Project 4

| Site: | MoodleHUB.ca 🍁 |

| Course: | Financial Management LearnEveryware Modules |

| Book: | Project 4 |

| Printed by: | Guest user |

| Date: | Wednesday, 24 December 2025, 10:38 AM |

Description

Created by IMSreader

1. Project 4

Project 4: Starting an Accounting System

Project Introduction

© pressmaster/ 27077821/Fotolia

Before a business can open its doors to the public, it needs to set up books to keep accurate records of its finances. This project consists of five training rooms to show you how to set up these books. The training rooms are as follows:

Training Room 1: The Beginning Balance Sheet

Suggested Time: 160 minutes

Training Room 2: Chart of Accounts

Suggested Time: 160 minutes

Training Room 3: Opening the Ledger

Suggested Time: 160 minutes

Training Room 4: Opening Entry

Suggested Time: 160 minutes

Training Room 5: Posting the Opening Entry

Suggested Time: 160 minutes

Continue to Training Room 1, where Sakineh, the financial management trainer, will walk you through preparing a beginning balance sheet.

1.1. Training Room 1

Training Room 1: The Beginning Balance Sheet

Training Room 1 Introduction

Suggested Time: 160 minutes

In this training room you will see a heading called Check Your Understanding, where you are asked some questions to reflect on what you have learned. Training Tips are provided to help you solve problems. These tips can be found under Tips and Tricks in the Toolkit, and you can refer to them whenever you like.

1.2. Page 2

Training Room 1: The Beginning Balance Sheet

What I Need to Know

beginning balance sheet: the first balance sheet a business prepares before it opens its doors to customers

seed money: money to pay for expenses to start a business

This training room will concentrate on preparing a beginning balance sheet, which is the first financial statement a business prepares before it opens its doors to customers.

© 2009 Jupiterimages Corporation

Why Is This Important?

It is necessary for a business to know its initial financial position to see if it is making or losing money. This statement can also be presented to a financial institution to apply for a loan for seed or start-up money. Seed money is money to pay for expenses to start a business.

What Do I Need to Do?

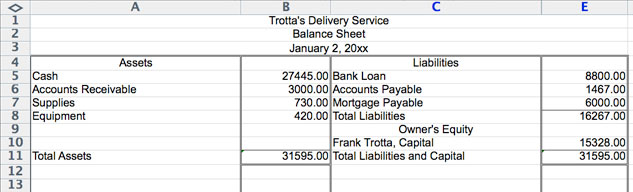

Recall that in the last project Gurpreet Singh reviewed his personal balance sheet and decided that he could begin his own business. He can now determine what resources he has available to set up his business.

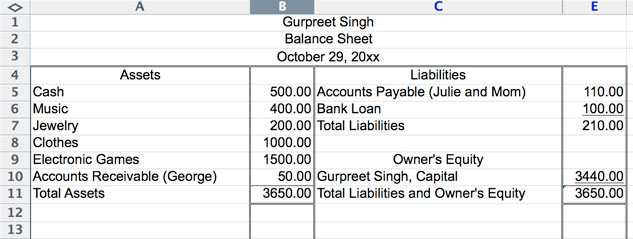

Gurpreet Singh’s personal balance sheet was as follows:

Let’s check out how he is doing by selecting the Gurpreet Singh Slide Show.

Certain formalities must be observed when preparing all financial statements. I will explain these formalities to you as we prepare the beginning balance sheet for Gurpreet’s business.

Many companies use accounting software programs to record their financial data on a computer. Various accounting software programs are available. You are going to use the spreadsheet program Excel¬Æ to prepare the beginning balance sheet for Gurpreet’s new company.

