Section 1

| Site: | MoodleHUB.ca 🍁 |

| Course: | Math 20-3 SS |

| Book: | Section 1 |

| Printed by: | Guest user |

| Date: | Tuesday, 2 December 2025, 6:58 AM |

Description

Created by IMSreader

Table of contents

- 1. Section 1

- 1.1. Lesson 1

- 1.2. Launch

- 1.3. Are You Ready?

- 1.4. Refresher

- 1.5. Discover

- 1.6. Explore

- 1.7. Explore 2

- 1.8. Explore 3

- 1.9. Explore 4

- 1.10. Connect

- 1.11. Lesson 1 Summary

- 1.12. Lesson 2

- 1.13. Launch

- 1.14. Are You Ready?

- 1.15. Refresher

- 1.16. Discover

- 1.17. Explore

- 1.18. Explore 2

- 1.19. Explore 3

- 1.20. Explore 4

- 1.21. Connect

- 1.22. Lesson 2 Summary

- 1.23. Lesson 3

- 1.24. Launch

- 1.25. Are You Ready?

- 1.26. Refresher

- 1.27. Discover

- 1.28. Explore

- 1.29. Explore 2

- 1.30. Explore 3

- 1.31. Connect

- 1.32. Lesson 3 Summary

- 1.33. Lesson 4

- 1.34. Launch

- 1.35. Are You Ready?

- 1.36. Refresher

- 1.37. Discover

- 1.38. Explore

- 1.39. Explore 2

- 1.40. Connect

- 1.41. Lesson 4 Summary

- 1.42. Section 1 Project

- 1.43. Section 1 Summary

1. Section 1

Section 1: Personal Budgets

Jupiterimages/Comstock/Thinkstock

Section 1 Introduction

Do you have a plan for paying your bills? Will your future income be enough to cover all your expenses and still leave enough for savings and extras?

In this section your project is to create a personal financial plan designed to be a personal budget to suit your needs. Each of the four lessons will guide you through the budgeting process. You will explore your income and learn how to organize expenses, and your budget will be built on your personal circumstances. You will organize your finances and create, present, and modify your budget based on guidelines to help you greet bills with enthusiasm and take that next step to real independence!

1.1. Lesson 1

Section 1: Personal Budgets

Lesson 1: Introduction to Budgeting

Focus

National Archives of Canada / PA-29120

It may seem that life was simpler in the past. But people had to plan ahead no matter whether they lived off the land or in a city. Did people have sufficient food and adequate shelter to meet their needs and survive in difficult times?

Today you must also plan carefully to meet your present and future needs. You must balance income and expenses to survive financially in the modern world. Part of this financial planning involves preparing a budget.

A budget is a plan used to predict income and expenses to meet your financial goals. This lesson introduces you to preparing a personal budget.

Lesson Questions

In this lesson you will investigate the following questions:

- What categories of income and expenses are used to create a personal budget?

- How can personal budgets be applied to real-life situations?

Assessment

Your assessment for this lesson may include a combination of the following:

- course folder submissions from Try This and Share

- your contribution to the Mathematics 20-3: Glossary Terms

- Lesson 1 Assignment (Save a copy of your lesson assignment document to your course folder now!)

- the Project Connection

In this course you may come across Self-Check questions, Try This questions, and other activities that may or may not be assessed.

Remember that these questions and activities provide you with the practice and feedback that you need to successfully complete this course. You should respond to all the questions and place those answers in your course folder. Your teacher may wish to view the work that you have stored in your course folder to check on your progress and to see if you require assistance in some way.

Materials and Equipment

- calculator

Time

This lesson has been designed to take 150 minutes; however, it may take more or less time depending on how well you are able to understand the lesson concepts. It is important that you progress at your own pace based on your own learning needs.

1.2. Launch

Section 1: Personal Budgets

Launch

This section checks to see if you have the necessary background knowledge and skills required to successfully complete Lesson 1.

Complete the following Are You Ready? questions. If you have difficulty or any questions, visit Refresher for a review or contact your teacher.

1.3. Are You Ready?

Section 1: Personal Budgets

Brand X Pictures/Thinkstock

Are You Ready?

- Anny has just accepted a job at Ben’s Garage in Bienfait, Saskatchewan. Her hourly wage is $25. If she works an average of 140 h per month, what will her gross pay be? Answer

- Explain why Anny’s net pay will be less than her gross pay. Answer

- If Anny's only deductions are income tax, Employment Insurance premiums, and Canada Pension Plan contributions, what will her monthly net pay be? You can use the Canada Revenue Agency’s Payroll Deductions Online Calculator or any other online calculator you can find. Answer

If you answered the Are You Ready? questions without problems, move on to Discover.

If you found the Are You Ready? questions difficult, complete Refresher to review these topics.

1.4. Refresher

Section 1: Personal Budgets

Refresher

If you do not know the answers to the Are You Ready? questions or require more information, review deductions and net pay in Lesson 7 of Mathematics 10-3: Module 8.

Go back to Are You Ready? and try the questions again. Contact your teacher if you continue to have difficulty.

1.5. Discover

Section 1: Personal Budgets

Discover

Digital Vision/Thinkstock

Share 1

With a partner, or in a group, look at the photo as you discuss the following questions:

- Anny has rented an apartment for $950 per month. This apartment is located close to her work at Ben’s Garage. Aside from the rent, what other monthly expenses might Anny have?

- How much money does Anny have to spend on these other monthly expenses?

![]() If required, save a record of your discussion in your course folder.

If required, save a record of your discussion in your course folder.

As you are working on this Share section, refer to the Share Rubric. The rubric will help you understand what your teacher expects of you.

1.6. Explore

Section 1: Personal Budgets

Photodisc/Thinkstock

Explore

In Discover, you shared your answers with other students.

Anny’s friend Alexei listed some other possible expenses.

If you look at Alexei’s list you will notice that some of these predictable expenses will be the same from one month to the next. These expenses are called recurring expenses. Some expenses will change in amount from month to month and are called variable expenses.

Because some expenses only occur occasionally, they cannot be predicted. These are unexpected expenses.

Try This 1

Follow the instructions to complete Alexei’s Expenses, a drag-and-drop activity.

