Training Room 5: Petty Cash

Practice 5

- Open General Journal Template, and save it in your Course Folder as pr1-tr5-p5.

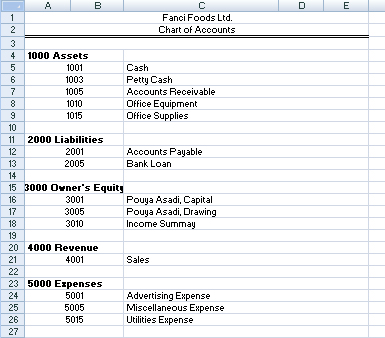

- Using the account titles from the chart of accounts below, journalize the following transactions on page 7 of a general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

These transactions are for March of the current year. The numbers in Column 1 refer to the day of the month.

1 |

Established a petty-cash fund, $200.00 |

2 |

Received $2000.00 from a customer, Receipt #30 |

6 |

Paid $100.00 to advertise in the local newspaper, Cheque #100 |

9 |

Received $250.00 from a customer, Receipt #31 |

11 |

Received $150.00 from Accounts Receivable, Receipt #32 |

11 |

Paid the bank $200.00 of amount owed, Cheque #101 |

15 |

Paid utility bill for $150.00, Cheque #102 |

17 |

Sold old office printer $150.00, Receipt #33 |

20 |

Owner withdrew $100.00, Cheque #103 |

24 |

Received $200.00 from customers, Receipt #34 |

31 |

Paid Accounts Payable $150.00 of amount owed, Cheque #104 |

31 |

Replenished the petty-cash fund. There was $62.50 cash in the petty-cash box.

Use the following vouchers for the month:

Hint: Cash plus the vouchers should equal the amount established in petty cash. If there is less cash, then you must do a Cash Short and Over debit. If there is more cash, then you must do a Cash Short and Over credit.

Think through these questions: How much money should be in petty cash? How much would you have to put into petty cash to replenish it to the established amount? |

To check your work, go to Fanci Foods Ltd. General Journal Answer.

Continue to another practice when you have finished, or proceed to Time to Work if you are confident about journalizing.