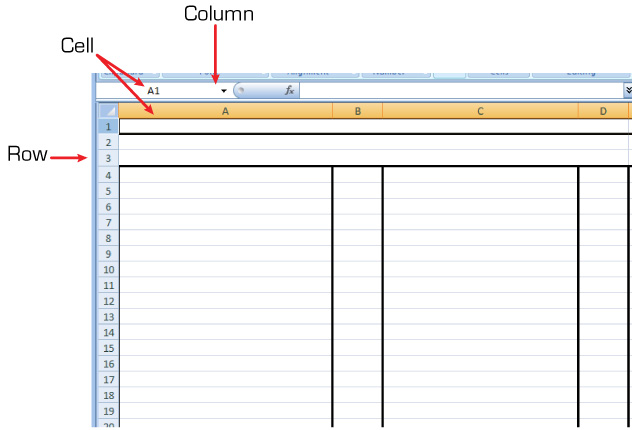

Open the accounting form called Balance Sheet Template, and save this in your FIN1015 Course Folder as Gurpreet’s Balance Sheet.

Columns are indicated with letters at the top of the spreadsheet, and rows are numbered on the left of the spreadsheet. Each box that your cursor is in is called a cell. The cell location of the cursor is at the top of your spreadsheet. In this case, it is A1 because the cursor is in Column A, Row 1. As you go through your training, please check under the Tips and Tricks in your Toolkit if you need further information about Excel®.

The first three lines on this form are for the heading, which includes the who, what, and when for the company. To learn more, view the video titled Beginning Balance Sheet Heading.

The first three lines on this form are for the Heading, which includes the Who, What, and When for the company.

![]()

You will go through the steps necessary to complete a beginning Balance Sheet for Gurpreet’s Snow Removal. Open a blank Balance Sheet Template, and save it in your FIN1015 Course Folder as Gurpreet’s Snow Removal.¬†

You may want to minimize this instruction page and the Balance Sheet on your screen to view them at the same time. To do this, refer to the video on Minimizing the Screen. This is also available in your Toolkit. You may also find it helpful to view the video titled Filling in a Balance Sheet. You may also want to look at Calculating Capital, Changing the Data Format, Number Formatting, and How to Rule the Balance Sheet.

1.3. Page 3

Training Room 1: The Beginning Balance Sheet

Check Your Understanding

Open the balance sheets of the three companies that you saved from the Project 3: Financial Statements. These are saved in your FIN1015 Course Folder.

Note that these business balance sheets are in a different format, all in a row, called a report form. This is because they have so many accounts to record. However, all the sections remain the same as what you have been practicing.

- See if you can find the assets, liabilities, and qwner’s equity sections.

- Can you find the total lines in the business balance sheets that you saved?

- Are there any double lines?

Your teacher may wish to discuss these findings with you.

Did you notice that in every case the total assets equaled the total liabilities plus the owner’s equity? This is described in more detail in the video titled The Accounting Equation.

Imagine a perfectly balanced weigh scale. Whatever occurs on one side affects the other side. If one side has more weight, then the scale will tip. If both sides are equal, the scale will stay in balance. The Fundamental Accounting Equation is similar to a weigh scale.

Time to Practise

This is an opportunity to practise completing beginning balance sheets for four different companies.

These practice activities are very similar and will prepare you for the assignment in this project that is submitted for assessment. You can check your work at the end of each practice.

Here are some tips for creating financial statements:

- Put the date in full.

- Do not use $ or spaces in the dollar amounts.

- Capitalize the names of accounts, since they are formal names.

- Do not use any abbreviations.

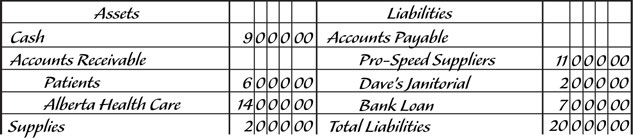

For multiple accounts receivable (people owing the business money) and multiple accounts payable (people to whom the business owes money), follow the format of the example below:

For an example of a completed balance sheet, check the piece titled Balance Sheet Exemplar.

There are four different practice activities listed below. You may practice as many of these as needed to prepare for the balance sheet assignment. Be sure you are confident that you can complete a beginning balance sheet before proceeding to the Time to Work, where you complete the assignment for assessment. Please contact your teacher if you are having difficulty.

