Unit Three- Financial Choices

| Site: | MoodleHUB.ca 🍁 |

| Course: | CALM |

| Book: | Unit Three- Financial Choices |

| Printed by: | Guest user |

| Date: | Friday, 7 November 2025, 7:44 AM |

1. Lesson One: Financial Planning

Through this lesson, you will learn:

- how financial planning and goal setting are related

- why financial planning and goal setting can give you more options in the future

- about the relationship between needs and wants

Now is the time to take charge of your future. Financial planning and goal setting will allow you to determine what is important for your future, and will help you reach your dreams.

Getting the things that you want out of life starts with a little planning. Setting financial goals is very much like setting any other goal. If you set your financial goals for the future the way you set other goals for yourself, you will find that you are able to obtain the material things you want in life. Now, this is not to diminish those who do not wish to have a lot of material goods. It is just a way of getting the things we want and need in life. For example, have you thought about.....

1) Who is going to pay for your post-secondary education?

2) Do you want to have a car to drive?

3) When do you want to move out of your parents' home and live on your own?

4) Do you want a

partner and children in life? Kids cost money!!

5) Do you want to have a vacation home in a warm country?

6) How much income will I need to afford the things that I want?

All of these things are worth considering and although some are long way off, others will sneak up on you before you know it!

1. Dream the goal

Make a list of everything that each of you wants ... all the goals you think you want to achieve. They may involve money, or material things, or better relationships, or a special vacation, an improvement in your grades, or a change in your personal attitudes or habits.

Get some paper and a pen and go somewhere where you will be uninterrupted. Write down everything that comes to mind. Don't judge or dismiss any of your ideas. Remember that every member of the family should do this. You will all compare and agree to compromise on which goals to work toward first.

After you have this long list of goals written down, put the list away for a few days. Some of the things you wrote may begin creating a burning energy in your mind.

Review your list in about a week and see which of the goals you're still interested in. Anything that you don't feel strongly about should be removed from the list. Goal setting will not work if you're not really committed to achieving the goal. Have your family members do the same.

After you identify the goal or goals that you want to work on start writing everything down. A notebook just for your goals might be very helpful. Write down your goal on the first page of your notebook and you can all start formulating them in order of the least to most important.

2. Identify the obstacles that may prevent you from achieving the goal

After you've set your goal, make a list of things that may threaten the successful achievement of the goal and what you can do to remove those threats.

For example, are you and your spouse or child fighting over some of these goals? Write down ALL the obstacles that you feel may prevent you from reaching your goal.

This is a particularly magical part of goal setting because it takes all of the obstacles that seemed so huge before and reduces them to words on a piece of paper. Once the obstacles are clearly defined, they are often easily solved.

3. Identify the things you need to help you achieve the goal

After you've identified the obstacles, make a list of the things you will need in order to achieve your goal.

This list should also include the people whose cooperation will assist you working towards your goal. Some of the items on this list may include some things that will represent solutions to the problems you wrote down earlier.

4. Set a date for the

achievement of your goal Setting a date for the attainment

of your goal is the ignition for the goal-seeking missile in your mind. Make

sure that your date is realistic... not so soon that it's impossible, but not

so delayed that you'll lose interest before you reach it. Write the date of your goal down

next to your goal. Once you've set this date, you should never change it unless

it is absolutely necessary. 5. Write down the goal and

review it often Once you have your goal and the

date in writing, make more reminders of your goal. Put these reminders all

around your house, your car, your bathroom, your bedroom, your office. They will remind you of your goal

and the date that the goal will be achieved by, and each time you see this

information you will be programming your mind to take action toward your goal.

This is a crucial step. WRITE IT DOWN. REVIEW IT

OFTEN. 6. Make a step-by-step

plan First, let's review: You know what

you want and you know you want it badly. You have identified the obstacles

you need to overcome before you can achieve your goal and you know whose help

and cooperation you will need. You know the date for the attainment of the

goal. Now, make a step-by-step action

plan. Write down every little thing, no matter how small, that you must do in

order to reach your goal. Break down the project into small

chunks... If you have a complicated list, jot down all the ideas that come to

mind and then put them in date sequence later. If necessary, number them and then

type them into a word processor or re-write them in date sequence. Each item

should also have a deadline for accomplishment so you can keep on target. This is an important part of your

goal achievement so don't cut corners on your plan, especially if it is a

complicated goal or there are a lot of obstacles to overcome. 7. Follow your plan! This is the fun part, because

after you've set and hit your first goal, you'll know that all you have to do

to achieve your goal is to follow your plan! Review your plan every single day.

Work on something on your list every single day. Stay on schedule. Don't fall

behind. Review your goal and the deadline. Mark items off the list as you

accomplish them. You can't control every aspect of

your future, of course, but you will be surprised how many things you really

can control with these effective goal-setting techniques.

This example illustrates that what is considered a "need" in one country might be a "want" in another. Therefore, the real difference between a need and a want depends on your situation.

One person might need a truck, because they use it to haul fertilizer for their farm. Another person might want a truck because they like its power and its looks, and they want to impress other people – they may rarely, if ever, need it to haul dirty or large objects. The difference between a need and a want is often relative – it depends on the area in which you live, the company you keep, the lifestyle you choose, and the expectations of your society.

Needs and wants come in different forms. For example, you might need a television set, but does it "need" to be a 43 inch high definition plasma television or will a regular 13 inch television do the job? If you have enough money, then you could probably buy your want – the 43 inch HDTV. If not, you might have to settle for your need – a regular, older version television set.

1. They crave an item, but do not have the money available to buy it right away

2. So they borrow money and buy the item

3. They have to pay the money back, plus pay high interest fees

4. Because they are paying off their debt, they have little money available for other needs or wants

5. But they need to buy something else

6. So they borrow more money

7. Then they have to pay that money back, plus more interest fees

8. Now they have even less money than before, but they still need to buy things

9. So they borrow even more money

and so on, and so on. When people have difficulty distinguishing their needs versus their wants, they can get

caught in a vicious cycle of debt.

It is important that you strike a balance between those things that you must have and the things that you would like to have. And it's important that you be able to prioritize your spending. The goal is to focus on those things that will really improve your quality of life rather than just look flashy. This means, what will make your life substantially better in the long term?

Here's an example of prioritizing

between two "wants." Wouldn't it be nice to have a car – something

that will get

you around, help you meet people, and give you your freedom?

Wouldn't it also be nice to be

able to move out –

live on your own, make your own decisions, and have some independence?

Unfortunately, you might not have enough money to buy a car AND move out – you would have to make a choice. Would

your quality of life be improved more by having your own wheels – or by living on your own? It depends

on your situation, your priorities, and your personality – the choice is yours.

But, if you decide you must have both the car and the apartment, you will probably find yourself trapped in a cycle of debt – working hard to pay off interest charges on both items, and having no money available for other things that you need or want in life.

Making wise financial decisions involves making tough choices between what you need and what you want. If you plan well, you can make choices that will improve your quality of life now and in the future.

2. Lesson Two: Budgeting

- how budgeting helps you plan financially

- the difference between fixed and flexible expenses

- how to read a pay cheque

In the last lesson, you learned about financial planning and goal setting. To achieve your goals, it will be important to learn about the process of budgeting. A budget is a tool to help you keep track of your money, so you know what you are earning and what you are spending. A budget will give you important information about your finances so you can make choices about spending and saving that will help you meet your financial goals.

This lesson will also provide basic information about how to read a paycheque. Current paycheques are often filled with abbreviations and coded information and can look a little like an alien language. This lesson will help you sort out all the information so you will know exactly what you are being paid and why.

