Project 4

1. Project 4

1.9. Page 4

Project 4: Budgeting

Time to Work

Create a new folder in your FIN1030 Course Folder called Project 4 Training Room 2. All of the answers to the following questions must be saved in this folder for your teacher to mark.

Complete Assignment 1 and submit it to your teacher for assessment. Check with your teacher to see if it is necessary to complete the optional assignment.

Assignment 1

Step 1: Open Partial Budgeted Income Statement, and save it in your course folder as “Assignment 2 Budgeted Income Statement.”

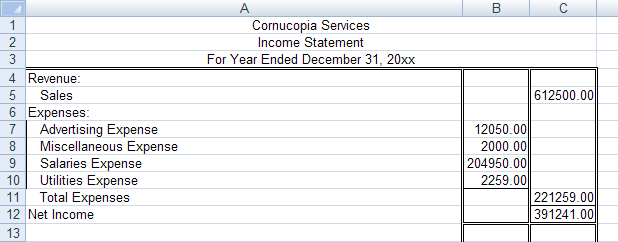

Step 2: Review the following income statement and complete the Actual column of the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 3: The owner of Cornucopia Services is projecting an increase in sales of 15% and an increase in expenses of 10% for the next fiscal period. Complete the budgeted income statement, and remember to save the statement when you have finished.

Step 4: Open Cash Budget Template, and save it in your course folder as “Assignment 1 Cash Budget.”

The end of the fiscal period balance sheet revealed that the company had $59 000.00 in the cash account.

The company estimates that about 70% of the customers pay cash. The other 30% are accounts receivable customers who will pay cash in the next fiscal period.

Bank loan payments are $1250.00 per month, and the mortgage payments are $2500.00 per month.

The company will pay 20% of the last budget period’s expenses.

The company anticipates that it will pay 80% of its expenses in cash for this fiscal period.

Step 5: Using the budgeted income statement, complete the cash receipts section and remember to save the statement when you have finished.

Assignment 2 (optional)

Check with your teacher to see if you need to complete the following optional assignment.

Step 1: Open Partial Budgeted Income Statement, and save it in your course folder as “Assignment 2 Budgeted Income Statement.”

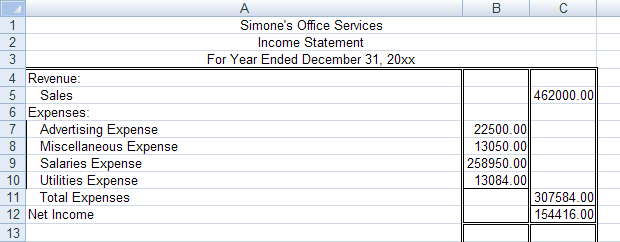

Step 2: Review the income statement below, and complete the Actual column of the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 3: The owner of Simone’s Office Services is projecting an increase in sales of 25% and an increase in expenses of 10% for the next fiscal period. Complete the budgeted income statement, and remember to save the statement when you have finished.

Step 4: Open Cash Budget Template, and save it in your course folder as “Assignment 2 Cash Budget.”

The end of the fiscal period balance sheet revealed that the company had $45 298.00 in the cash account.

The company estimates that about 60% of the customers pay cash. The other 40% are accounts receivable customers who will pay cash in the next fiscal period.

Bank loan payments are $1050.00 per month, and the mortgage payments are $2250.00 per month.

The company will pay 20% of the last budget period’s expenses.

The company anticipates that it will pay 80% of its expenses in cash for this fiscal period.

Step 5: Using the budgeted income statement, complete the cash receipts section and remember to save the statement when you have finished.