Practice 1: the beginning balance sheet for Dr. Zimmerman Medical Clinic

Practice 2: the beginning balance sheet for Koch Moving and Storage

Practice 3: the beginning balance sheet for Fanci Foods Ltd.

Practice 4: the beginning balance sheet for CHOO T.V.

Practice 1

![]()

Open a blank Balance Sheet Template, and save this in your FIN1015 Course Folder. Complete the beginning balance sheet for the Dr. Zimmerman Medical Clinic.

The following is Dr. Zimmerman’s Information. Your formatting must be exact.

Dr. Zimmerman is the owner of Dr. Zimmerman Medical Clinic. On January 31, 20xx, the assets and liabilities for the clinic were as follows: cash in bank, $9000; money due from patients (accounts receivable), $6000; money due from Alberta Health Care (accounts receivable), $14 000; supplies, $2000; equipment, $140 000; money owing to Pro-Speed Suppliers (accounts payable), $11 000; money owing to Dave’s Janitorial (accounts payable), $2000; bank loan, $7000.

![]()

When finished, check the Dr. Zimmerman Medical Clinic Balance Sheet.

Practice 2

![]()

Open a blank Balance Sheet Template, and save this in your FIN1015 Course Folder. Complete the beginning balance sheet for the Koch Moving and Storage.

Here is the information for Koch Moving and Storage. Your formatting must be exact.

Milos Popov is the owner of Koch Moving and Storage. The information for the beginning Balance Sheet on September 1, 20xx is given below:

Assets: cash, $1896.50

Accounts Receivable: J. Radick, $2500.00; City Bank, $11 750.00; M. Unger, $1565.00; warehouse, $137 500.00; truck, $47 500.00; office equipment, $3175.00

Liabilities: bank loan, $60 000; mortgage payable, $100 000

![]()

When finished, check the Koch Moving and Storage Balance Sheet.

Practice 3

![]()

Open a blank Balance Sheet Template, and save it in your FIN1015 Course Folder. Complete the beginning balance sheet for the Fanci Foods Ltd.

Here is the information for Fanci Foods Ltd.

Pouya Asadi is the owner of Fanci Foods Ltd. Use the current date.

Assets: cash, $7500.00

Accounts Receivable: $17 000.00; office supplies, $720.00; office equipment, $12 450.00

Liabilities: accounts payable, $9500.00; bank loan, $10 000.00

![]()

When finished, check the Fanci Foods Ltd. Balance Sheet.

Practice 4

![]()

Open a blank Balance Sheet Template, and save this in your FIN1015 Course Folder. You will complete the beginning balance sheet for the CHOO T.V.

Here is the information for CHOO T.V.

Duke Farrell, is the owner of CHOO T.V. Use the current date.

Assets: cash, $2106.31

Accounts Receivable: $1200.00; studio equipment, $45 000.00; mobile equipment, $27 000.00; office furnishings, $3575.00

Liabilities: accounts payable, $24 500.00; bank loan, $30 000.00

![]()

When finished, check the CHOO T.V. Balance Sheet.

1.4. Page 4

Training Room 1: The Beginning Balance Sheet

Time to Work

When you are confident that you understand how to do a balance sheet, you are ready to move on to Assignment 1.

You are assessed according to the Balance Sheet Rubric, which is useful as a checklist to make sure you didn’t forget anything. This and all other rubrics are available in the Toolkit for you to access at any time.

Assignment 1

![]()

Open a blank Balance Sheet Template, and save it in your FIN1015 Course Folder.

Complete the beginning balance sheet for Cheryl Yu, the owner of Yu Accounting Service. Use the current date and be careful to use the correct formatting. Remember to save your work when you are finished.

Assets: cash, $40 000.00; land, $60 000.00

Accounts Payable: Royal Office Equipment, $19 000.00; building, $75 000.00; vehicle, $19 000.00; office equipment, $21 500.00; mortgage payable, $85 000

Optional Assignment

Check with your teacher to see if you need to do this optional assignment.

Open a blank Balance Sheet Template, and save it in your FIN1015 Course Folder.