Controlling your financial affairs requires a budget. For many people, the word "budget" has a negative connotation. Instead of thinking of a budget as financial handcuffs, think of it as a means to achieve financial success.

Whether you make thousands of dollars a year or hundreds of thousands of dollars a year, a budget is the first and most important step you can take towards putting your money to work for you instead of being controlled by it and forever falling short of your financial goals.

To those of you who think you know where your money goes without keeping detailed records, I issue this challenge: keep track of every cent you spend for one month. I promise you'll be surprised and perhaps shocked by how much some of your "small" expenditures add up to.

When was the last time you took a good look at your home personal budget finance?

Let us face it. We live in a credit crunched world today. We live at a time when the experts around us scare the life out of us by mentioning terms like depression, meltdown, and recession. What this ultimately means is that you need to watch the way you spend money. You should make sure you live within your means, start saving as much as you can, and stay out of debt. How do you do that? Here are some inexpensive ideas to get started with.

First of all, develop the habit of writing down your income and track expenses. Keep a tab on your personal budget finance all the time. By writing down your income and your money expenses, you get to know how much you spend on your basic needs, how much you're spending on important things, and how much you're spending on totally unnecessary items. Once you find this out, you can easily find a way to stop the unnecessary personal expenses.

You can find a lot of experts suggesting some sort of home budget software to calculate your monthly expenses. My take on this issue is simple - if you can afford it, go for the home financial software, it will keep track of your financial budget a lot easier and it will save you time. If not, a good old pencil and paper or a personal budget spreadsheet will do just fine.

The most important thing is that you should write everything down. Even if you spend $10 on a cup of latte, make sure you write it down. Do this for one month. At the end of the month, take a good look at each home expense and find out which was necessary and which was unnecessary.

• If you are spending on coffee/pop/snacks $ 5 - 10 a day, stop doing it today. Not only is it unhealthy for your body, it's unhealthy for your wallet. Instead, buy a coffee maker, prepare your snacks at home and take them with you and drink water! This way, you get to drink coffee any time you want, and eat healthy snacks, anywhere you want. Most importantly, you'd spend less, a significantly less, than drinking and eating out.

• If you have a thing for designer wear, switch to normal clothes. Designer wear cost a lot of money and it is definitely not worth paying it at a time when you are struggling to make ends meet.

• If you spend money eating out often, stop it now. Homemade food is healthy, tasty, and way cheaper. This is one of the simplest inexpensive ideas you can follow to cut your home expenses.

• Pay off your credit card debt and stop using it for a month. If you can't pay cash and buy something, don't buy it. Learn to live frugally. Initially, it will be difficult. But you'll get used to it in a few months.

• Buy in bulk. Getting a 12 pack for $5 is way cheaper than buying a single soda can for $1.

• Start saving because not saving will cost you more in the end. Even if it is a very little amount each month, it will continue to grow and, before you know it, you will have a substantial amount in your savings account. Keep it safe for a rainy day.

These are some of the simple ideas that can help you cut down your living expenses. Live well within your means, say no to unnecessary expenses, and improve your personal budget finance.

Budgeting and Financial Planning has become so important today that even our own Canadian Government has a section on budgeting on their website! Check it out below:

The idea of a budget seems simple enough, doesn't it? Money comes in and money goes out. Usually, though, balancing income and expenses is not that easy. A budget or spending plan can help you manage the family's finances.

Money problems can create a lot of anxiety and stress. They can be a major source of conflict within a relationship. Creating a reasonable budget can relieve some of this stress. It is important for a family to sit down and work on a plan together. This way, each member is involved and given a say in the family's major financial decisions.

A family budget can:

- make the best use of money

- save money

- reduce stress

- maintain family harmony

- make you feel good about yourself

Ask yourself - what are your family's spending habits?

- Do you have a budget or spending plan?

- Are you able to save some money each month?

- Do you feel frustrated and tense when you think about your household expenses?

- Does your money run out before the month ends?

- Do you talk to your partner about money issues?

How do you get better control of your finances:

- Get organized. You will need to take a longer term look at your family's spending habits. Gather your utility bills and invoices for any major expenses you had during the past year. These will help you estimate your yearly expenses. If you don't have them or have moved to a new area, utility companies will be able to give you an estimate of these costs. Credit card companies also maintain records of their card holders' transactions. As well, you will need pay records or a copy of your last tax return. If necessary, your current employer or last employer will be able to give you information about your pay.

- Design a family budget. You can use the sample budget outline given or look for other examples in books, magazines, or Internet sites. You may also want to talk to someone at your bank or look for a course in personal finance.

- Write down your household income from wages, pensions, insurance and tax credits starting with the current month and then record the month's expenses. You may need to search through your checkbook, bank statements and receipts. The more accurate and detailed you can be, the better picture you will get of your financial situation.

- Think about your family's lifestyle and spending habits. Your partner and children should be involved so they will understand and be part of the decisions made.What are the most important things you spend your money on? What could you do without?

- Estimate your family's income and expenses for the next year. You can base it on your current month's budget. Do you expect your income to change during the year? Have you accounted for expenses such as Christmas, holidays and birthdays?

- Find out about your Credit Report. A credit bureau service is available in every province. Call or visit the office to check your credit rating. You will find them listed in the yellow pages or government services pages of your phone book.

Before making a purchase, ask yourself - do you need it or do you want it?

Ways to save money:

- Pay yourself first. You won't miss the money you put away if it is built into your budget. Payroll deductions like Canada Savings Bonds are a good way to do this.

- Pay down on your debt and reduce or avoid interest charges.

- Are you paying for telephone or cable TV services you don't use? These costs can really add up over time

- Cut down on eating out. Prepare special meals at home.

- Make a food shopping list and stick to it when you go to the store.

- Check the free programs and services that are offered in your community.

- If you quit smoking, try to save the money you would have spent on cigarettes.

- Use the public library. You can save on buying books or magazines and Internet service.

- Share babysitting and child care responsibilities with friends or neighbours.

- Learn to repair things in your home.

- Resist impulse buying - think about buying the item for a couple of days.

Now, make yourself a chart.

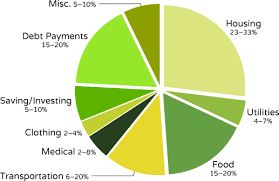

1) List your expenses in categories such as savings, groceries, home repair, vehicle etc.

2) Determine what are fixed expenses ie: Those that you cannot avoid and are generally about the same each month. For example, Rent is $900.00/month.

3) Determine, from your income, what you can afford to spend on each category after you have paid your fixed expenses and others that are mandatory.

4) Pay yourself first. Savings are incredibly important. Savings will enable you to reach your financial goals, stay out of debt, have emergency funds, and prevent you from living pay cheque to pay cheque.

For a good resource to develop such a budget, see:

Statement of Earnings and Withholdings

When you get your first paycheque, the first reaction is usually one of shock?

HOW COME IT ISN'T VERY MUCH??? Well, the employer is required to make certain

deductions from your income which you will now read about. Remember, it is

important as a teen to file an income tax form as you will get a good portion

of these deductions back from the government.

The Statement of Earnings is also known as a pay slip and can come in many different forms, ranging from a handwritten report to a computer printout attached to a cheque made out in the name of the employer. In some instances, cash may be paid out with no accompanying pay slip. A written statement must be provided to the employee at the end of the pay period. The statement includes the name and Social Insurance Number of the employee and the dates of the pay period. More importantly, it contains vital information that should be double checked by the employee.