1.7. Explore 2

Section 1: Personal Budgets

Inuit artistry varies in style and composition depending on the region of Canada’s North where the artist lives. The main areas are Baffin Island, Keewatin, the Western Arctic, Belcher Islands, northern Québec, and Labrador.

PhotoObjects.net/Hemera Technologies/Thinkstock

There are similar categories for income.

Regular income is the amount of income you receive on a regular basis, such as your monthly salary.

Variable income is income that changes—the amount is not predicable. This total includes tips, commissions, income from garage sales or yard sales, and casual labour.

An example of variable income is the payments an Inuit artist receives for carvings.

![]()

Work through “Example 1” on page 304 of your textbook, MathWorks 11.

Consider the following as you read:

- Could any of the expenses be considered unexpected expenses?

- How does Loree’s total income compare to her total expenses?

- How much money does Loree have left after her expenses are added up? Suggest what she could do with this money.

1.8. Explore 3

Section 1: Personal Budgets

Stockbyte/Thinkstock

Try This 2

Andre works as a short-order cook in a restaurant in his hometown. For the month of September he has prepared a spreadsheet for his net pay, his share of the tips, and his expenses. Andre owns a car and makes monthly insurance payments.

Open Andre's Life spreadsheet and, if possible, work with a partner to answer these questions.

- To describe Andre's income, enter an R (for recurring) or V (for variable) in the column headed Regular or Variable.

- Enter an R or V in the column headed Recurring or Variable to describe his expenses.

- Andre’s total expenses in September were greater than his total income; Andre spent more than he earned.

- Suggest ways Andre might have adjusted his expenses so that they total less than his earnings.

- Enter your suggested dollar values in the Expenses column.

- Explain why you made each suggestion in the Explanation of Adjustment column.

- Suggest ways Andre might have adjusted his expenses so that they total less than his earnings.

- What percentage of his regular income does Andre spend on rent?

![]() Save a copy of the spreadsheet and your answers to your course folder.

Save a copy of the spreadsheet and your answers to your course folder.

1.9. Explore 4

Section 1: Personal Budgets

Now, check your understanding of the lesson’s objectives.

Self-Check 1

- Do question 1 of “Build Your Skills” on page 309 of MathWorks 11. Answer

- Do question 3 of “Build Your Skills” on page 309 of MathWorks 11. Answer

It is now time to add new math terms, definitions, and examples/notes to your Mathematics 20-3: Glossary Terms document. Complete the missing pieces of the document, and save it to your desktop. Note that some terms, defintions, and examples/notes have already been provided in the document.

In this lesson the new terms you will add are the following:

- regular income

- variable income

- recurring expenses

- variable expenses

- unexpected expenses

- gross pay

- net pay

1.10. Connect

Section 1: Personal Budgets

Connect

Project Connection

At this time you should now be ready to begin your Section 1 Project: Create Your Own Personal Budget. Take some time to read over the project expectations and the assessment rubric. You may complete Step 1 of the project now. Save all your work in your course folder.

Lesson 1 Assignment

Your lesson assignment contains some problems for you to solve using the knowledge gained during the lesson. Now you will have the chance to apply the concepts and strategies that you have learned to a new situation. Please show work to support your answers.

Open the Lesson 1 Assignment that you saved to your course folder and complete the questions.

1.11. Lesson 1 Summary

Section 1: Personal Budgets

Lesson 1 Summary

Creatas/Thinkstock

In this lesson you were introduced to the budgeting process. You analyzed income and expenses and categorized them as regular income or variable income and as recurring, variable, or unexpected expenses.

Setting up a budget can help you realize your financial goals and live within your means.

1.12. Lesson 2

Section 1: Personal Budgets

Lesson 2: Creating a Budget

Focus

Many people find it difficult to live within their means. Even though they may have what appears to be adequate income, at the end of each month they are struggling to pay all their bills and may go further into debt by resorting to credit. One way to avoid accumulating debt is to draft a conservative budget and follow this guide as strictly as possible. To create this budget, it is necessary to review spending habits and determine which expenses can be reduced or eliminated.

iStockphoto/Thinkstock

A conservative budget is a plan to help people live within their means. Expenses will be less than income, with money left over at the end of the month.

Lesson Question

How can you estimate your income and expenses so that you can create a conservative budget?

Assessment

Your assessment for this lesson may include a combination of the following:

- course folder submissions from Try This and Share

- your contribution to the Mathematics 20-3: Glossary Terms

- Lesson 2 Assignment (Save a copy of your lesson assignment to your course folder now.)

- the Project Connection

Materials and Equipment

- calculator

1.13. Launch

Section 1: Personal Budgets

Hemera/Thinkstock

Launch

This section checks to see if you have the necessary background knowledge and skills required to successfully complete Lesson 2.

Complete the following Are You Ready? questions. If you have difficulty or any questions, visit Refresher for a review or contact your teacher.

An important skill in preparing a budget is working with percentages. Various expenses are often expressed as a percentage of a person’s income.

1.14. Are You Ready?

Section 1: Personal Budgets

Are You Ready?

Jon’s gross salary is $4550 per month. His monthly deductions are 30% of his gross salary.

- What percentage of Jon’s gross salary is his net pay? Answer

- Calculate his net pay. Answer

- Jon pays $1200 in rent each month. What percentage of Jon’s net pay is his rent? Round to the nearest tenth of one percent. Answer

- In December, Jon spent $200 more than his net pay. What were Jon’s expenses as a percentage of his net pay? Round to the nearest tenth of one percent. Answer

If you answered the Are You Ready? questions without any issues, move on to Discover.

If you had some difficulty with the Are You Ready? questions, complete Refresher.