Complete the beginning balance sheet for Raj Douglas, the owner of Douglas Company Ltd. Use today’s date.

Raj has $9000.00 cash for his business and has $12 500.00 that is owing to him. He has outstanding debts of $400.00, and he owns $30 000.00 worth of equipment and $1800.00 worth of supplies. Raj has also taken out a bank loan for $8000.00.

Remember to save your file.

Portfolio Submission

Include a balance sheet in your Course Portfolio from either the practice activity or project. Pick the best one to showcase your best work. Prospective employers would like to know that you can create a balance sheet. Include the purpose of a balance sheet in your portfolio and show how to calculate capital. This will also be a good reference for you to use in future assignments in this course and in future financial management courses at both the secondary school and post-secondary school levels.

Training Room 1 Summary

Now that you know how a business prepares the beginning balance sheet, which shows the financial position at the start of the business, you need to continue to Training Room 2 where you will learn how a business sets up the general ledger to record business activities.

1.5. Training Room 2

Training Room 2: Chart of Accounts

Training Room 2 Introduction

Suggested Time: 160 minutes

1.6. Page 2

Training Room 2: Chart of Accounts

© Grace Victoria/2287876/Fotolia

What I Need to Know

Just as a book has a table of contents, the general ledger begins with a chart of accounts. Each account is similar to a chapter in a book, with a separate account number.

Why Is This Important?

This makes it easy to see and to find exactly how much money is in each account. An account is a special page or a storage space on the computer used to record financial changes for each item affecting the financial position. For example, it records what each asset is worth or what is owed for each liability.

Recall that a balance sheet is divided into assets, liabilities, and owner’s equity. A chart of accounts is also divided into these sections. All assets begin with the number 1, all liabilities begin with the number 2, and all owner’s equity begin with the number 3.

chart of accounts: a list of the accounts of a business, and their numbers, arranged in numerical order

account: a page used to record financial changes for each item affecting the financial position

This makes accounts easy to locate since they are not only in numerical order, but the type of accounts are identifiable by the beginning number.

What Do I Need to Do?

The accountant for a business, in consultation with the owner or manager, makes a list of the accounts that will best suit the needs of the business to make management decisions. For example, the accounts for a construction business are quite different from those of a hairdressing salon. From time to time, as business needs change, accounts are added or deleted as required. For example, the business might have started a charge account at a store and needs to open a new liability account to record that debt. For consistency when keeping the business records, the accountant may also develop rules about the type of transactions to be included in each account.

![]()

2. The Consistency Principle

In the preparation of financial statements, the same accounting principles are applied in the same way in each accounting period.

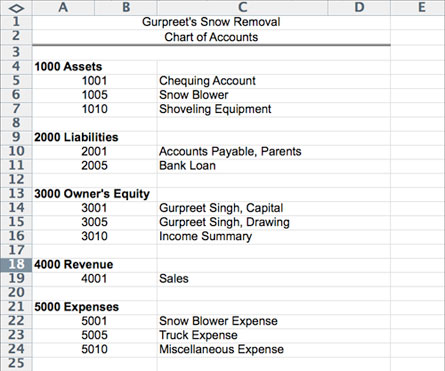

Gurpreet Singh is still in the process of setting up his snow removal business. Let’s set up a chart of accounts for him by following the steps below.

Step 1

Recall the balance sheet for Gurpreet’s Snow Removal that you completed in the last training room. We will refer to this financial statement as we complete the Chart of Accounts.

![]()

You may find it helpful to view Alignment and Bold at this time.

1.7. Page 3

Training Room 2: Chart of Accounts

Time to Practise

Practice 1

![]()

Based on what you have learned in the preceding steps, now it is your turn to complete Gurpreet’s Chart of Accounts. Open up a Chart of Accounts Template, and save it in your FIN1015 Course Folder.

Refer to the preceding steps and complete Gurpreet Singh’s chart of accounts.

You may also wish to refer to the Chart of Accounts Rubric for a guide to completing your work. This rubric is available for you in the Toolkit to access in the future.