This information includes the total amount paid to the employee—the gross

income. Gross income can include regular earnings as well as overtime pay. It

is often labeled as gross income or total pay before deductions. The statement

must also include the dates of the pay period, the wage rate, the overtime

rate, total hours of both regular and overtime work, time off in lieu of

overtime, and all other deductions with the reason for each. Should any

inaccuracies be found, the employee should contact the employer immediately.

From the gross amount, various

deductions may be made. Possible deductions include the following:

• Income tax

• Canada Pension Plan (CPP)

• Employment Insurance (El)

• Other forms of insurance including health insurance

• Union dues

• Professional dues

• Retirement plans

• Charitable deductions

• Payroll savings plan payments

• Savings bonds deductions

• Work plan investments

Some deductions, such as income tax and CPP, can be taken off automatically.

Court-ordered deductions, for example, for child support or income-tax evasion,

are also automatic. Others require written authorization from the employee.

Union dues come off the paycheques of unionized labourers in order to fund union

activities. The job of the union is to advocate on behalf of workers, to make

sure they work under good conditions and they receive fair pay. Professional

dues usually go to associations of a given profession that advocate on behalf

of the people who work in it, for example, the Alberta Association of Landscape

Architects or the Petroleum Accountants Society of Canada. They also work to

recruit young people into the field, to educate the general public about the

work they do, and to set the standards and regulations for the particular

industry. Some of these deductions increase as income increases.

Want to learn more about taxes in Canada? Watch the video below.

And check out these top five tax tips for young Canadians.

3. Lesson Three: Saving Your Money

- saving money will give you more options in the future

- saving money is a wise choice for all people

- young people benefit the most from saving money

|

Introduction

|

|

|

|

What would you like to do in the future? Attend a post-secondary institution? Travel abroad? Own your own home? Own your own vehicle? Saving money now will help you have more choices in your future. In this lesson, you will learn about the many reasons to save, plus you will discover how a little money saved early in your life can mean big bucks in your future! |

Grasshopper or Ant? Spender or Saver? |

|

|

|

Have you heard the story about the carefree grasshopper and the hard-working ant? All summer the grasshopper relaxed in the sun and enjoyed the warm days while the ant worked steadily to build a home and to store food for the winter. When the winter came, the ant enjoyed a warm home and food and the grasshopper... well, you get the picture. What do you see of yourself in this tale? When it comes to handling money, are you the ant - saving for the future - or the grasshopper - enjoying the moment? Or a bit of both? |

|

|

|

Try this quiz to find out what kind of spender or saver personality you have.

1. I spend most of my money on:

2. How often do I make deposits on my savings account?

|

|

3. How often do I make withdrawals from my savings account?

4. When I get money do I:

|

|

5. When I spend my money on something big, I feel:

6. Do I lend money?

7. How often do I borrow money?

8. What would I do if I won or was given a large sum of money, say $25,000?

|

|

9. Of the following, which would I buy first?

10. How often do I discuss my money with my family?

11. Which of the following describes me best?

12. Which statement best describes me?

13. Which statement best describes my spending habits?

14. Which statement best describes my shopping habits?

Add up your score, and find out what kind of spender / saver personality you have!

|

1. |

a. 0 |

b. 1 |

c. 4 |

d. 3 |

e. 2 |

|

2. |

a. 3 |

b. 2 |

c. 1 |

d. 0 |

e. 4 |

|

3. |

a. 2 |

b. 1 |

c. 0 |

d. 4 |

e. 3 |

|

4. |

a. 4 |

b. 0 |

c. 3 |

d. 1 |

e. 2 |

|

5. |

a. 2 |

b. 4 |

c. 3 |

d. 1 |

e. 0 |

|

6. |

a. 4 |

b. 2 |

c. 3 |

d. 0 |

e. 1 |

|

7. |

a. 2 |

b. 1 |

c. 4 |

d. 3 |

e. 0 |

|

8. |

a. 1 |

b. 3 |

c. 0 |

d. 4 |

e. 2 |

|

9. |

a. 0 |

b. 3 |

c. 4 |

d. 1 |

e. 2 |

|

10. |

a. 3 |

b. 4 |

c. 1 |

d. 2 |

e. 0 |

|

11. |

a. 4 |

b. 3 |

c. 2 |

d. 1 |

e. 0 |

|

12. |

a. 2 |

b. 1 |

c. 0 |

d. 3 |

e. 4 |

|

13. |

a. 1 |

b. 3 |

c. 0 |

d. 2 |

e. 4 |

|

14. |

a. 2 |

b.1 |

c. 0 |

d. 3 |

e. 4 |

Spending / Saving Personalities |

|

|

43 - 46 points |

You have strong symptoms of being a miser. Saving money may be an obsession with you and you may be sacrificing more worthwhile things like friendship and happiness. You can control your life in better ways than stockpiling money. Having lots of money does not make a person better. |

|

35 - 42 points |

You are the very cautious saver, one who may have a tendency to be stingy. Although you may always be worrying about not having enough money for the future, money is not an obsession. However, if going without makes you unhappy now, perhaps you may want to rethink why you are saving. |

|

21 - 34 points |

You are a wise planner. You have a well-balanced attitude towards spending and saving money. You spend carefully on things important to you. You most likely have good decision-making skills too. |

|

10 - 19 points |

You are somewhat of a high roller. You spend a lot and save little. You are, however, a sharer; but sometimes you use money to make an impression on others. A frequently empty bank account means you need to look at better money management and decision-making techniques. |

|

0 - 9 points |

You are a confirmed spender. Money is easy-come, easy-go. You can be self-indulgent and usually buy on impulse. You may keep trying to get a grip on things, but nothing seems to work. Counselling on money management and decision making is a good idea for you. |

SAVINGS

The difference between the money you earn and the money you spend is called

savings.

Regardless of how little you earn, it is a good idea to begin a regular savings

program early. By doing this, you will develop the habit of saving as a regular

part of your financial planning, and will have less difficulty later.

Your savings

aid the economy

Your savings dollars aid you in satisfying your short- and long- term needs and

wants. At the same time, while you are waiting for your savings to grow, other

individuals, businesses and governments are using your dollars to fulfill their

goals. They, in turn, pay interest for the use of your money, part of which

goes to you.

Without savings from you, and thousands of people like you, financial

institutions would not have money available to lend.

Without borrowed capital funds, most Canadian businesses would not be able to

pay the costs of formation, buy the many goods and services necessary for

production, expand their operations, explore for resources, research new

products, and pay salaries to workers.

The money you save is important in the over-all economic scene.

Why do people

save?

People save money for a number of different reasons.

• Emergencies— Have you ever heard the old saying—”Saving for a rainy day”?

Rainy days can happen to any individual, family or business. Accidents, illness

and even death can strike at any time. In addition, there are repairs to

automobiles, home repairs, appliance repairs, etc. One means of protecting

against losses caused by emergencies is insurance. But insurance doesn’t always

cover the total loss, nor does it cover all emergencies. Savings would

certainly help meet expenses during an emergency.

• Future needs— Many people save money to help pay for education. Parents set

aside money for their children’s education and other future needs. Many people

save money during their working years to provide for their needs and wants after

retirement. People save for holidays, a new car, a new home—both for the short

and the long term.

• Opportunities— Some people use their savings account to take advantage of

opportunities that may arise. These could take the form of covering the expenses

of beginning a better job elsewhere, starting one’s own business or becoming a

partner in one, purchasing real estate, and many others.

Goals

Your savings goals can be either short-term or long-term. A short- term goal is

one for the purchase of a fairly inexpensive item within a short period of

time. For example, Gerald is a Grade 12 student who will be incurring several

graduation expenses in June. In September, Gerald estimated that graduation

would cost approximately $525. His estimate included the cost of a new suit,

shirt, tie, shoes, school yearbook, graduation photo, ticket to the Senior Prom

and miscellaneous item fund.