1.16. Discover

Section 1: Personal Budgets

Comstock/Jupiterimages/Thinkstock

Discover

Josephine is an auto mechanic in Yellowknife. She is saving for a holiday in Europe and wishes to create a budget. As part of the budgeting process, Josephine is reviewing her bank records for the past six months to analyze expenses. She has entered her income and expenses on a spreadsheet. The following are Josephine's records for November. Note that, for example, her paycheque was received on November 1.

|

Josephine’s November Income and Expenses |

|||

|

Date |

Description |

Expense |

Income |

|

1 |

Paycheque |

|

$4325.00 |

|

1 |

Rent |

$1200.00 |

|

|

1 |

Prescription |

$31.16 |

|

|

2 |

Groceries |

$47.19 |

|

|

2 |

Cash withdrawal |

$200.00 |

|

|

3 |

Computer repair |

$73.36 |

|

|

4 |

Car insurance |

$150.00 |

|

|

6 |

Oil change on car |

$52.00 |

|

|

7 |

Pizza |

$24.00 |

|

|

7 |

Fuel |

$59.50 |

|

|

7 |

Life insurance premium |

$26.95 |

|

|

8 |

Restaurant |

$25.50 |

|

|

9 |

Cross-country skis |

$150.00 |

|

|

10 |

Movies |

$20.00 |

|

|

11 |

Snow tires |

$600.00 |

|

|

12 |

Groceries |

$45.67 |

|

|

14 |

Gift for friend |

$40.00 |

|

|

15 |

Cable TV fees |

$50.00 |

|

|

15 |

Cosmetics |

$35.75 |

|

|

16 |

Phone rental |

$62.00 |

|

|

17 |

Milk and bread |

$12.50 |

|

|

18 |

Cash withdrawal |

$200.00 |

|

|

19 |

Takeout food |

$24.95 |

|

|

20 |

Fuel |

$53.00 |

|

|

21 |

New jeans and sweater |

$142.00 |

|

|

22 |

Groceries |

$75.35 |

|

|

23 |

Airfare to Edmonton |

$250.00 |

|

|

24 |

Restaurant |

$55.00 |

|

|

25 |

Motel in Edmonton |

$105.50 |

|

|

26 |

Taxi |

$50.00 |

|

|

26 |

New winter coat |

$235.00 |

|

|

27 |

Books |

$73.49 |

|

|

29 |

Fuel |

$50.00 |

|

|

30 |

Takeout food |

$40.00 |

|

Try This 1

- Review Josephine’s expenses for November. Group similar expenses into the same category. For example, two listings you might use are rent and clothing.

- Total all of Josephine’s November expenses. Is this total more than her income, or are her expenses less than her income?

Share 1

Discuss your answers to Try This 1 with a classmate or with a group of people.

- Did you have any similar categories? What different categories did you notice?

- With your partner or group, decide if Josephine’s budget is conservative.

![]() If required, save a copy of your discussion in your course folder.

If required, save a copy of your discussion in your course folder.

1.17. Explore

Section 1: Personal Budgets

Explore

In Discover, you shared your answers with other students. It was likely that different students used different categories to group Josephine’s November expenses. Categories are often a matter of personal choice and can depend on the personal circumstances of the person who is drafting a budget. Even the number of categories may differ.

Try This 2

Open Josephine's November Expenses activity by clicking on the button to the left. Then, do the following:

- Under the Category heading, type in the categories you chose to use in Try This 1.

- If you require an additional line for more categories, click “Add a new category.”

- Categorize each of Josephine’s expenses by selecting the appropriate category from the drop-down menu beside each expense.

- When you put a particular expense into a category, the total for the category is updated and the percentage of that total as compared to Josephine’s net income is also updated.

- One category you cannot delete or add an expense into is Savings. Remember that Josephine’s expenses were $65.13 less than her net or net pay.

- What is the sum of the percentages for all the budget categories and savings? Why?

- Should Josephine create a budget based on November spending alone? Why or why not?

- Some financial advisors suggest an individual should not spend more than 35% of net pay on rent or house payments. According to your table, is Josephine within this guideline?

- What was the cost of snow tires as a percentage of her net pay? Round to one decimal place.

![]() Save your answers to your course folder.

Save your answers to your course folder.

net pay = $4325

Let n be the percent.

1.18. Explore 2

Section 1: Personal Budgets

George Doyle/Stockbyte/Thinkstock

Next, you will create a budget based on several months of expense and income information. This will be a conservative budget. The budget will be designed so that at the end of each month there will be a surplus, or money left over. A conservative budget is set up to avoid running into a deficit and to ensure there is enough income to cover any unforseen month-end expenses.

Example

Marcel works as a clerk in a hardware store during the day. In the evenings, he supplements his income by tutoring young students in mathematics. Marcel would like to save money each month for a proposed trip to Europe next year. Marcel has reviewed his income and expenses for the past six months. Help Marcel create a conservative budget to achieve his goal.

The following chart summarizes Marcel’s income and expenses for the last six months.

|

Marcel’s Income and Expenses |

||||||||

|

Income |

|

Expenses |

|

|

Income |

|

Expenses |

|

|

January |

|

April |

||||||

|

Regular |

$2210 |

Rent |

$600 |

|

Regular |

$2210 |

Rent |

$600 |

|

Tutoring |

$200 |

Food |

$285 |

|

Tutoring |

$190 |

Food |

$345 |

|

|

|

Vehicle |

$300 |

|

|

|

Vehicle |

$410 |

|

|

|

Insurance |

$200 |

|

|

|

Insurance |

$200 |

|

|

|

Clothing |

$125 |

|

|

|

Clothing |

$210 |

|

|

|

Entertainment |

$230 |

|

|

|

Entertainment |

$290 |

|

|

|

Other |

$300 |

|

|

|

Other |

$340 |

|

February |

|

May |

||||||

|

Regular |

$2210 |

Rent |

$600 |

|

Regular |

$2210 |

Rent |

$600 |

|

Tutoring |

$150 |

Food |

$310 |

|

Tutoring |

$230 |

Food |

$295 |

|

|

|

Vehicle |

$420 |

|

|

|

Vehicle |

$420 |

|

|

|

Insurance |

$200 |

|

|

|

Insurance |

$200 |

|

|

|

Clothing |

$250 |

|

|

|

Clothing |

$75 |

|

|

|

Entertainment |

$170 |

|

|

|

Entertainment |

$280 |

|

|

|

Other |

$250 |

|

|

|

Other |

$355 |

|

March |

|

June |

||||||

|

Regular |

$2210 |

Rent |

$600 |

|

Regular |

$2210 |

Rent |

$600 |

|

Tutoring |

$180 |

Food |

$318 |

|

Tutoring |

$325 |

Food |

$328 |

|

|

|

Vehicle |

$350 |

|

|

|

Vehicle |

$395 |

|

|

|

Insurance |

$200 |

|

|

|

Insurance |

$200 |

|

|

|

Clothing |

$300 |

|

|

|

Clothing |

$125 |

|

|

|

Entertainment |

$340 |

|

|

|

Entertainment |

$240 |

|

|

|

Other |

$290 |

|

|

|

Other |

$345 |

Step 1: Estimate Marcel’s monthly income.

|

Marcel’s income from tutoring varies from month to month. Use a monthly average of his income from tutoring. |

|

|

Add all the income he receives from tutoring over the six months. |

$200 + $150 + $180 + $190 + $230 + $325 = $1275 |

|

Divide by 6 to find the monthly average. |

|

|

Since you want to create a conservative budget, it is wise to underestimate Marcel's variable income.