Save your work when you have finished.

![]()

Check Chart of Accounts Exemplar when you have completed Practice 1.

Practice 2

![]()

Open a Chart of Accounts Template, and save it in your FIN1015 Course Folder.

Prepare a chart of accounts for Clear View Window Cleaners, owned by Emil Jolini. Number the accounts consecutively within each classification (e.g., assets, liabilities, owner’s equity). Allow a few numbers in between. Use a four-digit accounting system.

Assets: cash; accounts receivable, D. Thurston; accounts receivable, Triad Café; accounts receivable, Harry’s Eatery; equipment, truck

Liabilities: bank loan; accounts payable, A-1 Rentals; accounts payable, Super Supplies

Owner’s Equity: ?, capital; ?, drawing, income summary. (Who is the owner? Replace the ? with the owner’s name.)

Revenue: vending machine sales; service fees

Expenses: rent expense, truck expense, utilities expense

![]()

Check Clear View Window Cleaners Chart of Accounts when you have completed Practice 2.

Practice 3

![]()

Open Chart of Accounts Template, and save it in your FIN1015.

Prepare a chart of accounts for High Tech Company, owned by Trina Aslanba. Number the accounts consecutively within each classification (e.g., assets, liabilities, owner’s equity). Allow a few numbers in between. Use a four-digit accounting system.

Assets: cash; accounts receivable; equipment; automobile

Liabilities: bank loan; accounts payable, Computer Software Co.; accounts payable, Equipment Repairs Co.

Owner’s Equity: ?, capital; ?, drawing, income summary (Who is the owner? Replace the ? with the owner’s name.)

Revenue: sales

Expenses: automobile expense, rent expense, miscellaneous expense

![]()

Check High Tech Company Chart of Accounts when you have completed Practice 2.

1.8. Page 4

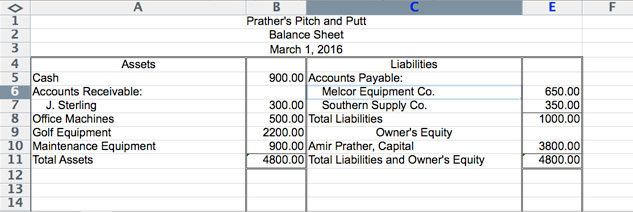

Training Room 2: Chart of Accounts

Time to Work

Click on Assignment 1 and answer the questions in the worksheet.

Next, complete Assignment 2. Open Chart of Accounts Template, and save it in your FIN1015 Course Folder.

Prepare a chart of accounts for Prather’s Pitch and Putt using a four-digit accounting system. Number the accounts consecutively within each classification (e.g., assets, liabilities, owner’s equity), allowing a few numbers in between.

Use the beginning balance sheet below as well as the following temporary accounts: Green Fees, Pro Shop Fees, Rent Expense, Maintenance Expense, Miscellaneous Expense, Income Summary, and don’t forget the Drawing Account‚Äîgive it an appropriate name.

Portfolio Submission

Include a chart of accounts in your portfolio. Pick the best one to showcase your best work. Include the purpose of a chart of accounts in your portfolio as well as a description of what the different sections mean; for example, what is an asset?

Training Room 2 Summary

A chart of accounts is like a table of contents, which tells the reader where to find information. Assets always start with the number 1, liabilities with the number 2, owner’s equity with 3, revenue with 4, and expenses with 5. This makes it easy to find these accounts in the book called a ledger. Now you need to open these accounts in the ledger. Continue to Training Room 3, where Sakineh, the financial management trainer, will demonstrate how to start a ledger.

1.9. Training Room 3

Training Room 3: Opening Accounts

Training Room 3 Introduction

Suggested Time: 160 minutes

1.10. Page 2

Training Room 3: Opening Accounts

© 2009 Jupiterimages Corporation

What I Need to Know

You need to know a company’s chart of accounts before you can open the accounts. From this list, you are able to open up each page in the ledger to prepare it to record money going in and money going out.

