Project 3

| Site: | MoodleHUB.ca 🍁 |

| Course: | Financial Management LearnEveryware Modules |

| Book: | Project 3 |

| Printed by: | Guest user |

| Date: | Wednesday, 24 December 2025, 10:34 AM |

Description

Created by IMSreader

1. Project 3

Project 3: Financial Statements

Project Introduction

In this project you are introduced to financial statements and examine the financial statements of a variety of businesses. Financial statements are accounting documents prepared to organize the financial picture of a company.

This project is divided into two parts. Part 1 explores your personal financial picture and Part 2 takes a closer look at how businesses record their financial picture. You are introduced to a young entrepreneur, Gurpreet Singh, in this project and follow his progress as he sets up his business.

If you are new to using Excel 2007, you may want to refer to the Excel Interface in the Toolkit before you begin.

1.1. Page 2

Project 3: Financial Statements

What I Need to Know

It is important for businesses to keep accurate records of all of its financial activities. This allows them to know if they are earning a profit or not, and assists them in making decisions to help maximize these profits. This section will show you how to complete a balance sheet so you are able to better understand a business’s financial statements. A balance sheet shows the financial position of a business on a specific date.

Part 1

© zimmytws/shutterstock

Why Is This Important?

Financial management is all about money and keeping track of it. For businesses, how well they manage their finances can be the difference between success and failure. The preparation of financial statements can help determine where these successes and/or failures occur. A common financial statement prepared by business is a Balance Sheet. A good way to begin to understand the working of this statement is to look at your personal money.

What Do I Need to Do?

Let’s assume that you decide to travel the world and need to get your hands on as much cash as possible.

You decide the fastest way to do this is to sell off all your possessions. But how do you know if this will raise the money you need? A starting point is to estimate the value of your items so you can project how much money you will end up with. This is valuable information, since you also must consider any debts that you have to settle from your projected cash.

Time to Work

Assignment 1

On a piece of paper, draw a line down the middle of the page or create a two-column table in a word-processing document.

On the left hand side, write the title Own and list all of your possessions with a dollar value beside each. When in doubt, estimate or guess at a low value.

![]()

4. The Principle of Conservatism

The Principle of Conservatism provides that accounting for a business should be fair and reasonable. Accountants are required in their work to make evaluations and estimates, to deliver opinions, and to select procedures. They should do so in a way that neither overstates nor understates the affairs of the business or the results of operation.

Grouping your items together can make it easier to organize. For example:

- Cash could include the money in your wallet and any money you have in the bank.

- Music could include your portable music device and CDs.

- Jewelry could include watches, rings, and necklaces.

- Clothes could include shirts, jeans, and belts.

If you have lent money to someone, include this in your list since you will want this money back for your trip. Don’t worry about the values being exact; this is just to give you an estimate of how much money you can raise. When you finish your list, calculate the total and place this number at the bottom on the left-hand side of your paper. This is the money that you would have if you liquidated everything you own. To liquidate means to turn into cash.

liquidate: to convert assets into cash

debt: money that is owed

Look at Screen 1 in the “Calculation of Worth” example to see how this looks. Note: Do not close the Calculation of Worth example‚Äîyou will refer to it several times in the next few minutes.

That is a good start for your trip. However, before you depart, you need to clear up any outstanding debts.

© 2009 Jupiterimages Corporation

On the right-hand side of your paper, write the title Owe and list any money you owe. For example, if you borrowed money from your friend to go to a movie, write your friend’s name and how much is owed. Put the total of how much is owed under the word Owe. If you do not owe anybody money, just write Total Owed = 0.00 under the title Owe. You can see what this looks like by moving to Screen 2 in the Calculation of Worth example.

Now you have to see how much money you have left to spend after you pay all the money that you owe. Under your total owed, write the word Worth as a title.

Subtract your total amount owed from the total amount that you own.

To check your subtraction, add your total owed to your total worth. This amount should be the same as the amount owned. Refer to Screen 3 in the Calculation of Worth media piece to see what this looks like.

Do you have enough money left for your trip?

If not, you may have to get a part-time job or a loan to complete your world travels. Perhaps, if you already have a job, you can increase your hours, or you might have to put off your trip for a bit. This financial information will help you to make decisions about your future.

Submit this assignment to your teacher.