About $200/month is appropriate, as Marcel may not tutor very much in July and August. |

Tutoring average income ~ $200/month |

|

Add his regular income of $2210 from the hardware store. This is Marcel's estimated monthly income. |

$2210 + $200 = $2410 |

Step 2: Average the budget categories and predict appropriate monthly amounts.

|

Rent |

|

|

Food |

|

|

Vehicle |

|

You will now finish creating Marcel’s budget by completing Try This 3.

1.19. Explore 3

Section 1: Personal Budgets

Try This 3

- Calculate Marcel’s budget estimates for clothing, entertainment, and other expenses. Remember to overestimate for all three categories because you are preparing a conservative budget.

Clothing Estimated clothing expenses:

Entertainment Estimated entertainment expenses:

Other Estimated other expenses:

- What is the total of all estimates for Marcel’s monthly expenses?

- Are Marcel’s estimated monthly expenses more or less than his estimated income?

![]() Save your answers in your course folder.

Save your answers in your course folder.

1.20. Explore 4

Section 1: Personal Budgets

The estimates for income and expenses you have just calculated are in the following chart. This is a possible monthly budget for Marcel to follow.

|

Marcel’s Monthly Budget |

||||

|

Income |

|

|

Expenses |

|

|

Regular |

$2210 |

|

Rent |

$600 |

|

Variable |

$200 |

|

Food |

$320 |

|

|

|

|

Vehicle |

$390 |

|

|

|

|

Insurance |

$200 |

|

|

|

|

Clothing |

$190 |

|

|

|

|

Entertainment |

$260 |

|

|

|

|

Other |

$320 |

|

|

|

|

Savings |

$130 |

|

|

|

|

|

|

|

Totals |

$2410 |

|

|

$2410 |

Marcel will be able to put $130 per month into his savings account if he sticks to this budget.

Self-Check 1

Try these questions based on Marcel’s budget.

- What percentage of his estimated income would Marcel put into savings? Round to the nearest tenth of one percent. Answer

- Many financial analysts argue that you should pay yourself first by saving 10% of your income. If Marcel were to follow that advice, how much would he put into savings? Round to the nearest $10. Answer

- Suggest ways for Marcel to modify his budget to save 10% of his income. Answer

For more practice in creating a budget, turn to pages 315 to 317 of MathWorks 11 and work through “Example 1.”

Comstock/Getty Images/Thinkstock

Tips for creating a conservative budget include the following:

- Review previous income and expenses.

- Group expenses into suitable budget categories.

- Underestimate income and overestimate expenses.

- Set goals.

- Modify the budget as required.

Once a budget is created, stick to this guide to meet your goals.

Check your understanding of the lesson’s objectives. Check your answers.

Self-Check 2

1. Do question 1 from “Build Your Skills” on page 321 of MathWorks11. Answer

2. Do question 2 from “Build Your Skills” on page 321 of MathWorks11. Answer

3. Do question 4 from “Build Your Skills” on page 322 of MathWorks11. Answer

It is now time to add new math terms to Mathematics 20-3: Glossary Terms.

In this lesson the new terms you will add are

- conservative budget

- surplus

- deficit

1.21. Connect

Section 1: Personal Budgets

Connect

Going Beyond

Once your budget is created, you should stick to this plan. However, budgets must be modified when circumstances change. Making necessary changes is often difficult to do and involves compromises. For example, you may have to limit the money spent on entertainment or travel.

The following question challenges your problem-solving abilities.

Turn to page 324 of MathWorks 11, and complete question 8 of “Extend Your Thinking.”

|

Josif’s Draft Monthly Budget |

||||

|

Income |

|

|

Expenses |

|

|

Regular monthly net pay |

$2123.33 |

|

Housing |

$1800.00 |

|

Net overtime pay |

$0.00 |

|

Food |

$650.00 |

|

|

|

|

Gas |

$200.00 |

|

|

|

|

Educational savings |

$300.00 |

|

|

|

|

Miscellaneous |

$350.00 |

|

Total |

$2123.33 |

|

Total |

$3300.00 |

|

Draft deficit |

$1176.67 |

|

|

|

Project Connection

You are now prepared to begin working on Step 2 of the Section 1 Project: Create Your Own Personal Budget.

Lesson 2 Assignment

Your lesson assignment contains some problems for you to solve using the knowledge gained during the lesson. Now you will have the chance to apply the concepts and strategies learned to a new situation. Please show work to support your answers.

Open the Lesson 2 Assignment that you saved to your course folder and complete the questions.

1.22. Lesson 2 Summary

Section 1: Personal Budgets

Lesson 2 Summary

In this lesson you examined how a review of several months of expenses and income is an integral part of creating a budget. These expenses are first grouped into categories, and then an average is calculated for each category. For a conservative budget that builds in savings, the averages for expenses are overestimated and any variable income is underestimated.

Setting up a conservative budget will help you realize your financial goals and help you live within your means.

1.23. Lesson 3

Section 1: Personal Budgets

Lesson 3: Displaying a Budget

Focus

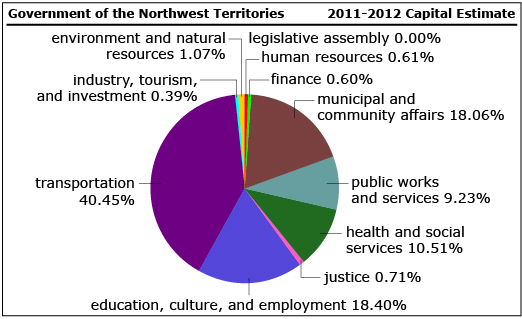

The budgeting process is a necessary part of planning for individuals, businesses, and governments. To clarify budget estimates, businesses and governments both use graphs. One of the principal graphs used is the circle graph or pie graph. This form of graph is used to show how the money is divided. The following illustration is a pie graph used by the Northwest Territories government to outline its spending estimates for the fiscal year 2011–2012.