Why Is This Important?

These account numbers are used to record all the daily business activities. It is important to set up the books accurately to reflect what the business needs. These accounts, or special pages in the ledger, make it quick and easy for the accountant and/or the business owner to access information. For example, if someone wanted to know how much a customer owed the business, he or she would find the account number in the chart of accounts and turn to the ledger page for that customer. Businesses also refer to these records to prepare financial statements, which helps to assess business activities and make informed business decisions.

What Do I Need to Do?

Explore the General Ledger

![]()

Open the General Ledger Template. Save this form in your FIN1015 Course Folder as Gurpreet’s Ledger so you can check your work when you are finished.

Refer to General Ledger for information about using the general ledger form.

Open Accounts into the General Ledger

We are now going to open all of the accounts from the chart of accounts.

Opening an account means placing the account name and the account number in the ledger.

The chart of accounts for Gurpreet’s Snow Removal, which you completed in Training Room 2, is available for you to refer to below. Follow the steps below to open the ledger from this chart of accounts.

Step 1: Opening the Asset Accounts

The asset accounts are opened as shown in the multimedia piece titled Opening the Asset Accounts.

![]()

You can check your answer by clicking on Gurpreet’s Snow Removal General Ledger.

1.11. Page 3

Training Room 3: Opening Accounts

Time to Practise

Let’s see how well you understand. In these practice activities, you will prepare a chart of accounts and then open these accounts into a general ledger. You are given a beginning balance sheet for each of these activities. You also need to have a drawing account and an income summary account in owner’s equity. Expense and revenue account titles are given in each practice activity. Check your answers when you have finished each one.

Chart of Accounts Rubric and Opening Accounts Rubric contain checklists that you can use for reference.

![]()

You may choose to do one of these practice activities or all three before you proceed to Time to Work, where you prepare an assignment for assessment.

Practice 1: Koch Moving and Storage

Open a new Chart of Accounts Template and a General Ledger Template for Koch Moving and Storage. Save these files in your FIN1015 Course Folder.

Note for Accounts Receivables, you may have the Account Title as A/R  J. Radick etc.

The Koch Moving and Storage Balance Sheet is given. Mr. Popov has also decided to include the following accounts: Sales, Advertising Expense, Truck Expense, Utilities Expense, and Miscellaneous Expense.

Complete the chart of accounts and open these accounts in his ledger.

Check your answers by viewing Koch Moving and Storage Chart of Accounts and Koch Moving and Storage General Ledger.

Practice 2: Fanci Foods Ltd.

Open a new Chart of Accounts Template and a General Ledger Template for Fanci Foods Ltd. Save these files in your FIN1015 Course Folder.

The Fanci Foods Ltd. Balance Sheet is given. Mr. Asadi has also decided to include the following accounts: Sales, Advertising Expense, Utilities Expense, and Miscellaneous Expense.

Complete the chart of accounts and open these accounts in his ledger.

Check your answers by viewing Fanci Foods Ltd. Chart of Accounts and Fanci Foods Ltd. General Ledger.

Practice 3: CHOO T.V.

Open a new Chart of Accounts Template and a General Ledger Template for CHOO T.V. Save these files in your FIN1015 Course Folder.

The CHOO T.V. Balance Sheet is given. Mr. Farrell has also decided to include the following accounts: Advertising Sales, Studio Expense, Equipment Expense, and Miscellaneous Expense.

Complete the chart of accounts and open these accounts in his ledger.

Check your answers by viewing CHOO T.V. Chart of Accounts and CHOO T.V. General Ledger.

1.12. Page 4

Training Room 3: Opening Accounts

Time to Work

When you are confident that you understand how to create a chart of accounts and open the necessary accounts in the ledger, you are ready to complete your assignment.

![]()

Chart of Accounts Rubric and Opening Accounts Rubric contain checklists that you can use for reference.

When completed, submit your assignment to your teacher.

Assignment 1

Open up a new Chart of Accounts Template and a General Ledger Template.