Gerald has been saving $60 a month from his

allowance and part-time job since September. By June, he should have enough to cover graduation expenses

plus a bit to spare.

A long-term savings goal is for the purchase of an expensive item and usually requires saving for a year or more. For example, it is January, and Jay is a Grade 10 student at Southwood High School. Each year, his school plans a student trip during the March break. Next year, when Jay is in Grade 11, the trip will be to Orlando, Florida.

Jay would like to go, and his parents agree, if between them they can save the money. Jay and his parents sit down and from the information provided by the school, work out the following savings plan:

Costs:

Flight and accommodations (Cdn $1) (Includes bus transportation $543.00to and from Orlando area attractions including Disney World)

Departure tax 27.00

Service charge and tax 30.00

Meals and spending money 450.00

Allowance for price fluctuation 50.00

Total cost $1,100.00

Flight and accommodations (Cdn $1) (Includes bus transportation $543.00to and from Orlando area attractions including Disney World)

Departure tax 27.00

Service charge and tax 30.00

Meals and spending money 450.00

Allowance for price fluctuation 50.00

Savings:

From parents 400.00

From Jay 700.00

$1,000.00

Jay has a part-time job at local dry cleaners. During the school year he earns $30 per week and during the summer he earns $100 per week. He estimates that he can save $40 per week during the summer and $5.50 a week during the school year. He has calculated his savings as follows:

Savings from Jay

Summer (12 weeks x $40) 480.00

School year (40 weeks x $5.50) 220.00

Savings needed for trip $700.00

To give another example of a long-term savings goal, assume that when Jay was three years old, his parents decided to open a savings account to help cover the costs of his post-secondary education. Each month since then, they have been depositing the Family Allowance cheque into the account. By the time Jay graduates from high school, the accumulated savings, plus the interest earned, should go a long way to help defray costs should Jay decide to further his education.

• They can save it.

• They can invest it.

• They can give it away.

When people save money, they tend to hold on to it as money and earn interest. When people invest, they tend to look for other things to do with their money to enable it to grow in value more quickly. Investments can involve some kind of purchase whether it be real estate, art, stocks, or bonds.

Savings and investment choices are a form of consumer decision making. There are many options to choose from that range from starting a simple savings account to investing in mutual funds and stocks.

Mutual funds: a way of investing in which money of investors is pooled and used

to purchase a range of different stocks.

Stocks: shares of an incorporated company. People who purchase stocks own a

part of that company and will receive part of the profit.

The line between savings and investments is not as clear as some people think. In fact, except for savings which occurs in a penny jar or in a sock under a mattress, all savings are some form of investment. Money placed in any financial institution, such as a bank, is really being invested. It is being loaned to some other entity for its use, and a reimbursement is paid to the person who loaned the money. In the case of a bank, the reimbursement takes the form of interest being paid. In the case of investments, it is the dividend paid or the increase in the price of each share of the stock.

Investments can be viewed on a continuum with the most secure, the most safe, at one end and the riskiest, most chancy investments at the other end. Making a decision about where to place, or invest, money needs to take into consideration how much risk a person is willing to take with that money. “Risk” refers to the chance that the amount of money, the investment, may gain in value (through an increase in interest rates, amount of dividend, or increase in price of each share) or lose value through decrease in interest rate, decrease or lack of dividend, or a decrease in the price of each share.

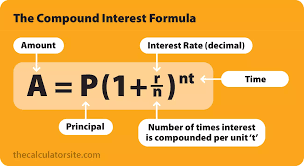

Compounding means earning interest both on your principal, or initial investment, and on the interest earned by that principal. Here’s how it works.

Monica begins at age 19 to invest $2000 annually

in an RRSP. She does this for eight years and receives 10%

interest compounded annually. At the end of the first year, her investment is

worth $2200 ($2000 + $200 interest). At the end of the second year, her

investment is worth $4620 ($2200 + $220 on her first year’s investment + $2000

+ $200 on her second year’s). And so on.

By the time Monica turns 40, the total of $16 000 she’s invested is worth $95 541, six times as much!

Compare this to what happens to Dan’s $2000 annual RRSP investment, which he initiates at age 27. At 40, he has invested a total of $28 000, which grows just over two times to $61 545.

Rule of 72

The Rule of 72 is a simple way to see how many years it will take to double the

money in art investment. Simply divide 72 by the annual interest rate of the

investment. Using this formula, you can very quickly calculate that a 10%

interest rate compounded annually will double your Investment in just over 7

years (72 — 10 = 72)

COMPOUNDING COMPARISON (10% RATE

OF RETURN)

Age Annual Investment Year-end Value

19 $2000 $2200

20 $2000 $4620

21 $2000 $7282

22 $2000 $10 210

23 $2000 $13 431

24 $2000 $16 974

25 $2000 $20 872

26 $2000 $25 159

27 $27 675

28 $30 442

29 $33 487

30 $36 835

COMPOUND IT- AND KNOW WHAT

YOU’RE DOING

The people who really win with their money are those who understand the power

of com pound interest. Compound interest is the money paid on the money and

interest you made the year before. That’s why the true power of compound

interest takes a few years to show itself off in its best style. For example,

if you invest $1 every year and leave it to compound, this is what happens:

FUTURE WORTH OF ONE DOLLAR INVESTED AT THE END OF EACH YEAR WITH INTEREST

PAYABLE AND REINVESTED AT THE END OF EACH YEAR

Year 1% 2% 3% 4% 5% 10%

1 1.00 1.00 1.00 1.00 1.00 1.00

2 2.01 2.02 2.03 2.04 2.05 2.10

3 3.03 3.06 3.09 3.12 3.15 3.31

4 4.06 4.12 4.18 4.25 4.31 4.64

5 5.10 5.20 5.31 5.42 5.53

So if, at the end of every year for 40 years, you put a dollar into an account

or investment that pays an interest rate of 5%, at the end of those 40 years

you get an amazing $120.80 for your efforts. Yet, $120.80 for a dollar a year

is not bad profit, considering you only invested $40. But who would bank one

dollar a year for 40 years?

The most important thing about this chart is the way you can really use it.

Let’s say you put away $8 a month - probably less than the cost of one movie.

That’s $96 a year. So at the end of the first year you will have $96. At the

end of Year Two you have $192.96 ($96 X 2.01). You get the multiplier amount from the chart that is based on a one dollar

amount and the 1% interest rate.

Let’s say that you cannot find any thing better than 1% interest. Well, by Year 5, at one movie’s worth a month, you’ll have $519.60 ($96 X 5.10) -not a bad sum of money for banking $8 a month for 5 years. You are not likely to miss the $8 each month. Just think of how much you spend a month- will $8 truly be missed?

But likely you will be able to find a savings account with better interest

-let’s say 2%. By putting away $10 a month, a total of $120 a year, you will

have saved $120 at the end of the first year. By the end of Year Two, at 2%,

you will have $242.40 (remember that the multiplier number takes into account

the fact that you have contributed another $120 in the second year).

Do the same thing - bank $10 a month for 4 years at 2%, and the total for your

efforts will be, and you will have $494.40, almost $500 savings without really

missing any big amount of money each month.

These are pretty short term amounts and investments. If you find a

savings/investment account at 5% for 5 years, and put $10 a month in it, at the

end of the term you will have $663.60. At ten years, you will have $1509.60!