Department of Finance, Capital Estimates 2011-2012 (Yellowknife: Government of the Northwest Territories, 2010), iii. Adapted and reproduced with permission.

A circle graph or pie graph represents the entire circle or pie. The sectors or wedges of the pie indicate the graph divisions. In what sector does the government of the Northwest Territories estimate it will spend the largest portion of money?

Lesson Question

In this lesson you will investigate the following question:

How can you represent a personal budget using a circle or pie graph?

Assessment

Your assessment for this lesson may include a combination of the following:

- course folder submissions from Try This and Share

- your contribution to the Mathematics 20-3: Glossary Terms

- Lesson 3 Assignment (Save a copy of your lesson assignment to your course folder now.)

- the Project Connection

Materials and Equipment

- calculator

- protractor

- ruler

- compass

1.24. Launch

Section 1: Personal Budgets

Did You Know?

The ancient Babylonians are credited with dividing the circle into 360 degrees. One theory is that the Babylonians knew there were 12 months in the year and approximately 30 days in a month. So, it took 12 × 30 or 360 days for the stars to “circle” the Earth and appear in the same position they were in a year earlier.

Launch

This section checks to see if you have the necessary background knowledge and skills required to successfully complete Lesson 3.

Complete the following Are You Ready? questions. If you have difficulty or any questions, visit Refresher as a review or contact your instructor.

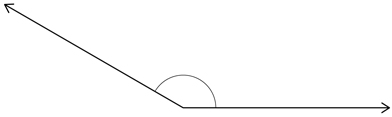

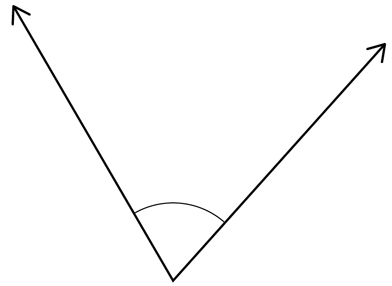

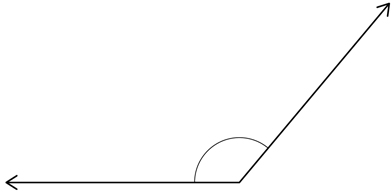

An important skill in drawing a circle or a pie graph is being able to draw and measure angles.

1.25. Are You Ready?

Section 1: Personal Budgets

Are You Ready?

Go to the Protractor Applet.

- Use the applet to position the moveable arm of the angle to form a 110° angle first shown in green and then in blue.

Now use your protractor to draw both orientations of this angle on paper. Be accurate. Answer

- Print the following diagram or work off the screen. Use your protractor to measure each angle to the nearest degree. Answer

a.

b.

c.

If you answered the Are You Ready? questions without any issues, move on to Discover.

If you had some difficulty with the questions for Are You Ready?, complete Refresher.

1.26. Refresher

Section 1: Personal Budgets

Refresher

If you do not know the answers to the Are You Ready? questions or require more information, click on the button to review sketching and measuring angles in Lesson 1 of Mathematics 10-3: Module 5.

Go back to Are You Ready? and try the questions again. Contact your teacher if you continue to have difficulty.

1.27. Discover

Section 1: Personal Budgets

Discover

iStockphoto/Getty Images/Thinkstock

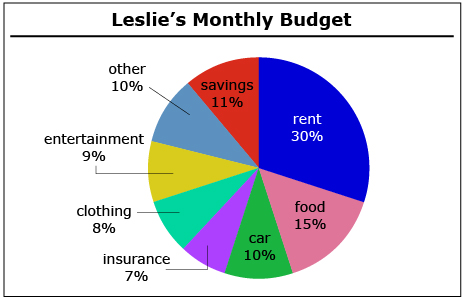

Leslie is a grader operator on the Alexander First Nation near Edmonton. Leslie’s net pay is $4000 per month. Leslie has prepared a personal budget. It is a balanced budget—expenses equal net pay. Leslie’s budget is shown in the following circle graph.

Share 1

Discuss the following questions with a classmate or in a group.

- If the percentage values were not shown on the graph, how could you tell what category Leslie spends the majority of his money on?

- Explain how you can tell that Leslie spends the least amount on insurance and clothing.

- What do the percentages add up to? Why?

- Leslie’s monthly take-home pay is $4000. How much does Leslie plan to save each month?

![]() If required, save a copy of your discussion in your course folder.

If required, save a copy of your discussion in your course folder.

1.28. Explore

Section 1: Personal Budgets

Explore

Comstock/Thinkstock

In Discover you determined that the percentages shown on the circle graph or pie graph total 100%. Dollar amounts can also be calculated from the percentages, as long as the expense total is given.

In the following activity you will examine different ways to create circle graphs.

Geraldine works as a painter. Her take-home pay is $2500 every month. She has prepared a balanced budget with a goal of saving $250 every month. Geraldine wants to build her savings in case there’s a down-turn in the economy and her income drops.

|

Geraldine’s Monthly Budget |

||||

|

Income |

|

Expenses |

||

|

Regular |

$2500 |

|

Rent |

$800 |

|

|

|

|

Car |

$500 |

|

|

|

|

Food |

$400 |

|

|

|

|

Clothing |

$200 |

|

|

|

|

Entertainment |

$200 |

|

|

|

|

Other |

$150 |

|

|

|

|

Savings |

$250 |

|

|

|

|

|

|

|

Totals |

$2500 |

|

|

$2500 |

If Geraldine asked you to prepare a circle graph, there are several choices.

Method 1: Draw the graph using a compass and a protractor.

Click on the button to the left to view How to Make a Circle Graph.

The following questions apply to the circle graph for Geraldine’s budget.

Try This 1

- What is the sum of all the percentages shown for Geraldine’s budget?

- Total all the degrees for each budget sector (wedge). What is this total? How does knowing this total help you create circle graphs?

-

- If Geraldine’s total expenses were $2500 and she spent $500 on car expenses, what percentage of her budget was spent on car expenses?

