Unit Three- Financial Choices

2. Lesson Two: Budgeting

- how budgeting helps you plan financially

- the difference between fixed and flexible expenses

- how to read a pay cheque

In the last lesson, you learned about financial planning and goal setting. To achieve your goals, it will be important to learn about the process of budgeting. A budget is a tool to help you keep track of your money, so you know what you are earning and what you are spending. A budget will give you important information about your finances so you can make choices about spending and saving that will help you meet your financial goals.

This lesson will also provide basic information about how to read a paycheque. Current paycheques are often filled with abbreviations and coded information and can look a little like an alien language. This lesson will help you sort out all the information so you will know exactly what you are being paid and why.

Controlling your financial affairs requires a budget. For many people, the word "budget" has a negative connotation. Instead of thinking of a budget as financial handcuffs, think of it as a means to achieve financial success.

Whether you make thousands of dollars a year or hundreds of thousands of dollars a year, a budget is the first and most important step you can take towards putting your money to work for you instead of being controlled by it and forever falling short of your financial goals.

To those of you who think you know where your money goes without keeping detailed records, I issue this challenge: keep track of every cent you spend for one month. I promise you'll be surprised and perhaps shocked by how much some of your "small" expenditures add up to.

When was the last time you took a good look at your home personal budget finance?

Let us face it. We live in a credit crunched world today. We live at a time when the experts around us scare the life out of us by mentioning terms like depression, meltdown, and recession. What this ultimately means is that you need to watch the way you spend money. You should make sure you live within your means, start saving as much as you can, and stay out of debt. How do you do that? Here are some inexpensive ideas to get started with.

First of all, develop the habit of writing down your income and track expenses. Keep a tab on your personal budget finance all the time. By writing down your income and your money expenses, you get to know how much you spend on your basic needs, how much you're spending on important things, and how much you're spending on totally unnecessary items. Once you find this out, you can easily find a way to stop the unnecessary personal expenses.

You can find a lot of experts suggesting some sort of home budget software to calculate your monthly expenses. My take on this issue is simple - if you can afford it, go for the home financial software, it will keep track of your financial budget a lot easier and it will save you time. If not, a good old pencil and paper or a personal budget spreadsheet will do just fine.

The most important thing is that you should write everything down. Even if you spend $10 on a cup of latte, make sure you write it down. Do this for one month. At the end of the month, take a good look at each home expense and find out which was necessary and which was unnecessary.

• If you are spending on coffee/pop/snacks $ 5 - 10 a day, stop doing it today. Not only is it unhealthy for your body, it's unhealthy for your wallet. Instead, buy a coffee maker, prepare your snacks at home and take them with you and drink water! This way, you get to drink coffee any time you want, and eat healthy snacks, anywhere you want. Most importantly, you'd spend less, a significantly less, than drinking and eating out.

• If you have a thing for designer wear, switch to normal clothes. Designer wear cost a lot of money and it is definitely not worth paying it at a time when you are struggling to make ends meet.

• If you spend money eating out often, stop it now. Homemade food is healthy, tasty, and way cheaper. This is one of the simplest inexpensive ideas you can follow to cut your home expenses.

• Pay off your credit card debt and stop using it for a month. If you can't pay cash and buy something, don't buy it. Learn to live frugally. Initially, it will be difficult. But you'll get used to it in a few months.

• Buy in bulk. Getting a 12 pack for $5 is way cheaper than buying a single soda can for $1.

• Start saving because not saving will cost you more in the end. Even if it is a very little amount each month, it will continue to grow and, before you know it, you will have a substantial amount in your savings account. Keep it safe for a rainy day.

These are some of the simple ideas that can help you cut down your living expenses. Live well within your means, say no to unnecessary expenses, and improve your personal budget finance.

Budgeting and Financial Planning has become so important today that even our own Canadian Government has a section on budgeting on their website! Check it out below:

The idea of a budget seems simple enough, doesn't it? Money comes in and money goes out. Usually, though, balancing income and expenses is not that easy. A budget or spending plan can help you manage the family's finances.

Money problems can create a lot of anxiety and stress. They can be a major source of conflict within a relationship. Creating a reasonable budget can relieve some of this stress. It is important for a family to sit down and work on a plan together. This way, each member is involved and given a say in the family's major financial decisions.

A family budget can:

- make the best use of money

- save money

- reduce stress

- maintain family harmony

- make you feel good about yourself

Ask yourself - what are your family's spending habits?

- Do you have a budget or spending plan?

- Are you able to save some money each month?

- Do you feel frustrated and tense when you think about your household expenses?

- Does your money run out before the month ends?

- Do you talk to your partner about money issues?

How do you get better control of your finances:

- Get organized. You will need to take a longer term look at your family's spending habits. Gather your utility bills and invoices for any major expenses you had during the past year. These will help you estimate your yearly expenses. If you don't have them or have moved to a new area, utility companies will be able to give you an estimate of these costs. Credit card companies also maintain records of their card holders' transactions. As well, you will need pay records or a copy of your last tax return. If necessary, your current employer or last employer will be able to give you information about your pay.