Try doing the figuring yourself. Choose an amount you can bank each month. Find

the best interest-bearing account you can. Then calculate what your money will

be earning for you. You can even have the amount you have chosen to save

withdrawn directly from your chequing account and directly deposited into your

savings account each month. You can make this arrangement with your bank.

How do you get better interest rates? One way is to have the smaller amounts

that you have saved, let’s say $500 or $1000, moved into a higher

interest-bearing investment such as a GIC (Guaranteed Investment Certificate)

or Term Deposit. Usually you have to leave your money in such an investment for

a longer period of time but the interest rate is higher and your money is

working harder for you.

One loony will:

One loony will:

• roast 2 turkeys in your oven

• run your microwave oven for 12 hours

• let you play video games for 34 days, 2 hours per day

• operate a 1,500-wall portable electric heater for 10 hours

• operate your host-free (older model) fridge for two and a half days

• light 3 strings of outdoor mini-lights (25 lights per string) for 73 days, 4

hours per day

• light 3 strings of 5-watt outdoor Christmas lights (25 lights per string) for

10 days, 4 hours per day

• cook 5 batches of Boston Baked Beans in your slow cooker

• make 33 steaming loaves of bread in your bread maker

• let you watch 51 movies on your VCR/TV

• make 50 freshly-brewed pots of coffee

• run your electric drill for 50 hours

• humidify the air for 6 days

Note: This may vary from province to province

Finally, please read the attached article, "How to Save Money as a Teen."

4. Lesson Four: Investing Your Money

1. Explain the difference between saving and investing.

2. Identify ways to invest your money.

3. Recognize the inherent differences in types of investments and relative safety of each.

Investing

When people deposit money in savings accounts, interest is earned and the money

up to a certain amount is protected against loss. But a savings account is only

one way to make money earn more money.

People can also invest by purchasing bonds issued by governments or

corporations, investing their savings in real estate, buying business

enterprises, or becoming part owners in one or more businesses by purchasing

shares of stock in corporations. Life insurance is another form of investment.

An investment that is ideal for one person may not suit another. People with

money to invest differ in age, amount of income, financial responsibilities and

the amount of money they have available. The less money you have to invest, the

less risk you should take. Your first investment should be one that allows the

greatest safety. When you already have safe investments, you might be willing

to risk some money in the hope of making a larger gain.

Before you invest, you should check the following criteria:

Safety- How secure is your investment?

Return- The interest or dividends you expect.

Liquidity- The ease of converting the investment into cash.

Growth- The chances of the investment increasing. Investing money has its risks

and rewards. You should comparison shop for an investment just as you would for

goods and services.

INVESTING: The pros and cons

Pros

Investing has two main advantages over savings.

-

There is often a higher profit rate of return and a greater chance of making a

profit.

-

Investments may grow in value during periods of inflation while savings tend to

remain the same or even lose value.

Cons

In general, an investment is considered “safe” if its dollar value remains

constant. If its dollar value moves up and down, it is called “risky” because

if its value falls, it will be worth less than you paid for it. It is possible

to lose some or all of your money in this way.

Aside from the obvious risk of value fluctuation, there are other “hidden”

risks which affect many investments. Some of these are:

• the erosive effect of inflation on your dollars

• the difference in the tax rates on different types of investment

• income

• the risk of tax changes

• the risk of failure of the business invested in

Usually the greater the risk, the greater the potential return offered to

induce investment.

A wise investment philosophy is to take little risk with money you cannot afford to lose (or at least do without for a while). As you accumulate excess capital over your needs, you may select more risky (speculative) investments in hope of greater gains.

In the principles of investing, it simply means to have your money work for you. When you choose to invest your money and prepare for the future, there are often monetary returns which are associated with these investments.

Why do people invest? People choose to invest because it enables security to be created for the future. Think about it this way, cash sitting in your home, under the mattress is not working for you – it is not accumulating interest and earning money while other people take advantage of it. Investments that are placed in accounts are doing the opposite; these investments are making you money throughout the process. So, what you choose to do with your money can determine your financial style. If you choose to invest, you are taking control – making your money work for you.

Most investors want to make the most of their income and earn enough investment income to be able to retire. Maximizing the income is the reason that most investors choose to invest. Investment has much to do with skill and little to do with luck – if you are looking to get lucky, perhaps you should buy a lottery ticket, but if you are seeking investment income, perhaps you should begin to research the market, the trends and the forecasts for the future in the investments that you have chosen.

Investing requires that the investor make short and long term goals about how they would like to see their investment perform. For example, as an investor would you like to see long or short term gains? This simple question can determine which types of investments would be beneficial for your financial situation.

What does investment require? To some extent, investing requires that certain risks be taken in different financial situations. Investing requires knowledge of the situation of investing and the willingness to continue learning about the subject of investments. Speaking with financial experts, reading financial magazines and newspapers and joining online investment groups and forums are all great ways to learn about investing. It is important to embark on the journey of investing with the willingness to learn, but at least have some investment knowledge under your belt.

There are many benefits to investing, it can help an individual to prepare for retirement and the costs associated with that transition and it can even help parents to prepare for the future of their children by investing in an education fund which deposits are made towards on a monthly basis. With guaranteed returns and options for low-risk investments – it has become easier than ever. With the current state of the economy and low interest rates, now is the time to begin learning, investing and preparing for the future of yourself and your family.

CDs (Certificates of Deposit) A CD is a special type of deposit account that typically offers a higher rate of interest than a regular savings account. Just like savings accounts, CDs are also insured up to $100,000. When you purchase a CD, you invest a fixed sum of money for fixed period of time. Usually, the longer the period, higher is the interest rate. There are penalties for early withdrawal. Money Market Deposit Accounts These accounts generally earn higher interest than savings accounts. They are very safe and provide easy access to your money. They are also insured by the FDIC. They offer many of the services that checking accounts offer, however, a limit is normally placed on the number of withdrawals or transfers you can make during a given period of time. Stocks When you buy stocks, you own a part of the company’s assets. If the company does well, you may receive periodic dividends and/or be able to sell your stock at a profit. If the company does poorly, the stock price may fall and you could lose some or all of the money you invested. Bonds A bond is a certificate of debt issued by the government or a company with a promise to pay a specified sum of money at a future date and carries interest at a fixed rate. Bond terms can range from a few months to 30 years. Bonds are tradable instruments and are generally considered a safer than stocks because bondholders are paid before stockholders if a company becomes bankrupt. Independent bond-rating agencies rate the likelihood that any given bond will default. Mutual Funds A mutual fund is generally a professionally managed pool of money from a group of investors. A mutual fund manager invests your funds in securities, including stocks and bonds, money market instruments or some combination of these, based upon the fund’s investment objectives. By investing in a mutual fund you can diversify, thereby, sharply reducing your risk. Most mutual funds charge fees. You often pay income tax on your profits. Annuities Annuities are contracts sold by an insurance company designed to provide payments to the holder at specified intervals, usually after retirement. Earnings cannot be withdrawn without penalty until a specified age and are taxed only at the time of withdrawal. Annuities are relatively safe, low-yielding investments. An annuity has a death benefit equivalent to the higher of the current value of the annuity or the amount the buyer has paid into it. Real Estate Buying a property is one of the most secure investments that you can make. As a famous quote puts it, "Buy land. They ain't makin' any more of it." Although humorous, this does succinctly say that there is only so much real estate out there and over time, the value of real estate generally increases. Real estate is a long term investment and primarily, one's home is the most significant piece of real estate that one will invest in. The returns can be enormous if you buy at a good price and sell at a higher price, but like any other investment, buying real estate can also turn around the other way and you can lose quite a bit. The real estate market generally fluctuates with the economy. In a strong economy, prices of real estate are higher and in a weaker economy, lower. An additional, or rental property can provide additional income and many income tax benefits. But, having rental property also means dealing with tenants and possible issues of property ownership in addition to owning your residence. Property investment varies widely depending upon the area of the world, or country that you live in. For example, buying a home in Fort McMurray will cost much more than buying a home in Lethbridge. TFSA - Tax Free Savings Account This type of savings account can offer a higher rate of interest. The "account" can be a regular bank account, GIC, or other form of government approved investment. You can invest up to $10000/year tax free. This is an initiative that was started for the 2015 tax year in Canada. Other types of Investments: You are not limited to investing in the above types of investment. You can invest in small business or a piece of a company or you can have a share in a friend's venture. Whatever money you invest, if it is not CDIC insured, make sure that you are prepared to lose that amount of money. If a deal comes along that is "Too Good to Be True" then it is. Walk away. Always check to make sure the company that you’re investing in is legitimate.