- What would be the degrees of the sector (wedge) used to represent car expenses in the circle graph?

- If Geraldine’s total expenses were $2500 and she spent $500 on car expenses, what percentage of her budget was spent on car expenses?

1.29. Explore 2

Section 1: Personal Budgets

Method 2: Use a spreadsheet.

Another method to create the circle graph is to use the graphing feature of a spreadsheet. Watch the information provided in How to Use a Spreadsheet.

Share 2

With a partner or in a group, discuss the following questions:

-

- What similarities do you notice between the circle graphs created in Methods 1 and 2?

- What differences do you notice between the circle graphs created in Methods 1 and 2?

- What similarities do you notice between the circle graphs created in Methods 1 and 2?

- How important are these differences?

![]() If required, save a record of your discussion in your course folder.

If required, save a record of your discussion in your course folder.

Method 3: Use software specifically designed for creating circle graphs.

Try This 2

Using the Internet, enter the keywords “Circle Grapher” in a search engine to find a tool that allows you to make your own circle graph. Those keywords should take you to a website called Illuminations: Resources for Teaching Math.

1.30. Explore 3

Section 1: Personal Budgets

Now, check your understanding of the lesson’s objectives. Then check your answers.

Self-Check 1

- Betty has prepared her personal budget and a pie graph. Betty's budget is balanced and based on her take-home pay of $2465. One of her expense categories is food. She budgets $350 for food.

- Felix has prepared a balanced monthly budget.

- Prepare a circle graph using the method you prefer. Following is the solution determined from using the spreadsheet in the lesson. Answer

- How much more would Felix save if he moved and his rent was only 35% of his income? Answer

Felix’s Monthly Budget Income Expenses Regular

$3000

Rent

$1200

Car

$600

Food

$400

Clothing

$200

Entertainment

$300

Other

$200

Savings

$100

Totals

$3000

$3000

- Prepare a circle graph using the method you prefer. Following is the solution determined from using the spreadsheet in the lesson. Answer

It is now time to add new math terms to Mathematics 20-3: Glossary Terms.

In this lesson the new terms you will add are

- balanced budget

- sector

- circle graph or pie graph

1.31. Connect

Section 1: Personal Budgets

Connect

Project Connection

In the Create Your Own Personal Budget project, you will use the budget analyzer to draft and modify your budget. This tool automatically creates a circle graph when you make changes. You may choose to create a circle graph using another method. Add this information to your presentation.

Going Beyond

It is possible to use the percentages from a circle graph to determine dollar values.

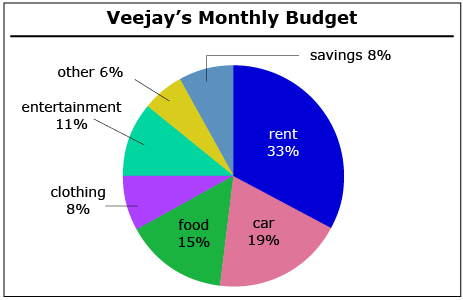

The following circle graph shows Veejay’s monthly budget. If Veejay budgets $360 for food, what is his total budget?

Lesson 3 Assignment

Your lesson assignment contains some problems for you to solve using knowledge gained during the lesson. Now you will have the chance to apply the concepts and strategies that you have learned to a new situation. Please show work to support your answers.

Open the Lesson 3 Assignment that you saved to your course folder and complete the questions.

1.32. Lesson 3 Summary

Section 1: Personal Budgets

Lesson 3 Summary

Creatas/Thinkstock

In this lesson you created circle graphs to interpret and clarify personal budgets. To create a circle graph you needed to

- calculate what percentage is represented by the expense

- calculate the number of degrees this percentage is represented by in a circle

This skill is used by professionals in business and government to make budget details more easily understood by the general public. After all, isn’t a picture worth a thousand words?

1.33. Lesson 4

Section 1: Personal Budgets

Lesson 4: Modifying a Budget

Focus

iStockphoto/Thinkstock

Circumstances change despite a person's best plans. A new baby, a loss or a change of jobs, an accident, or unexpected car repairs are just a few changes that may force a review of a person’s budget. Goals may have to be reassessed and amounts reduced on discretionary spending items such as travel or entertainment. And options may have to be considered, such as a move to less expensive accommodation. These are situations almost everyone must cope with from time to time. In this lesson you will examine how budgets might be modified when circumstances or goals change.

Lesson Question

In this lesson you will investigate the following question:

- What are some strategies for modifying a budget to meet unexpected or changing circumstances?

Assessment

Your assessment for this lesson may include a combination of the following:

- course folder submissions from Try This and Share

- your contribution to the Mathematics 20-3: Glossary Terms

- Lesson 4 Assignment (Save a copy of your lesson assignment to your course folder now.)

- the Project Connection

Materials and Equipment

- calculator

1.34. Launch

Section 1: Personal Budgets

Launch

Did You Know?

Daniel Tammet is a remarkable young man who can perform incredible calculations in his head. He was asked to divide 13 by 97 in his head and gave the answer to more than 32 decimal places! This is just one of his abilities; for instance, he learned to speak Icelandic in just fifteen hours. To learn more about Daniel, you can access a BBC documentary on the Internet titled The Boy with the Incredible Brain.

This section checks to see if you have the necessary background knowledge and skills required to successfully complete this lesson.

Complete the following Are You Ready? questions. If you have difficulty or any questions, visit Refresher for a review or contact your teacher.

Important skills you can use to analyze budgets are

- estimating

- mental math

You can use estimating as a check to see if amounts on your calculator or on a spreadsheet are reasonable. It is easy to make a mistake when entering data or by applying the wrong operation. Have you ever switched two digits by mistake or pressed the division key when you intended to press the multiplication key? Estimation skills can help you identify these common errors everyone makes!

1.35. Are You Ready?

Section 1: Personal Budgets

Are You Ready?

Use your estimating and mental-math skills to answer the following questions. Then check your estimates with a calculator. How close were your estimates?

- Jeremy wants to save 9.5% of his monthly take-home income of $2165. About how much money does he wish to save? Answer

-

Petra’s net pay is $3865. She does not want to spend more than 21% of her income on her car. Approximately how much money should she budget for her car? Answer

Polka Dot/Thinkstock

Polka Dot/Thinkstock

- Hannah has her eye on a wide-screen television for $1989. To buy this TV in one year, how much would she have to save every day? Answer

If you answered the Are You Ready? questions without problems, move on to Discover.