Save these files in your FIN1015 Course Folder or where you have been instructed to save it for assessment.

The beginning balance sheet for Suneel Gupta, Barrister and Solicitor, is given below. Mr. Gupta has also decided to include the following accounts: Fees, Advertising Expense, Rent Expense, Utilities Expense, and Miscellaneous Expense. Complete the chart of accounts and open these accounts in his ledger.

Optional Assignment 2

Check with your teacher to see if you need to do this optional assignment.

Open up a new Chart of Accounts Template and a General Ledger Template.

Save these files FIN1015 Course Folder in your FIN 1015 folder or where you have been instructed to save it for assessment.

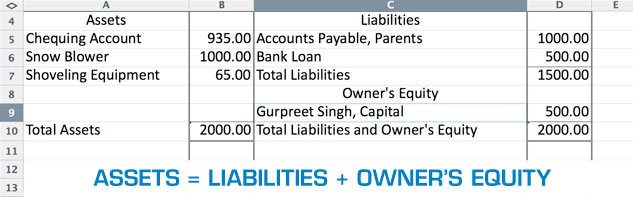

The beginning balance sheet for Trotta’s Delivery Service is given below. Mr. Trotta has also decided to include the following accounts: Sales, Advertising Expense, Maintenance Expense, Utilities Expense, and Miscellaneous Expense. Complete the chart of accounts and open these accounts in his ledger.

Portfolio Submission

Include in your Course Portfolio a balance sheet, chart of accounts, and an open ledger that you completed for one of the companies in this training room. Also include the relationship between the financial statement, which is the balance sheet, the chart of accounts, and the opening entry. Understanding where you are receiving information from will be invaluable to you as you continue to work on developing accounting knowledge.

Training Room 3 Summary

This concludes Training Room 3 on starting an accounting system, and the ledger is now ready to accept money into the accounts. In this training room, you used the balance sheet to set up a chart of accounts and opened these accounts in the general ledger. Continue getting the company records ready for the daily business in Training Room 4, where you will see how to record the beginning balance sheet of a business into a general journal.

1.13. Training Room 4

Training Room 4: The Opening Entry

Training Room 4 Introduction

Suggested Time: 160 minutes

journal: a book or a diary where transactions are recorded in chronological order

transaction: a financial event changing the financial position of a business

© 2009 Jupiterimages Corporation

Before financial events can be entered into the journal, it is necessary to record the beginning financial position of the business, or the information from the beginning balance sheet.

1.14. Page 2

Training Room 4: The Opening Entry

What I Need to Know

There are different kinds of journals. In this training room, you will be instructed how to enter information into a general journal. A general journal is a two-column accounting form used to record financial events in chronological order and looks like this:

entry: each item entered into the journal

opening entry: the first entry made into a journal of a new business

source document: any piece of paper that provides details about a financial change in business (e.g., invoices, cheque stubs, cash  register tapes)

Each item entered into a journal is called an entry and the beginning is the opening entry. Because this balance sheet is the business paper that is being used for this entry, it is referred to as the source document.

Why Is This Important?

The general journal records all parts of a transaction in one place—what occurred, when it occurred, and why it occurred—so that it is clear to anyone reading the accounting records where money was spent or received. All entries must include the source of where this information was received. As previously mentioned, the source document for the opening entry is the beginning balance sheet. Other source documents could be cheque numbers or invoice numbers, for example. This will be explored more in FIN1020 when transactions are recorded for daily business activities.

Do you know which GAAP principle is in effect here? When you think you know, click on the GAAP icon to see if you were right.

![]()

5. The Principle of Objectivity

The Principle of Objectivity states that accounting will be recorded on the basis of objective evidence. Objective evidence means that different people looking at the evidence will arrive at the same values for the transaction. Simply put, this means that accounting entries will be based on fact and not on personal opinions or feelings.

The source document is the objective evidence.

What Do I Need to Do?

Recall the beginning balance sheet for Gurpreet’s Snow Removal from Training Room 1, which appears below.