|

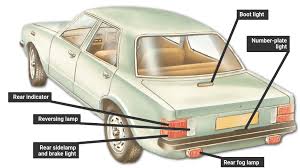

5. Lesson Five: Transportation Expenses

- a car depreciates over time and is usually a poor way to make money

- the kind of car insurance you choose will affect the type of coverage you will receive

- your choice of transportation can affect how much money you can save

In the last lesson, you explored the topic of investing your hard earned money. For some of you, saving money for a car is a priority. If it, I want you to think about whether it is better to be buying a new or used vehicle. In this lesson, you will be taking a look at the costs:

|

The Cost of Owning and Operating

a Car

Ownership (fixed) costs:

• Depreciation (based on purchase price)

• Interest on loan (if buying on credit)

• Insurance

• Registration fee, license, taxes, GST

• Service contract (if purchased)

Operating (variable) costs:

• Gasoline

• Oil and other fluids

• Tires

• Maintenance and repairs

• Parking and tolls

• Tickets

Real cost of operating a car

Ownership costs include insurance, finance charges, license, registration,

taxes and depreciation.

Operating costs include gas, oil, tires & maintenance.

Gas just one factor in cost of

owning a car

By Kathleen Pender

Thursday May 29, 2008

The owners of sport utility vehicles and other gas hogs are

feeling particularly squeezed these days. While the cost of filling their tank

is going through the roof, the value of their cars is falling fast. Between March and April of this year, average used-car

prices fell 4.5 percent for large SUVs and 5.6 percent for large pickup trucks,

according to J.D. Power & Associates. They rose 7.3 percent for compact

basic cars such as the Honda Fit, Toyota Yaris or Nissan Versa. A separate study by Kelly Blue Book found that large luxury

cars, such as the Mercedes-Benz S-Class and BMW 7 Series, "are

depreciating even faster than SUVs," says Kelly spokeswoman Robyn Eckard.

She says large luxury cars get the same lousy gas mileage as SUVs - about 12

miles per gallon. But unlike most SUVs, they generally require premium

gasoline. Because depreciation is the biggest cost of owning a car,

people who trade in gas guzzlers for a more fuel-efficient vehicle could wind

up losing more than they save at the pump, according to a new study by Consumer

Reports. This is especially true if they financed the first car and trade it

within three years for a new car. The study highlights the importance of looking at the total

cost of owning a car and not just the soaring price of gasoline. The biggest cost, according to

Consumer Reports, is: depreciation (48 percent),

followed by fuel (21 percent), interest (12 percent), insurance (11 percent),

maintenance and repairs (4 percent), and taxes (4 percent). "The first three years of

owning a vehicle is the most expensive time," says Jeff Bartlett, deputy

automotive editor with ConsumerReports.org. That's because cars depreciate or

lose their value fastest in the first three years and much more slowly in later

years. And if you finance the car, interest will make up a larger percentage of

your monthly payment in the early years and a smaller portion in later years.

Home loans work the same way, although over a much longer period. If you trade in a car before it's

paid off, you might have less "equity" or trade-in value than you

expected. If you swap a 2- or 3-year-old car

for a new car, "you are rushing from the most expensive period of one car

into the most expensive period of the next," Bartlett says. You'll also pay

more taxes, higher licensing fees and, in many cases, more for insurance. Consumer Reports estimated the

total cost of keeping a 3-year-old gas guzzler financed with a five-year loan

for an extra year or two versus trading it in for a new, more fuel-efficient

car. It ran the scenario for a sedan, an SUV and a pickup truck. In all three cases, it was cheaper

overall to hold the guzzler for another year or two. "Even if gas prices

increase to $5 per gallon, our analysis shows trading in after three years

instead of five would still be a hit to your long-term finances," the

report says. Bartlett says it could be

economical to trade in a 3-year-old gas guzzler if you had paid cash for it. If you're buying a car for

environmental reasons, it makes sense to buy the highest-mileage vehicle that

fits your budget and needs. David Jamison of San Francisco

ordered a bright yellow Smart Car - a tiny two-seater made by Mercedes-Benz -

over the Internet about 10 months ago, before even test-driving one. "It's

a visible signal of cutting down gas usage and automobile size," he says.

"We're trying to make a statement but have fun at the same time." But if you're looking for a good

trade-off between fuel economy and overall cost to own, here's what three automotive

experts suggest. -- Jack Nerad, executive market

analyst with Kelly Blue Book, recommends "a high-mileage conventional

vehicle," such as the Honda Civic. Alternatively, "a 2- or

3-year-old Hyundai is a pretty high-quality vehicle, but because it doesn't

have as good resale value, it might be a better deal than a Civic," he

adds. "Taking a contrarian view, if

you need a full-size SUV because you tow a horse trailer or have seven kids,

this might be a great time to buy one. There are a lot of incentives, and you

might find the money you save more than makes up for any fuel cost," Nerad

says. "The best full-size SUVs are

the Chevy Tahoe and GMC Yukon, which have intelligent fuel management systems

that let you operate on four or eight cylinders," depending on need.

"If you look at the number of passengers you can carry, the fuel economy

per person transported is pretty darn good. They only become an issue"

when there's a single occupant. -- Philip Reed, senior consumer

advice editor for Edmunds.com, says gas-electric hybrids get superior gas

mileage but cost more than their non-hybrid counterparts. As gasoline prices rise, the time

it takes to recoup the price premium is shortening for some models, Reed says.

"It's down to 1.6 years for the Toyota Camry hybrid," Reed says. "So much attention is paid to

hybrids that people overlook other ways to get good fuel economy," Reed

adds. "You can get a fairly large family sedan with a four-cylinder

engine, such as the Honda Accord. If you drive it right, you might get 30 miles

per gallon." The newly redesigned Chevy Malibu

"is a very fuel-efficient vehicle, even with six cylinders," he adds. Reed predicts the new Smart Car

"will be a hit initially. It's so cute." It gets good gas mileage and

seats two comfortably. But he says some Americans will dislike the balky,

European-style transmission. -- Bartlett says, "The best

way to improve fuel economy is to buy just the size you need, not a size

bigger." Among hybrids, "the slam dunk

now is the Toyota Prius." Among regular sedans, the Nissan

Altima with a 2.5-liter, four-cylinder engine is "a fantastic option. It's

a top-rated car by Consumer Reports and also has among the highest fuel economy

in its class. It's really entertaining to drive." For large families, he recommends

minivans, such as the Honda Odyssey or Toyota Sienna, over SUVs. Both get about

19 miles per gallon. "One interesting alternative

that deserves attention is the Mazda 5. It's a cross between a station wagon

and a minivan," he says. It seats six in three rows and in Consumer

Reports tests got about 23 miles per gallon.Add up the costs

Recommendations

WHAT ARE YOU WAITING FOR?

