Project 4

1. Project 4

1.7. Page 2

Project 4: Budgeting

What Do I Need to Know?

Budgeted Income Statement

© jeff Metzger/shutterstock

A budgeted income statement is a projection of a business's anticipated revenue, expenses, and net income for a fiscal period. This statement is sometimes referred to as an operating budget. To prepare this report, a business must refer to the income statement for the current fiscal period.

budgeted income statement: a projection of a business's anticipated revenue, expenses, and net income for a fiscal period

operating budget: a projection of a business's anticipated revenue, expenses, and net income for a fiscal period

cash budget: a projection of a business' expected cash receipts and cash payments for a fiscal period

Cash Budget

The cash budget is an estimate of cash, cash receipts, and cash payments. This budget helps companies maintain an adequate cash flow. For example, companies must have cash to meet monthly expense demands, such as payroll.

Cash Receipts

A company must estimate cash receipts from all sources:

- cash sales: an estimate of projected sales for the period, generally approximately 10% of sales

- collection on accounts receivable: an estimate of amounts received from customers

The cash receipts are not equal to the sales for the month, as accounts are often paid 30 days after sales. Some accounts are uncollectible (bad debts), and there are sometimes returns on some sales. These estimates will change from business to business. For example, one business may have a high rate of collection of accounts receivable because most customers promptly pay their accounts. Another business may have a low rate of collection as many customers do not pay their overdue accounts.

Once a business has operated for a period of time, calculations can be made to predict the rate of repayment. These predictions are used in budget preparations.

Cash Payments

Estimated cash payments for the budgeted period might include these items:

- Payments on Accounts Payable: The plan to pay on account for each period (e.g., per month) is important. Late payments may affect a company's credit rating and its ability to borrow money. If a company is in the business of purchasing and selling merchandise, the accounts payable will be considerably higher than for a service business.

- Payments for Expenses: A company may have ongoing selling expenses and administrative expenses. These expenses may need to be analyzed each period.

- Payments for Capital Purchases: A company will sometimes require large outlays of cash for equipment. These large expenditures need to be budgeted.

- Miscellaneous Payments: Other payments, such as payments on notes as they become due, will reduce the amount of cash a company has available.

In this course you are studying a service business, where there is no inventory to be concerned with. For example, Gurpreet’s business is a service business where he sells the service of lawn care and snow shovelling. Gurpreet has no inventory that he is purchasing to sell. If a budget were to be prepared for a merchandise business, a purchases budget would have to be included in the budgeting process. This will be discussed in future financial management courses.

Why Is This Important?

A budgeted income statement provides the company with an estimated net income based on historical records, trend analysis, and business experience. This allows the company to set goals regarding future spending, such as an expansion of the business or a relocation to attain the future projected net income.

A cash budget provides the company with a projected estimate of cash received and cash paid. This data allows the company to be aware of how much cash should be available for such things as paying back loans, taking advantage of cash discounts, or unexpected market fluctuations.

Both of these reports direct a company towards making informed decisions regarding future spending to maximize profits and growth. Consistent reporting allows comparisons from fiscal period to fiscal period and allows for better planning.

© Marek/13044691/Fotolia

What Do I Need to Do?

Preparing the Budgeted Income Statement

To prepare this report, which makes projections about future revenue and expenditures, you need to examine the current income statement for the company.

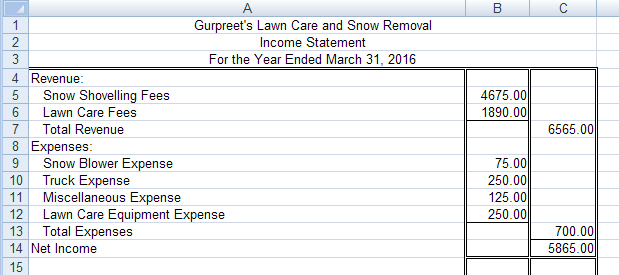

Have a look at Gurpreet’s income statement, which includes his present or actual financial information for the fiscal period.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Check out Gurpreet’s Plan to see what Gurpreet plans to budget for his next fiscal period.

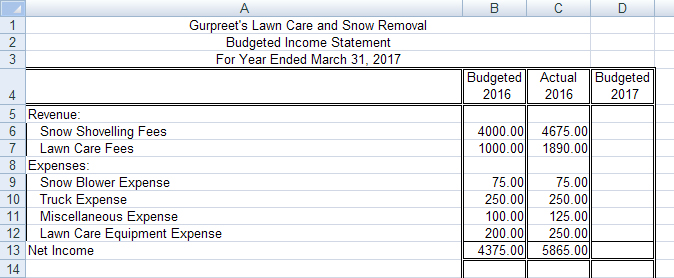

Gurpreet prepared the partial budgeted income statement which follows. Notice that the first column is what he had budgeted for and the second column is what actually happened. The actual numbers were taken directly from his current income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The third column is for his projection, or plan, for the coming fiscal year.