- Design a family budget. You can use the sample budget outline given or look for other examples in books, magazines, or Internet sites. You may also want to talk to someone at your bank or look for a course in personal finance.

- Write down your household income from wages, pensions, insurance and tax credits starting with the current month and then record the month's expenses. You may need to search through your checkbook, bank statements and receipts. The more accurate and detailed you can be, the better picture you will get of your financial situation.

- Think about your family's lifestyle and spending habits. Your partner and children should be involved so they will understand and be part of the decisions made.What are the most important things you spend your money on? What could you do without?

- Estimate your family's income and expenses for the next year. You can base it on your current month's budget. Do you expect your income to change during the year? Have you accounted for expenses such as Christmas, holidays and birthdays?

- Find out about your Credit Report. A credit bureau service is available in every province. Call or visit the office to check your credit rating. You will find them listed in the yellow pages or government services pages of your phone book.

Before making a purchase, ask yourself - do you need it or do you want it?

Ways to save money:

- Pay yourself first. You won't miss the money you put away if it is built into your budget. Payroll deductions like Canada Savings Bonds are a good way to do this.

- Pay down on your debt and reduce or avoid interest charges.

- Are you paying for telephone or cable TV services you don't use? These costs can really add up over time

- Cut down on eating out. Prepare special meals at home.

- Make a food shopping list and stick to it when you go to the store.

- Check the free programs and services that are offered in your community.

- If you quit smoking, try to save the money you would have spent on cigarettes.

- Use the public library. You can save on buying books or magazines and Internet service.

- Share babysitting and child care responsibilities with friends or neighbours.

- Learn to repair things in your home.

- Resist impulse buying - think about buying the item for a couple of days.

Now, make yourself a chart.

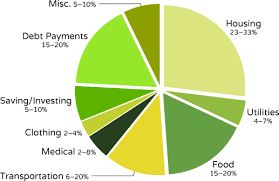

1) List your expenses in categories such as savings, groceries, home repair, vehicle etc.

2) Determine what are fixed expenses ie: Those that you cannot avoid and are generally about the same each month. For example, Rent is $900.00/month.

3) Determine, from your income, what you can afford to spend on each category after you have paid your fixed expenses and others that are mandatory.

4) Pay yourself first. Savings are incredibly important. Savings will enable you to reach your financial goals, stay out of debt, have emergency funds, and prevent you from living pay cheque to pay cheque.

For a good resource to develop such a budget, see:

Statement of Earnings and Withholdings

When you get your first paycheque, the first reaction is usually one of shock?

HOW COME IT ISN'T VERY MUCH??? Well, the employer is required to make certain

deductions from your income which you will now read about. Remember, it is

important as a teen to file an income tax form as you will get a good portion

of these deductions back from the government.

The Statement of Earnings is also known as a pay slip and can come in many different forms, ranging from a handwritten report to a computer printout attached to a cheque made out in the name of the employer. In some instances, cash may be paid out with no accompanying pay slip. A written statement must be provided to the employee at the end of the pay period. The statement includes the name and Social Insurance Number of the employee and the dates of the pay period. More importantly, it contains vital information that should be double checked by the employee.

This information includes the total amount paid to the employee—the gross

income. Gross income can include regular earnings as well as overtime pay. It

is often labeled as gross income or total pay before deductions. The statement

must also include the dates of the pay period, the wage rate, the overtime

rate, total hours of both regular and overtime work, time off in lieu of

overtime, and all other deductions with the reason for each. Should any

inaccuracies be found, the employee should contact the employer immediately.

From the gross amount, various

deductions may be made. Possible deductions include the following:

• Income tax

• Canada Pension Plan (CPP)

• Employment Insurance (El)

• Other forms of insurance including health insurance

• Union dues

• Professional dues

• Retirement plans

• Charitable deductions

• Payroll savings plan payments

• Savings bonds deductions

• Work plan investments

Some deductions, such as income tax and CPP, can be taken off automatically.

Court-ordered deductions, for example, for child support or income-tax evasion,

are also automatic. Others require written authorization from the employee.

Union dues come off the paycheques of unionized labourers in order to fund union

activities. The job of the union is to advocate on behalf of workers, to make

sure they work under good conditions and they receive fair pay. Professional

dues usually go to associations of a given profession that advocate on behalf

of the people who work in it, for example, the Alberta Association of Landscape

Architects or the Petroleum Accountants Society of Canada. They also work to

recruit young people into the field, to educate the general public about the

work they do, and to set the standards and regulations for the particular

industry. Some of these deductions increase as income increases.

Want to learn more about taxes in Canada? Watch the video below.

And check out these top five tax tips for young Canadians.