Training Room 5: Petty Cash

Practice 3

- Open General Journal Template, and save it in your Course Folder as pr1-tr5-p3.

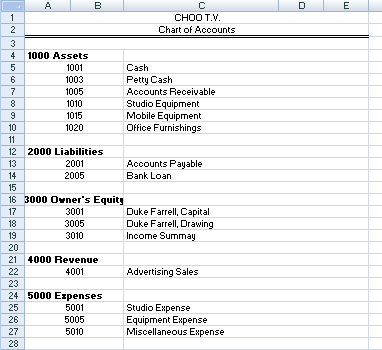

- Using the account titles from the chart of accounts below, journalize the following transactions on page 2 of a general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

These transactions are for July of the current year. The numbers in Column 1 refer to the day of the month.

1 |

Established a petty-cash fund, $200.00 |

5 |

Received $3000 for Advertising Sales, Receipt #21 |

6 |

Paid $1500 to Accounts Payable, Cheque #13 |

7 |

Received $2500 for Advertising Sales, Receipt #22 |

7 |

Customer charged Advertising Sales, $500.00, Invoice #5 |

10 |

Paid $850 to fix the equipment, Cheque #14 |

16 |

Received $1000 from Accounts Receivable, Receipt #23 |

21 |

Sold old studio equipment for $20 000.00, Receipt #24 |

25 |

Paid $250.00 to the bank, Cheque #15 |

27 |

Bought new studio equipment for $50 000, Receipt #25 |

29 |

Received Advertising Sales, $20 000, Receipt #26 |

31 |

Replenished the petty-cash fund. There was $75.00 cash in the petty-cash box.

Use the following vouchers for the month:

Hint: Cash plus the vouchers should equal the amount established in petty cash. If there is less cash, then you must do a Cash Short and Over debit. If there is more cash, then you must do a Cash Short and Over credit.

Think through these questions: How much money should be in petty cash? How much would you have to put into petty cash to replenish it to the established amount? |

To check your work, go to CHOO T.V. General Journal Answer.

Continue to another practice when you have finished, or proceed to Time to Work if you are confident about journalizing.