If you found the Are You Ready? questions to be difficult, complete Refresher to review these topics.

1.36. Refresher

Section 1: Personal Budgets

Refresher

If you don't know the answers in Are You Ready?, or if you require more information, click on the button to the left to review estimating and mental math in Lesson 2 of Mathematics 10-3: Module 2.

Go back to the Are You Ready? section. Try the questions again. If you still have difficulty, contact your teacher.

1.37. Discover

Section 1: Personal Budgets

Discover

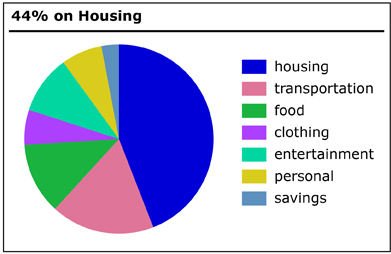

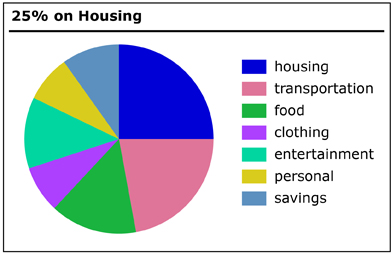

When you are creating a personal budget, be careful not to spend too much on any single category. If you spend too much money on one slice of pie, you will have to cut back on the other slices.

Banks and mortgage companies in Canada will not loan you money to purchase a home if your payments turn out to be more than 44% of your income. Spending 44% on housing is a serious strain on most families.

Compare the pie graphs for 44% of income spent on housing and 25% of income spent on housing.

You can see that less money going to housing means more money for other items in categories such as savings, personal, and entertainment.

Try This 1

Perform a search on the Internet to see what experts on budgeting and spending recommend as percentages of disposable income. Use search words such as “Personal Budget Guidelines” or “Personal Spending Guidelines.”

Complete the Budget Table using information you find from at least three websites. Canadian banks often include spending guidelines as percentages of income on their web pages. Add more categories if necessary.

![]() Save your table to your course folder.

Save your table to your course folder.

Share

Discuss the following questions with a classmate or with a group.

- What is similar among these guidelines?

- What is different among these guidelines?

- Why might different experts suggest different guidelines?

- Would these guidelines apply to all income levels? Why or why not?

![]() If required, save a copy of your discussion in your course folder.

If required, save a copy of your discussion in your course folder.

1.38. Explore

Section 1: Personal Budgets

Explore

In Discover, you shared your answers with other mathematics students. It is possible that, depending on their personal circumstances, different students argued for different percentages of net income to be allocated to the various budget categories. A person clearing $2000 a month is not likely able to spend $1000 a month or 50% on rent. However, a person clearing $6000 may easily handle 50% on housing as this person would have $3000 of disposable income remaining.

In Explore you will examine several budgets. You will recommend changes based on spending guidelines and changing circumstances.

Most experts agree on the following guidelines. You will use this information to complete Try This 2.

SPENDING GUIDELINES

| Budget Category | Percentage of Net Income (Maximums) |

Housing (This includes rent or mortgage payments, taxes, utilities, repairs, insurance, and renovations.) |

25% to 35% |

Transportation (This includes car payments, public transit, vehicle fuel, repairs, parking, tolls, and insurance.) |

10% to 20% |

Savings |

10% |

All other spending categories include charitable donations, credit card payments, food, clothing, recreation/entertainment, cable TV and phone, medical, and personal. |

35% to 45% |

Brand X Pictures/Thinkstock

Caution: The percentages must total 100% or all disposable income.

Try This 2

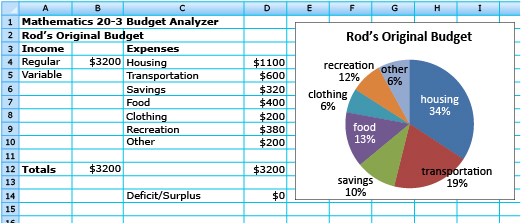

Rod is a carpenter. He has been working on a long-term project in northern Manitoba where he clears $3200 a month. He lives in an apartment and commutes to work in his new truck that he is making payments on. Rod's budget based on that income is shown. However, the project has been completed, and Rod has accepted a new job in The Pas. His net pay will be $2500. Rod must revise his budget to live within his means.

Your task is to balance Rod’s budget. You must follow the expense guidelines provided in the Spending Guidelines table. Modify Rod’s budget by

- entering new dollar values for his change in income

- making his expenses balance with his new income

Use Rod’s Budget to balance his budget.

Answer the following questions based on your modifications.

- By what amount must Rod reduce his expenses?

If you need help answering this question, review the following hints.

- In Rod’s new modified budget, the expenses need to be reduced. Suggest changes Rod could make to live within his new budget.

![]() Save your answers to your course folder.

Save your answers to your course folder.

1.39. Explore 2

Section 1: Personal Budgets

Self-Check

Creatas/Thinkstock

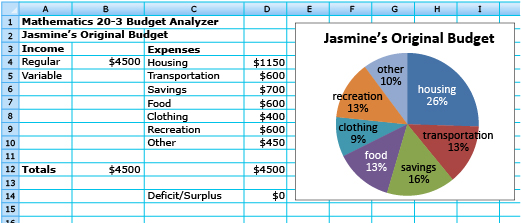

Jasmine is a firefighter in Yellowknife, Northwest Territories. Her net pay is $4500 a month. She currently rents an apartment for $1150 a month. She has been saving to purchase a new home. If she buys a home, Jasmine estimates that her housing costs would likely be 35% of her take-home pay.

Use Jasmine’s Original Budget to see the current budget. Then modify Jasmine’s budget by entering appropriate dollar values to reflect this purchase. Justify your changes. Rename the budget. You must follow the expense guidelines given in this lesson.

Answers will vary. A sample answer is given.

It is now time to add new math terms to Mathematics 20-3: Glossary Terms.

