Project 4: Budgeting

Time to Practise

Do as many of the following three practices as you need to feel confident in completing a budgeted income statement and a cash budget before continuing on to the assignment in Time to Work. This assignment will be submitted for assessment.

If, after completing all three practices, you are still not confident that you know how to complete these budgets, you may redo the practices or see your teacher for help.

Practice 1

Step 1: Open a Partial Budgeted Income Statement, and save it in your course folder.

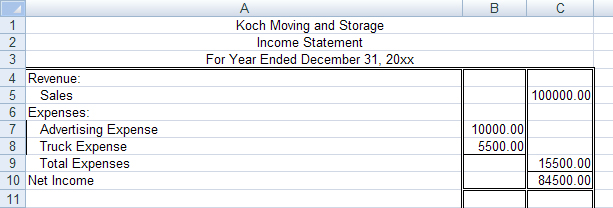

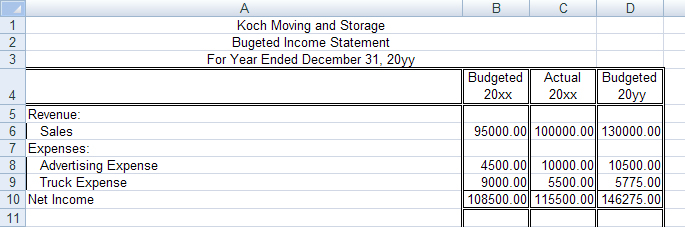

Step 2: Koch Moving and Storage projects a 30% increase in sales for the coming year and a 5% increase in expenses. The end of the fiscal period income statement for this company appears below. Complete the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

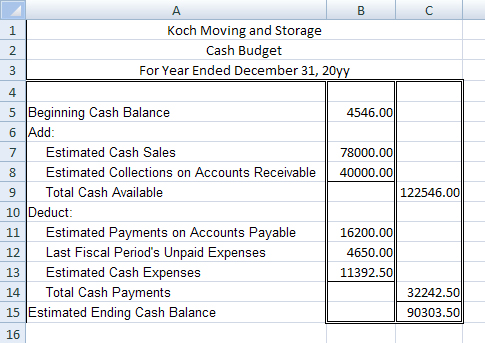

Step 3: Open Cash Budget Template, and save it in your course folder.

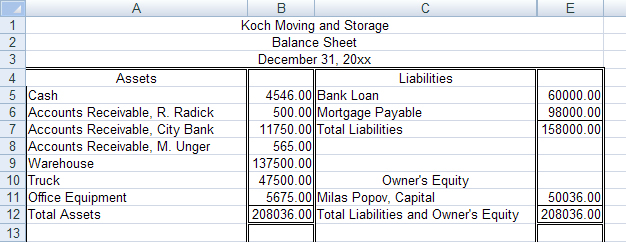

Step 4: Review the following balance sheet for this company.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

- The company estimates that about 60% of the customers pay cash. Refer to the budgeted income statement. Use the Budgeted 20yy column to calculate this number. The other 40% are accounts receivable customers from the actual fiscal period from whom cash will be collected in the next fiscal period. Use the Actual 20xx column to calculate this number.

Bank payments are $500.00 per month, and the mortgage payments are $850.00 per month.

The company will pay 30% of the last budget period’s expenses (Actual 20xx column).

The company estimates that it will pay 70% of expenses in cash for this fiscal period (Budgeted 20yy column).

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

If you need more practice, continue on to Practice 2 or Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

Practice 2

![]()

Step 1: Open a Partial Budgeted Income Statement, and save it in your course folder.

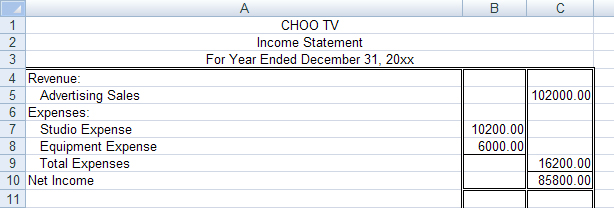

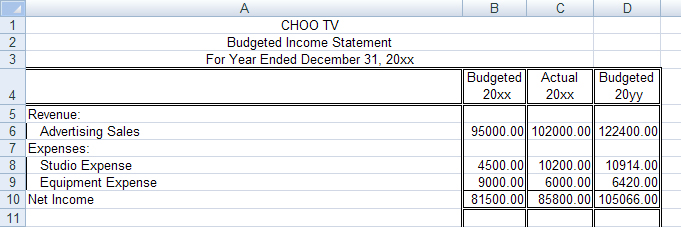

Step 2: CHOO TV projects a 20% increase in sales for the coming year and a 7% increase in expenses. The end of the fiscal period income statement for this company appears below. Complete the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

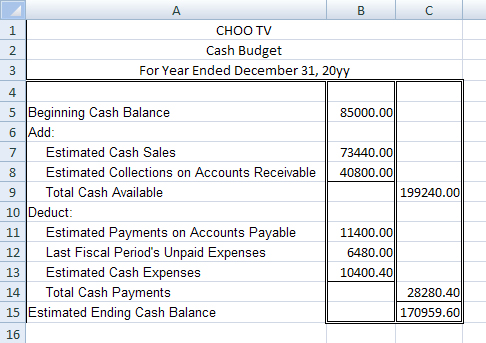

Step 3: Open the Cash Budget Template, and save it in your course folder.

