Project 1

1. Project 1

1.19. Page 4

Training Room 5: Petty Cash

Time to Work

There are two assignments that you must complete for assessment. There is also an optional assignment. Please check with your teacher to see if you need to complete the optional assignment.

Assignment 1

Complete Training Room 5 Assignment 1.

Assignment 2

- Open General Journal Template, and save the form in your Course Folder as pr1-tr5-2.

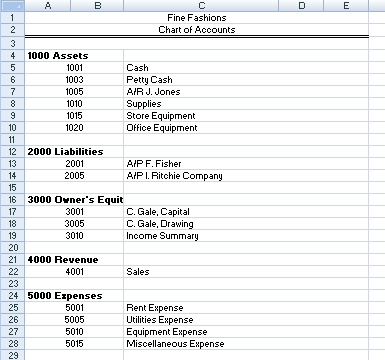

- Use the account titles from the chart of accounts below:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

- Journalize the following transactions on page 2 of a general journal.

Transactions for July of the current year are below. The numbers in Column 1 refer to the day of the month.

July |

Transactions |

1 |

Establish a petty-cash fund, $200.00 |

1 |

Paid $2000 for rent, Cheque #100 |

5 |

Received $1000 for sales, Receipt #20 |

7 |

Paid $1500 to F. Fisher for amount owed, Cheque #101 |

8 |

Received $3500 for sales, Receipt #21 |

10 |

Paid $500 to repair store equipment, Cheque #102 |

10 |

Paid $400 for utilities, Cheque #103 |

11 |

Owner withdrew $300.00 for personal use, Cheque #104 |

16 |

Owner invested $3000 in the business, Receipt #22 |

21 |

Sold old store equipment for $1000, Receipt #23 |

25 |

Purchased supplies for $200.00, Cheque #105 |

29 |

Received $2000.00 from sales, Receipt #24 |

31 |

Replenished the petty-cash fund. There was $23.50 cash in the petty-cash box.

Use the following vouchers for the month:

|

Assignment 3 (Optional )

Check with your teacher before you attempt this optional assignment.

- Open General Journal Template, and save the form in your Course Folder as pr1-tr4-3.

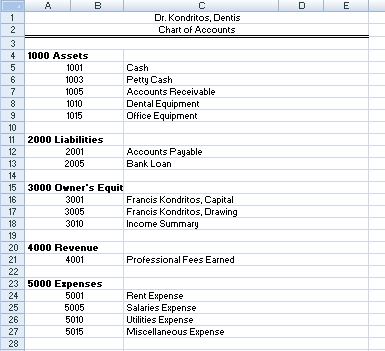

- Use the account titles from the chart of accounts below:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

- Journalize the following transactions on page 7 of a general journal.

Transactions are for May of the current year. The numbers in Column 1 refer to the day of the month.

1 |

Establish a petty-cash fund, $250.00 |

1 |

Paid $1500.00 rent for May, Cheque #200 |

2 |

Received $20 000.00 for dental services, Receipt #111 |

8 |

Received $50 000.00 for Accounts Receivable, Receipt #112 |

10 |

Bought new office equipment for $5000.00, Cheque #201 |

14 |

Paid $25 000.00 to the bank on amount owed, Cheque #202 |

15 |

Charged Accounts Payable $1500.00 for dental equipment, Purchase Order #15 |

20 |

Owner withdrew $2000.00, Cheque #203 |

22 |

Paid utilities of $850.00, Cheque #204 |

23 |

Bought new office chairs for $5000.00, Cheque #205 |

29 |

Purchased a new computer for $5000.00, Cheque #206 |

30 |

Paid salaries of $10 000.00, Cheque #207 |

31 |

Replenished the petty-cash fund. There was $85.50 cash in the petty-cash box.

Use the following vouchers for the month:

|

© Feng Yu/shutterstock

Training Room 5 Summary

In this training room you established a petty-cash fund, journalized daily transactions, and replenished the petty-cash fund at the end of the month. You should now be more aware of the various ethical issues surrounding the recording of petty cash to the accounting records of a business.

The next training room will show you how to post these entries to the ledger, so you know how much money remains in each account.