With his new plan in mind, open Gurpreet’s Partial Budgeted Income Statement and complete the third column.

View Gurpreet’s Budgeted Income Statement for detailed instructions and to check your answer.

Preparing the Cash Budget

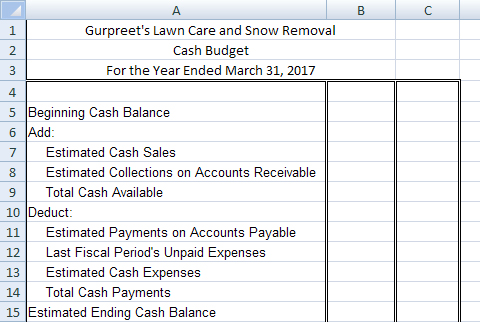

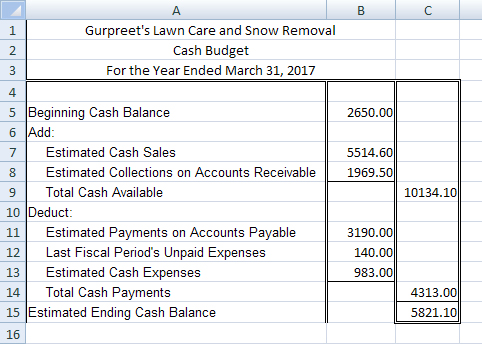

Gurpreet is busy completing his cash budget for his next fiscal period. The format of his form is shown below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

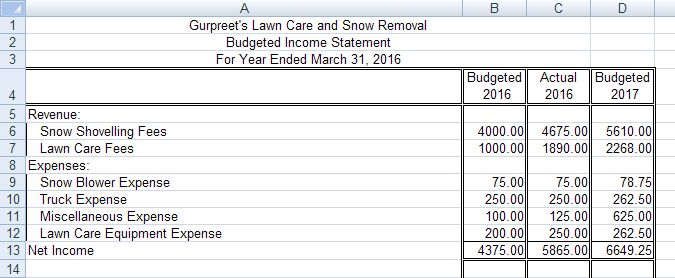

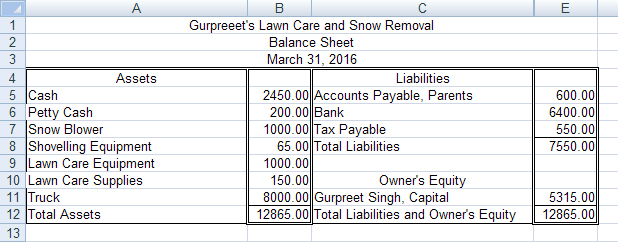

To complete this cash-budget form, Gurpreet needs to refer to his budgeted income statement and his balance sheet at the end of the last fiscal period. Both are shown.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Open the Cash Budget Form, and save the form as “Gurpreet’s Cash Budget.” Complete his cash budget using the financial statements above and the information below.

There are three sections to complete on the cash budget: beginning cash, cash receipts, and cash payments. The beginning cash balance will include the petty cash from his balance sheet.

Use the following information to complete Gurpreet’s Cash Budget.

1. Cash Receipts or the Add Section of the Cash Budget

From looking at his previous revenue, Gurpreet estimates that about 70% of his customers pay cash. The other 30% are accounts receivable customers that he will collect from in the next fiscal period.

Gurpreet is estimating that he will receive cash from 30 percent of his last fiscal period in the upcoming budget period.

Hint: Estimated collections on accounts receivable = total revenue from the actual column times 0.30.

2. Cash Payments or the Subtract Section of the Cash Budget

Gurpreet has an agreement to pay his parents $50.00 per month, the bank $170.00 per month, and he will pay off tax payable in full before the end of the next fiscal period.

He still needs to pay 20% of his last budget period’s expenses. Some of these expenses were not due until the end of the first month, so Gurpreet will have to use the cash for this fiscal period. Be sure to use the actual column to calculate this.

Gurpreet anticipates that he will pay 80% of his expenses in cash for this fiscal period.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

If you did not get the same ending cash balance, you may refer to the videos below for detailed instructions. One video gives instructions on the Cash Balance and Cash Receipts calculations, and the other has information on the Cash Payments calculations.

- Cash Balance and Cash Receipts

- Cash Balance and Cash Receipts—Completing the Cash Payment or the Subtract Section

Review the following rubrics and exemplars, and apply them to the various budgets that you have just prepared before you attempt the practices or the assignments:

Budgeted Income Statement Rubric

Budgeted Income Statement Exemplar

These rubrics are available for your reference in the Toolkit at any time.