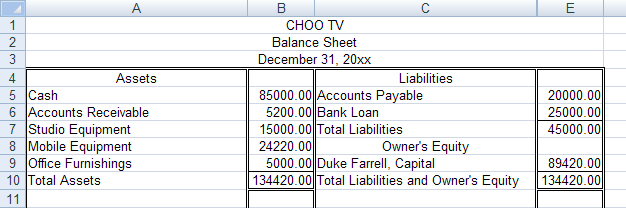

Step 4: Review the following balance sheet for this company.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

- The company estimates that about 60% of the customers pay cash. Refer to the budgeted income statement. Use the Budgeted 20yy column to calculate this number. The other 40% are accounts receivable customers from the actual fiscal period from whom cash will be collected in the next fiscal period. Use the Actual 20xx column to calculate this number.

- Accounts Payable payments are $600.00 per month, and the Bank Loan payments are $350.00 per month. Add these totals together for estimated payments on accounts payable.

The company will pay 40% of the last budget period’s expenses (Actual 20xx column).

The company anticipates that it will pay for 60% of the expenses in cash for this fiscal period (Budgeted 20yy column).

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

If you need more practice, continue on to Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

Practice 3

Step 1: Open Partial Budgeted Income Statement, and save it in your course folder.

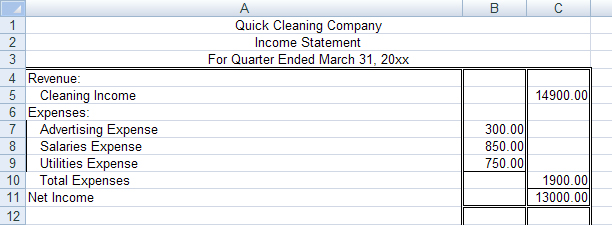

Step 2: Quick Cleaning Company projects a 25% increase in sales for the coming quarter and a 6% increase in expenses. The end of the fiscal period income statement for this company appears below.

Complete the budgeted income statement. Notice that it is for the quarter ended March 31, 20xx. The second quarter will be the next three months and will end June 30, 20xx.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

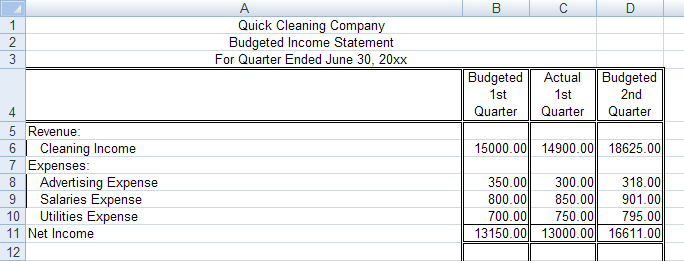

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

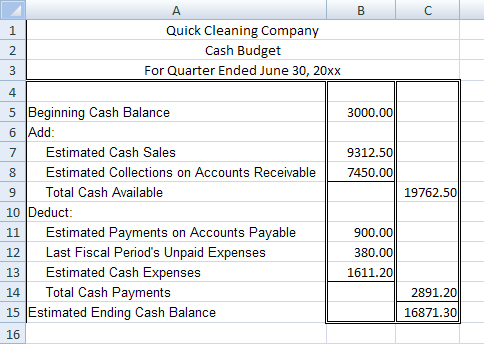

Step 3: Open Cash Budget Template, and save it in your folder. Note that the budgeted quarter, or the next three months, will end June 30, 20xx.

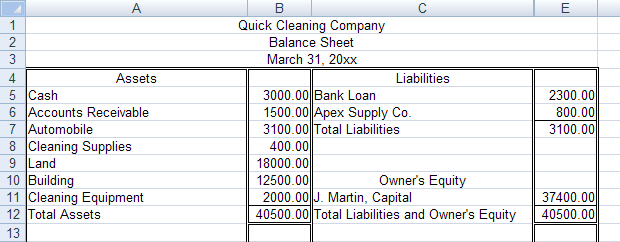

Step 4: Review the following balance sheet for this company.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 5: Complete a cash budget using the following information:

The company estimates that about 50%t of the customers pay cash. Refer to the budgeted income statement. Use the Budgeted 2nd Quarter column to calculate this number. The other 50% are accounts receivable customers from the actual fiscal period from whom cash will be collected in the next fiscal period. Use the Actual 1st Quarter column to calculate this number.

Bank Loan payments are $600.00 per quarter, and the Apex Supply Co. payments are $300.00 per quarter. Add these together for estimated payments on accounts payable.

The company will pay 20% of the last budget period’s expenses (Actual 1st Quarter column).

The company anticipate that it will pay 80% of its expenses in cash for this fiscal period (Budgeted 2nd Quarter column).

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.