According to news reports, large numbers of twenty- and thirty—year-olds are migrating back to their parents’ houses where they get a free roof over their heads and free use of the TVs, VCRs, gym equipment, and so forth. This trend is supposed to indicate that America has produced a new generation of freeloaders, who lack the gumption to go out into the world and make it on their own. There’s a good side to this that we haven’t heard much about, except in a recent headline in The Wall Street Journal: “Generation X Starts Saving for Retirement.”

The gist of the story is that the freeloading twenty-something’s who belong to

the so-called lost generation, or Generation X, have been quietly stashing away

their loot. Apparently, there are more savers in this group than among their

parents, the baby boomers who prefer buying things now to saving money for

later. The Xers have realized that they can’t count on social security to bail

them out. They’ve watched their parents struggle to pay off credit-card debts,

and they want to avoid repeating this mistake. They seek financial

independence, and they’re working toward it while they’re still at home, with

their parents picking up the tab.

This is a very positive development, and we can only hope that more teenagers will follow in the footsteps of the twenty-something’s and not fall into the familiar trap of buying an expensive car. Many kids can’t wait to do this. As soon as they land that first steady job, they become slaves to the car payments.

It’s cool to drive around in a flashy new Camaro instead of a used Ford Escort,

but that kind of cool is very costly in the long run. What’s the price of cool?

Consider the following two cases:

Joe and Sally

Joe gets a job as a clerk at Wal-Mart. He’s living at home and saving every

last dollar so he can make the $2,000 down payment on a $20,000 Camaro with the

racing scoop on the hood. He takes out a car loan for the remaining $18,000.

His parents have to sign for the loan, but Joe is making the payments. It’s a

five-year loan at 11.67 percent interest, so he sends $400 to the finance

company every month. He cringes the first time he seals the envelope, kissing $400

goodbye, but he forgets all about that when he’s driving around in the Camaro

and his friends are telling him what a cool car it is.

A few months later, there are scratches on the door and stains on the carpet

and nobody is oohing and aahing when the Camaro pulls into the parking lot.

It’s just another car by now, but Joe is stuck with the payments. To be able to

afford the car and a date to ride in the car he works an extra night shift,

which means he’s too busy to get many dates.

At the end of five years, he’s sick of the Camaro, which lost its cool a long

time ago. He’s finally paid off the car loan, which cost him an extra $6,000 in

interest charges, so between the loan and the original purchase price, Joe has

invested $26,000 in this car, not including taxes and fees, insurance premiums,

gas, oil, and maintenance.

At this point, the Camaro has dents and stains and the engine sounds a bit

rough. If he sold the thing he could get maybe $5,000 for it. So what he’s got

to show for his $26,000 investment is a $5,000 car that he doesn’t even like

anymore.

Sally also lives at home and works the Wal-Mart checkout line a few feet away

from Joe, but she didn’t buy a cool car. She took the $2,000 she’d saved up and

bought a used Ford Escort. Since Sally paid cash, she didn’t have car payments.

So instead of sending $400 a month to the finance company, she invested $400 a month in a

mutual fund for stocks.

Five years later, when Joe was mailing out his last car payment, the value of

Sally’s mutual fund had doubled. Between the doubling of the fund itself and

the steady stream of $400 contributions to the fund, Sally has an asset of

nearly $30,000. She also has the Escort, which gets her back and forth OK, and

she never worries about the dents and stains because she never thought of her

car as an investment. It’s only transportation.

Automobile insurance policies are basically similar in nature and the companies that issue them are strictly controlled by government regulations. It is always a good idea to read the policy carefully clause by clause, to make sure you fully understand all of the conditions of the agreement before you sign it.

• The second section covers accident benefits to drivers’ passengers. Often,

where both parties to an accident are insured, the insurance companies will

agree not to take court action to establish responsibility. This “no-fault”

plan saves the insurance company administrative costs and court time.

• The third section gives protection to the owner against possible damage to

the vehicle. Next to your home, your automobile may be the most expensive

property you own. You stand to lose a great deal if your vehicle is damaged in

an accident or through fire, theft, acts of malice, accidental windshield

breakage, etc.

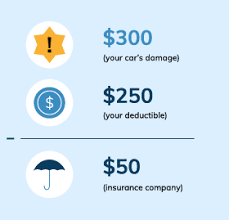

Deductible clause

You probably heard of $100-deductible or $250-deductible insurance. Insurance

premiums would be much higher if the insurance companies were to pay for every

scratch or dent that occurred. To lower costs, most policies include a

“deductible clause”. This clause means that if the vehicle were damaged, the

first $10 or $250 of the repair costs will be borne by the insured and the

balance will be paid by the insurance company.

Automobile insurance rates

Insurance rates vary according to five factors.

Your locale. Rates in each province differ and they even vary from city to city

within the provinces. Usually, they are higher in areas where traffic is heavy

and lower in rural areas where traffic is light. In regions roads are hazardous

in winter, rates can be higher than where roads are dry.

Your classification. There are three classifications.

• The car is owned and driven by an adult over the age of 25;

• The principal driver of the car is over 25, but it is also driven by a young

adult under 25;

• The principal operator is under 25.

A male driver who is under 25 belongs to the driver category with the worst

accident record. Premiums are highest in this category. When he gets older and

establishes a record of driving without accidents, or without major traffic

violations, his premiums will be substantially reduced. Some insurance

companies give a discount if a new driver has completed an approved driver-

training course.

The use to which the car is put. There are three classifications.

• The car is used for business only.

• The car is used to drive to and from work.

• The car is used for pleasure only.

*Premiums are lower to mainly for pleasure rather than for business. The number

of kilometers driven is another factor taken into consideration.

Your driving record. A person who has a bad accident record or has been of

major traffic violations will have to pay more than the regular premium rate.

The make and age of the car. When a policy holder automobile is totally damaged

in an accident, the amount paid by the insurance company will depend on the

value of the car at the time of the loss. The car value depends on such things

as make, model, age and condition.

Uninsured motorist coverage

All provinces have passed legislation setting up “unsatisfied judgment funds”

to provide at least a minimum payment of damages in automobile accident claims

where the person responsible for the accident carries no insurance. The fund

sometimes allows for the payment of damages for injuries in hit and-run

accidents.

If an uninsured motorist is at fault in an accident and the victim receives

payment from the unsatisfied judgment fund, the motorist generally will be

called upon to reimburse the fund for the amount paid. Failure to repay the

fund may result in suspension of the driver’s license.

**Many Insurance companies are now adding an additional clause to motor vehicle

coverage called Uninsured Motorist Coverage

Exploring Transportation Alternatives

North Americans have a continuing love affair with the automobile. The great distances between centres of population, the personal convenience of coming and going as one pleases, and the relatively inexpensive nature of owning and operating a car contributed to this affair.

In recent years, the cost of fuel

has increased

dramatically. Concern over environmental pollution

by engine exhaust is also mounting. In response to

government pressure and the demand of customers, the automotive industry has made changes in the size. efficiency. and safety standards of cars produced in North America.

The cost of new cars has risen

dramatically in recent years. The cost of servicing, repairing, and insuring

them has

increased as well. At some point one questions the trouble and expense of owning and operating a car. People are seeking alternatives.

It makes sense for young people, in particular, to examine alternatives to owning a car. Borrowing money to buy a car is expensive. Also, insurance rates for young people are higher than for any other age category. You can expect to pay from $1200 to $4,500 or more per year for insurance. The average annual cost of owning a car according to the

Canadian Automotive Association is $10560 if driven 24,000 km annually. These costs are outlined in their pamphlet, 2004 Driving Costs.