Part 1 Summary

This exercise allowed you to consider what your worth would be if you liquidated everything you own and how that knowledge can help you make decisions. A business must compile its financial information in a similar way to make business decisions.

To do so, the business prepares financial statements. This information about what the company owns, owes, and what it is worth is recorded into a financial statement called a balance sheet.

1.2. Page 3

Project 3: Financial Statements

Part 2

© James Steidl/shutterstock

What I Need to Know

What the business owns are referred to as assets.

What the business owes, such as car payments or loans from banks, are referred to as liabilities. The worth of the business is owner’s equity.

Notice that in the image of the weigh scale, the left side equals the right side, or the assets equals the liabilities and the owner’s equity. Return now to the “Calculation of Worth” media piece, and go to screen 4. What you own less what you owe equals your net worth. In other words, assets – liabilities = net worth or owner’s equity.

This is referred to as the accounting equation. Check out Calculating Owner’s Equity.

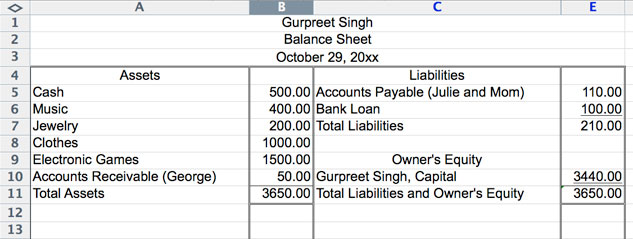

Gurpreet Singh is a high school student and has completed the same assignment that you have. The financial information for him, similar to what you compiled in the previous exercise, is recorded below in a financial statement called a balance sheet.

Notice that any money that Gurpreet is to receive has been put under assets as accounts receivable and any money that Gurpreet owes has been put under liabilities as accounts payable. Bank loans are a separate entry under liabilities.

asset: anything of value that is owned

liability: anything that is owed, such as car payments or loans from a bank

owner’s equity: the worth of the business; assets – liabilities = owner’s equity¬†

accounting equation: assets = liabilities + owner’s equity, or the left side of the balance sheet equals the right side of the balance sheet

accounts receivable: money that the business will be receiving

accounts payable: money that the business still has to pay; debt that is owed

Note that in the following sample balance sheet for Gurpreet Singh, the year is entered as 20xx. Whenever you see this, it refers to the current year.

How much money would Gurpreet have to start up a business if he liquidated all of his assets?

![]()

He would have $3440.00. You can determine the answer by subtracting total liabilities from total assets. In other words, the figure next to the line that reads “Gurpreet Singh, Capital” is the correct figure.

Gurpreet has enough money to begin his business. Keep his financial position in mind as you follow his business throughout the upcoming projects.

Why Is This Important?

It is important to disclose the company’s worth and to have a consistent format when setting up all financial statements. Which GAAP principles would apply here?

![]()

Check when you think you know the answer.

The Principle of Consistency

In the preparation of financial statements, the same accounting principles are applied in the same way in each accounting period.

The Full Disclosure Principle

The Full Disclosure Principle states that any and all information that affects the full understanding of a company’s financial statements must be included with the financial statements. Some items may not affect the ledger accounts directly. These would be included in the form of accompanying notes. Examples of such items are outstanding lawsuits, tax disputes, and company takeovers.

Part 2

Time to Work

Assignment 2

Conduct a search on the Internet for three different types of businesses; for example, a computer company, a clothing store, and a sporting equipment firm.

To help you with your Internet search, key in the name of the company followed by the words “financial statements” (e.g., Apple Computer financial statements). You will find various financial statements, including a balance sheet and an income statement. You will prepare a balance sheet in your next project. The income statement is studied in FIN1030. For now, all you need to do is find each company’s balance sheet and save them in your FIN1015 Course Folder under the company name.

Select Comparing Financial Statements when you are ready to complete this assignment, and save it in your FIN1015 Course Folder.

Portfolio Submission

Include the three balance sheets that you found on the Internet, complete with a summary of their similarities; for example, section headings, totals, and formats.

1.3. Project 3 Summary

Project 3: Financial Statements

Project Summary

You looked at your own finances to see how much money you would have if you liquidated all of your assets. These calculations allow you to make decisions regarding your future activities. You also examined how this important information can be put into a financial statement called a balance sheet, and you examined some company balance sheets through a search on the Internet. It is now time to discover how a business sets up its books.