Project 3

1. Project 3

1.7. Page 2

Project 3: Closing Entries

What Do I Need to Know?

Make sure that the total debits for the closing entries equal the total credits in the journal before posting these amounts into the ledger. Remember that the ledger holds all of the accounts for a business so that it is easy to see how much money is in each account. After posting, the revenue, expense, drawing, and income summary accounts will all be closed or equal zero. The capital account will be adjusted higher or lower, depending on whether the business made a net income or a net loss.

Why Is This Important?

If debits do not equal credits, you know you have likely made a mistake. It is important to try to eliminate any errors so that you are not posting incorrect amounts into the ledger. The balances in the ledger accounts will not be changed until these amounts are posted or placed in the ledger so that the new balances can be calculated.

What Do I Need to Do?

Posting closing entries is the same as when you posted other journal entries from the general journal into the general ledger in FIN1020.

Follow the instructions below to post Gurpreet’s closing entries from his journal into his ledger.

- Open Gurpreet’s General Journal, and save it as “Gurpreet’s General Journal” in your course folder.

- Open Gurpreet’s General Ledger, and save it as “Gurpreet’s General Ledger” in your course folder.

- View Posting the Closing Entry, and follow the instructions to post Gurpreet’s closing entries.

You can check your work when you have finished posting by clicking on the following links:

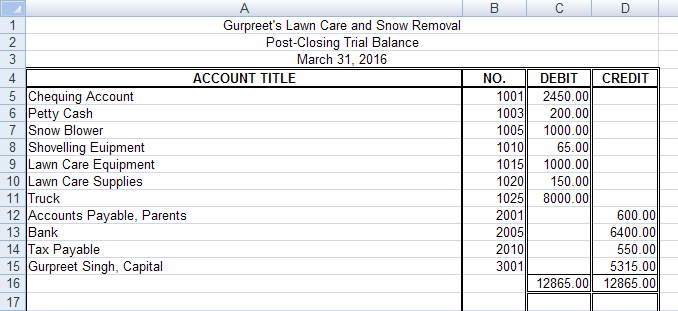

Post-Closing Trial Balance

After the closing entries have been posted and the accounts have been balanced, a trial balance is completed to test the equality of the debits and credits in the ledger. The trial balance taken after the closing entries have been posted is called a post-closing trial balance. Only accounts that are open at the end of the fiscal period are listed on the post-closing trial balance. The accounts that are left open are the assets, liabilities, and owner’s capital accounts. Those accounts with a zero balance are not included because they have been closed.

You should be familiar with completing a trial balance from FIN1020 as well as the trial balance section of the worksheet project. See if you are able to complete the post-closing trial balance for Gurpreet’s Lawn Care and Snow Removal before checking your work.

Tip: The heading must describe the who, what, and when.

Only accounts that remain open are listed.

Rule the post-closing trial balance when it is balanced.

Open a Trial Balance Form, and save it as “Gurpreet’s Post-Closing Trial Balance.”

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

When completing your practices and assignments, you may want to refer to the Post-Closing Entries Rubric, which includes a checklist of what to do when posting the closing entries. This rubric is also available in the Toolkit.

Remember that 20xx refers to the current year. Use the current year for all of the following practices and assignments.