In this lesson the new term you will add is

- spending guidelines

1.40. Connect

Section 1: Personal Budgets

Connect

Going Beyond

Budgets must be revised because prices rise. A price increase is called inflation. The Bank of Canada’s website has an inflation calculator. You can calculate how the price of a basket of goods has changed between any two years after 1914. For example, a “basket” that cost $2000 in 1914 would cost $38 524.59 in 2011. So a 2011 salary of $38 524.59 would be comparable to a salary of $2000 in 1914.

Go to the Internet and use the keywords “Bank of Canada inflation calculator” in a search engine. Use the Inflation Calculator to estimate what salary in 1967 would be equivalent to a salary of $65 000 in 2010.

Project Connection

At this time, you should now be ready to complete Steps 4 and 5 of the Create Your Own Personal Budget project. Review the evaluation rubric to ensure you have completed all parts of the project. Save your work in your course folder.

Lesson 4 Assignment

Your lesson assignment contains some problems for you to solve using knowledge gained during the lesson. Now you will have the chance to apply the concepts and strategies that you have learned to a new situation. Please show work to support your answers.

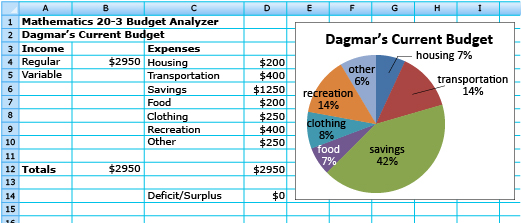

Open the Lesson 4 Assignment that you saved to your course folder and complete the questions. You will need to use Dagmar’s Current Budget to complete question 2.

1.41. Lesson 4 Summary

Section 1: Personal Budgets

Comstock/Thinkstock

Lesson 4 Summary

Whether you are just starting out on your own or preparing to retire, you need to keep a careful eye on your expenses. When your personal situation changes or when the unexpected occurs, youl have to modify your spending to maintain a balanced budget.

In this lesson you explored general spending guidelines, and you learned how to apply these directions in particular situations.

1.42. Section 1 Project

Section 1: Personal Budgets

Section 1 Project: Create Your Own Personal Budget

iStockphoto/Getty Images/Thinkstock

In late 2010, Statistics Canada estimated that the average household debt was more than $96 000. This amount included credit-card debt, bank loans, lines of credit, and money borrowed to purchase a home. Economists worry that the more debt Canadians have, the less money they have to save or spend on goods and services. This debt will slow down Canada’s economy.

A bright spot in the report was the level of savings. In 2009, Canadians increased their savings from 2% to 5% of income. Personal savings are important as a cushion against the unexpected, as a means of rewarding yourself, and to protect your lifestyle upon retirement.

In Section 1 you will explore how to budget income to ensure savings and safeguard against the burden of excessive debt.

Goal

Your goal is to design a conservative personal budget based on your income and expenses.

Time

The aim is to complete this project in less than 2.5 hours. Each lesson in the module will direct you to complete one or more of the steps.

Steps

- Report your average monthly income. Be sure to include any allowances or regular gifts, wages or salary from a job, or self-employed income.

- Collect data on your monthly expenses. One excellent source of information is a debit card summary. If requested, your bank will provide a list of all your transactions. If you have several months of data on hand, you can organize your expenses into categories such as Housing, Entertainment, Clothing, and so on. If you don't have this information, tracking your spending for several days should help you arrive at reasonable monthly estimates.

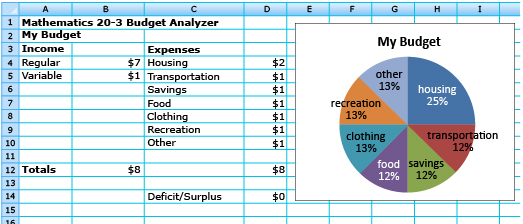

- Use the following budget information to draft a budget. The expense categories are suggestions only. For background, use information from throughout Section 1 and “How to Use a Spreadsheet” from Lesson 3. Change the category as you need by using something besides “Other” (as shown in this example on Line 10) and type in a category name that works for you. Save this budget as “My Budget.”

- Modify your budget as necessary to follow the guidelines in Lesson 4. Once you are comfortable with the result, save your new budget as “My Modified Budget.”

- In a short report or presentation, summarize what considerations you took in Steps 1 through 4. Explain your situation and budget in sufficient detail to enable another student to understand your thinking.

How You Will Be Evaluated

Your teacher will use the following rubric to evaluate your report.

SECTION 1 PROJECT RUBRIC

| Score | Required Concepts |

Connections | Budgets | Communication for Final Report |

3 Exceeds Acceptable Standard |

All of the project requirements have been addressed. | Explanations show a detailed understanding of connections between the mathematics of budgeting and their use in this project. |

All required budgets are complete, correct, and free of mathematical errors. | The work is presented in a neat, clear, and organized fashion that is easy to read and/or see. Images and documents are used to support explanations. |

2 Meets Acceptable Standard |

Most of the project requirements have been addressed. | Explanations show an adequate understanding of the connections between the mathematics of budgeting and their use in this project. | There may be some minor errors or flaws in the budgets. | The work is presented in an organized fashion but may be hard to read and/or see at times. Images and documents are used. |

1 Below the Acceptable Standard |

Few of the project requirements have been addressed. | The response shows little understanding of the connections between the mathematics of budgeting and their use in this project. | There are major errors in the budgets. | The work appears sloppy and/or unorganized. It is hard to know what information goes together. Images and documents may not be used, or they are referred to inappropriately. |

0 Does Not Meet the Minimum Standard |

A minimal number of the project requirements have been addressed. | The response shows a lack of understanding of connections between the mathematics of budgeting and their use in this project. | There is not an understandable attempt at using budgets. | There is not an understandable presentation of project work. |

Total Score / 18 |

/3 | /3 × 2 = /6 | /3 × 2 = /6 | /3 |

1.43. Section 1 Summary

Section 1: Personal Budgets

Section 1 Summary

© Michael DeLeon/iStockphoto

There is an old saying: “Take care of your pennies, and your dollars will take care of themselves.” This statement emphasizes that being careful with the small details of your finances means that your overall financial heath will be in order.

In this section, your project is to create a personal financial plan—a plan to ensure your financial health. Each lesson led you through the budgeting process. You planned, created, presented, and modified a personal budget to reflect your own circumstances. This plan was designed so that if you are on your own, you won’t have to count your pennies at the end of every month!