*Canadian Automotive Association figures are based

on the cost of operating a midsized North American car in Alberta. The figures do not reflect the higher costs of

insurance that a person under 25 would

have to pay.

Get all the information on the current costs before you make your decision.

Let's take a look at some other ways of spending

these transportation dollars.

Public Transportation

In cities, transit passes are available for $83/month

which is $8230/year. Still less expensive than owning a car and parking it. If

your work and home connect well with bus routes and scheduling, consider this

good alternative. You have no parking costs or tickets, no gas, oil or

servicing, and no tension from the traffic jams. You can read the papers, daydream, and enjoy yourself.

Bicycle

A bike can be purchased for $300 to $500. It is an

adventurous way of travelling in spring, summer and

fall. Nothing is more fun in traffic jam than a 10 speed bike!

Taxis

The bus or rapid transit system is not always

convenient. Shopping for groceries and going out in

the evening require more convenient forms of

transportation. Taxis are one option. Even allowing

$25 per week for taxis, the yearly total is $1300 less

than the cost of insurance for most young

people.

Holidays

Do you like to ski or snowboard? Jasper for the weekend from Calgary by bus at $194.50 plus tax, return is an interesting possibility. Perhaps you prefer Banff at $51.20 plus tax, return.

Let's say you take three trips by bus to Jasper and

two to Banff. The total cost is less than $750.

Longer Holidays

What about a long weekend in Las Vegas? Three days and four nights including air transportation, transfer between airport and hotel and accommodation comes to about $860 including tax.

In recent years, the cost of fuel has increased

dramatically. Concern over environmental pollution

by engine exhaust is also mounting. In response to

government pressure and the demand of customers, the automotive industry has made changes in the size. efficiency. and safety standards of cars produced in North America.

increased as well. At some point one questions the trouble and expense of owning and operating a car. People are seeking alternatives.

Canadian Automotive Association is $10560 if driven 24,000 km annually. These costs are outlined in their pamphlet, 2004 Driving Costs.

on the cost of operating a midsized North American car in Alberta. The figures do not reflect the higher costs of insurance that a person under 25 would

have to pay.

these transportation dollars.

Bicycle

A bike can be purchased for $300 to $500. It is an

adventurous way of travelling in spring, summer and

fall. Nothing is more fun in traffic jam than a 10 speed bike!

Taxis

The bus or rapid transit system is not always

convenient. Shopping for groceries and going out in

the evening require more convenient forms of

transportation. Taxis are one option. Even allowing

$25 per week for taxis, the yearly total is $1300 less

than the cost of insurance for most young

people.

Holidays

Do you like to ski or snowboard? Jasper for the weekend from Calgary by bus at $194.50 plus tax, return is an interesting possibility. Perhaps you prefer Banff at $51.20 plus tax, return.

two to Banff. The total cost is less than $750.

What about a long weekend in Las Vegas? Three days and four nights including air transportation, transfer between airport and hotel and accommodation comes to about $860 including tax.

Vacation

A good time to holiday in the

tropics is in the summer. Airfares and accommodation costs are low. Summer in Hawaii including seven days on Oahu and six days on Maui, with airfare and hotel accommodation, comes to about $3,000 if you can find a friend to travel with you.

Or take an offseason charter to Europe for $1000

airfare. The cost goes up in the summer months and

during Christmas holidays.

With the cost of bus passes,

taxis, a bike, five trips

to the mountains, a long weekend in Las Vegas and

a holiday to Hawaii or Europe, you will still spend

less on transportation than it costs to own and

operate an average car in Canada for one year.

Consider the alternatives to owning and operating a

private car.

puff and a lemon, you'd better stay away from the

used car market. These terms are used by salesmen to describe a delicious car in excellent shape or one that will sour on you. It takes more than luck to buy a cream puff. The following pointers will help you!

Will the money be well spent with your car giving

hours of enjoyment and pleasure? Or will you be

short of money for other things? Think of food,

clothing, shelter, dates, travel, and holidays. If your

car is going to be your main hobby and interest, you

may want a more powerful, expensive car. But know

what you are getting into. If you choose a sports

car, be prepared to spend a lot of money on purchase, interest, insurance, and repairs.

Before you start looking for a car decide how much

money you can afford to spend. Be sure that the

money would not be better spent attaining a more

important goal.

DO YOU REALLY NEED A NEW CAR?

According to Runzheimer, the average new compact cost about $7500 to run

last year. For a minivan, the price rises to around $ 8,400. The major expense

items are depreciation, gas and interest paid on financing. What the numbers

tell you is that the best way to save is not to buy a car! That is, the best

way to reduce depreciation and financing is to keep your old car longer or buy

a used vehicle. A two- or three-year-old car will have depreciated

considerably- by as much as 50% for some models, and financing and insurance

will be lower. When it comes to reducing fuel costs, the largest actor is how

much driving you do, followed by the vehicle’s fuel consumption.

The older used car will need more maintenance and repairs, and it may he in the shop more often. But the sayings easily outweigh the extra expense, and you should come out ahead at least $2,000 per year- more if it’s a second car you don’t plan to drive as often.

-You’re buying a new car: Obviously... but not necessarily! You might be

signing a lease, in which case ownership does not change hands. In today’s

depressed market, dealers make less on new cars than you think. Alter

negotiation, mark-ups range from zero to about 10%- figure about $500 to $

1,200 depending on the price of’ the car and your negotiating ability.

-Options: Almost no one buys just the basic model. Options can be bought

individually or as part of option packages. Factory options are marked up in

the 15% range. Dealer-installed options, like deluxe floor mats, racks and

radios, are marked up 30-50%. Add $100 or more profit, depending on the options

and the deal.

-You’re selling an old car: Your trade-in provides additional revenue for the

used car department. Depending on the pricing strategy, your trade will add

zero to $2,000 or more profit to the deal.

-Financing: A service you’ll probably be “purchasing”, either I win the dealer,

manufacturer, or a leading institution. Most people don’t look at financing as

a profit-maker for the dealer, or they think that financing is a generic item

with a generic price, but that’s not the case. The dealer passes on your

financing contract to the lowest bidder, usually a bank, and pockets the extra

interest you were charged, called the ‘‘spread” in industry jargon. I. easing

is an alternative wav of financing that is more profitable. Profit ranges front

about $150 to several hundred dollars, depending on the amount financed, the

duration of the loan and how well you shop.

-Loan insurance: Pays off your remaining payments in case of death or long—term

disability. It’s usually tacked on to your loan. Price varies greatly depending

on buyer smarts and seller integrity. It can add anywhere trout $50 to many

hundred dollars profit to the deal.

-Rustproofing: A dealer supplied service with a mark-up of 100% or more, for a

profit of $150 to $200. According to a recent CAA study, over 80% of dealer

rust-proofing is poorly applied. (In Ontario and Quebec, contact the APA for a

recommended aftermarket rust-proofer.)

-Paint sealer, upholstery protector, tire sealant: Other dealer supplied

services which usually have mark-ups in the 200-400% range. Add $200-$300

profit for the paint sealer, and $50-$75 each for the tire sealer and

upholstery spray. These services are usually available for much less at an auto

detailing shop. The APA does not recommend tire sealer and a can of Scotch

guard will protect fabrics as well as the cheaper generic product the dealer

uses.

-Extended warranty: Extra-cost coverage for mechanical failures. Dealer

commission for selling is usually 25-35%. It’s not necessary for most cars in

the APA’s recommended category.

-Liability and collision insurance: Relatively new arrivals to Canadian