Project 1

1. Project 1

1.22. Page 3

Training Room 6: Posting and the Trial Balance

© Jiang Dao Hua/shutterstock

Part 2 — Trial Balance

What I Need to Know

Just as a gymnast must stay balanced to continue across a balance beam, a business owner must continually keep the company books balanced to continue in business. A business cannot wait until the end of the year to determine if the books are balanced. The books must be balanced on a regular basis.

Why Is This Important?

A business does not have any place to check its work, as you have done in Part 1. However, the double-entry accounting system helps businesses to check their own work. Remember, the double-entry accounting system means for every debit there is an equal credit.

What Do I Need to Do?

To make sure that the ledger is in balance, or that debits equal credits, businesses need to add together all the debit balances to find the total debits, and then add together all the credit balances to find the total credits. These totals must be equal or an error has been made. An informal check of these balances may be done at any time.

trial balance: a list of all the debits and credits in the ledger

Its purpose is to prove that total debits equal total credits.

The formal accounting form used to check the equality of the debits and credits is called a Trial Balance. A trial balance is a list of all the debits and credits from the ledger, and is the last step in the Accounting Cycle. Check out Step 4 in the Interactive Accounting Cycle.

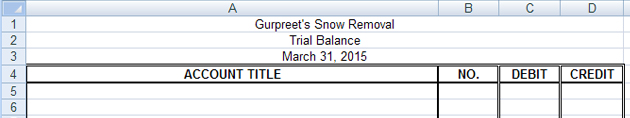

Let’s do a formal trial balance of Gurpreet Singh’s ledger to see if it is properly balanced. Open Trial Balance Template and save it as Gurpreet’s Trial Balance in your Course Folder.

The top heading is very similar to the balance sheet with the who, what, and when. If you need help with formatting the date as it appears in Excel®, view the demonstration “Changing the Date.”

Enter in the first three lines as shown below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Open Gurpreet’s ledger, which you saved in your Course Folder at the end of Part 1. It is easiest to view these two Excel® files on the screen side by side. If you forgot how to do that, watch the demonstratioon “Viewing Side by Side.”

Now you need to enter all of the account titles and their balances from the ledger. If an account has a zero balance, however, you do not need to include it. Watch the first few, which are shown for you, in the demonstration “Debit/Credit Balances.”

Enter all of the account balances in the trial balance.

The last step is to add together the two columns to make sure that the debits equal the credits.

Watch the demonstration “Totaling the Trial Balance” for instructions on how to do this, as well as to verify that you entered your accounts correctly from the ledger.

© Howard Sandler/shutterstock

What Do You Do if the Trial Balance Does Not Balance?

Everybody makes mistakes—it happens.

If you find that your trial balance does not balance, following the steps in Finding Trial Balance Errors. The steps are listed from the most common error to the least common error, so it is best to look for your error in that order. These steps are also available in your Toolkit in Tips and Tricks.

© zimmytws/shutterstock

It looks like Gurpreet found an error in his records.

© Alexey Afanasyev/8176652/Fotolia

Watch “Discussion About Finding Errors” to see what Gurpreet and Ravinder are discussing.

To correct this entry, do you know which account would get the debit and which account would get the credit?

Think through the steps.

Step 1: Which accounts are affected? (refer to the account titles and place on T-Accounts)

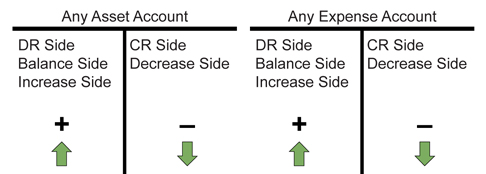

Step 2: What types of accounts are these?

Step 3: What does the T look like for this type of account? (refer to Analyzing the Balance Sheet in Tips and Tricks in the Toolkit)

Step 4: Are these accounts increasing or decreasing?

Step 5: Are these accounts debits or credits?

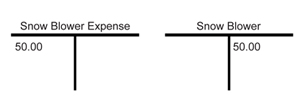

- The accounts that are affected are Snow Blower and Snow Blower Expense.

- Snow Blower is an Asset and Snow Blower Expense is an Expense.

- T-accounts are

- The Expense account is increasing—$50.00 should have been entered as an expense—a debit.

The Asset account is decreasing—$50.00 should never have been entered—a credit.

If you are ever unsure which account gets the debit and which account gets the credit, always do a rough T-account to help you think it through.

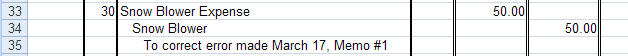

Gurpreet wrote an explanation of what had happened on Memo #1. What would the journal entry be to make this correction? Check your answer to see if you are correct. Note that you do not have to put this entry in your journal, because you did not make this error.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

While you are doing the Time to Practise and Time to Work problems, you may want to refer to Analyzing Transactions to help you remember when to add and when to subtract in your ledger.

The following rubrics are also available for reference. All rubrics have a checklist to help you self evaluate your work.

Check in the Toolkit for help with these concepts and exemplars, or help with Excel®.