Project 3

1. Project 3

1.2. Page 3

Project 3: Financial Statements

Part 2

© James Steidl/shutterstock

What I Need to Know

What the business owns are referred to as assets.

What the business owes, such as car payments or loans from banks, are referred to as liabilities. The worth of the business is owner’s equity.

Notice that in the image of the weigh scale, the left side equals the right side, or the assets equals the liabilities and the owner’s equity. Return now to the “Calculation of Worth” media piece, and go to screen 4. What you own less what you owe equals your net worth. In other words, assets – liabilities = net worth or owner’s equity.

This is referred to as the accounting equation. Check out Calculating Owner’s Equity.

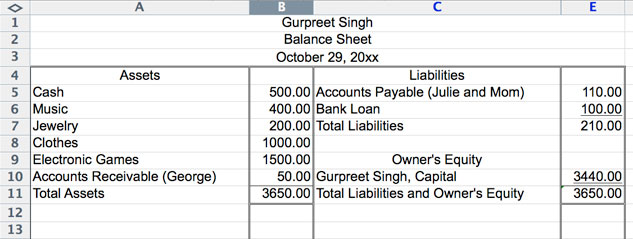

Gurpreet Singh is a high school student and has completed the same assignment that you have. The financial information for him, similar to what you compiled in the previous exercise, is recorded below in a financial statement called a balance sheet.

Notice that any money that Gurpreet is to receive has been put under assets as accounts receivable and any money that Gurpreet owes has been put under liabilities as accounts payable. Bank loans are a separate entry under liabilities.

asset: anything of value that is owned

liability: anything that is owed, such as car payments or loans from a bank

owner’s equity: the worth of the business; assets – liabilities = owner’s equity¬†

accounting equation: assets = liabilities + owner’s equity, or the left side of the balance sheet equals the right side of the balance sheet

accounts receivable: money that the business will be receiving

accounts payable: money that the business still has to pay; debt that is owed

Note that in the following sample balance sheet for Gurpreet Singh, the year is entered as 20xx. Whenever you see this, it refers to the current year.

How much money would Gurpreet have to start up a business if he liquidated all of his assets?

![]()

He would have $3440.00. You can determine the answer by subtracting total liabilities from total assets. In other words, the figure next to the line that reads “Gurpreet Singh, Capital” is the correct figure.

Gurpreet has enough money to begin his business. Keep his financial position in mind as you follow his business throughout the upcoming projects.

Why Is This Important?

It is important to disclose the company’s worth and to have a consistent format when setting up all financial statements. Which GAAP principles would apply here?

![]()

Check when you think you know the answer.

The Principle of Consistency

In the preparation of financial statements, the same accounting principles are applied in the same way in each accounting period.

The Full Disclosure Principle

The Full Disclosure Principle states that any and all information that affects the full understanding of a company’s financial statements must be included with the financial statements. Some items may not affect the ledger accounts directly. These would be included in the form of accompanying notes. Examples of such items are outstanding lawsuits, tax disputes, and company takeovers.

Part 2

Time to Work

Assignment 2

Conduct a search on the Internet for three different types of businesses; for example, a computer company, a clothing store, and a sporting equipment firm.

To help you with your Internet search, key in the name of the company followed by the words “financial statements” (e.g., Apple Computer financial statements). You will find various financial statements, including a balance sheet and an income statement. You will prepare a balance sheet in your next project. The income statement is studied in FIN1030. For now, all you need to do is find each company’s balance sheet and save them in your FIN1015 Course Folder under the company name.

Select Comparing Financial Statements when you are ready to complete this assignment, and save it in your FIN1015 Course Folder.

Portfolio Submission

Include the three balance sheets that you found on the Internet, complete with a summary of their similarities; for example, section headings, totals, and formats.