Notice the equation at the bottom of the balance sheet above. Do you remember what that is called? Open The Accounting Equation if you want to review the equation described at the bottom of the balance sheet.

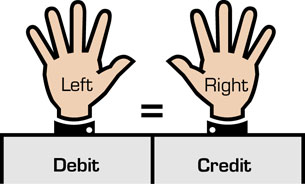

debit: left

credit: right

In accounting, the left side is called the debit side and the right side is called the credit side. Debits must always equal credits to be in balance. The short form of the word debit is DR or Dr., and the short form for the word Credit is CR or Cr.

double-entry accounting system: the total of the debit entries equals the total of the credit entries

The accounting equation must remain in balance.

This is referred to as the double-entry accounting system and provides a self-check while recording business transactions. This is important because, if you are not in balance, it is easy to know that an error has been made. Remember the weigh scale from Training Room 1? You don’t want the scale to tip. Therefore, both sides must be kept even at all times.

Recall that every item listed on the balance sheet is referred to as an account. Asset accounts are on the left side and therefore always have a debit balance. Liability accounts and the owner’s capital account are on the right side and therefore always have a credit balance.

Before you see how Gurpreet’s Snow Removal records this beginning balance sheet into the general journal, do you remember what this entry is called?¬†

![]()

It is called the opening entry.

Let’s have a look at Gurpreet’s Snow Removal’s general journal by opening the multimedia piece titled The Opening Entry.

Note that the Post Reference column remains blank here but will be used in the next training room when these entries are posted, or put into the ledger. Posting will be discussed in more detail in the next training room.

1.15. Page 3

Training Room 4: The Opening Entry

Time to Practise

There are two beginning balance sheets for you to practise making opening entries. You may choose to do one or both before you continue to your assignment in Time to Work. You can self-check your answers to see if you are doing the opening entries correctly.

The Opening Entry Rubric is here for reference.

![]()

You can also refer to the General Journal Exemplar here or, whenever you need it, from your Toolkit.

Practice 1: Dr. Zimmerman Medical Clinic

Open a blank General Journal Template.

Use the Dr. Zimmerman Medical Clinic Balance Sheet provided and complete an opening entry on page 1 of the general journal. Use the date of the balance sheet with the current year.

Check your answers by viewing Dr. Zimmerman Medical Clinic General Journal.

Practice 2: Koch Moving and Storage

Open a blank General Journal Template.

Use the Koch Moving and Storage Balance Sheet provided and complete an opening entry on page 1 of the general journal. Use the date of the balance sheet with the current year.

Check your answers by viewing Koch Moving and Storage General Journal.

1.16. Page 4

Training Room 4: The Opening Entry

Time to Work

When you are confident you can prepare an opening entry, continue to the assignment.

Assignment

![]()

Open a blank General Journal Template, and save it in your FIN1015 Course Folder.

Use the beginning Southwood Animal Clinic Balance Sheet to complete an opening entry. Be sure to save it for your teacher to mark.

Portfolio Submission

Include a balance sheet along with the corresponding opening entry. Include why it is necessary to copy the beginning balance sheet information into the general journal.

Training Room 4 Summary

The general journal now has all of the beginning financial information entered and the business is ready to start recording its day-to-day transactions. To finish setting up the books for an accounting system, there is one last step that you must do and that is posting. Continue to the next training room to learn how to post the opening entry.

1.17. Training Room 5

Training Room 5: Posting the Opening Entry

Training Room 5 Introduction

Suggested Time: 160 Minutes

© 2009 Jupiterimages Corporation

The last step in setting up an accounting system is to post the opening entry.

A rubber stamp is often the symbol or graphic used in accounting software packages meaning “to post.” Posting is the last step, so you are stamping that the work is finished. Accounting software will do this automatically for you. However, whether or not you are using a software package, it is important that you understand what posting is all about. This understanding will equip you with the knowledge to correct errors and interpret the data in the ledger.

1.18. Page 2

Training Room 5: Posting the Opening Entry

What I Need to Know

You were already introduced to a ledger in Training Room 2: Chart of Accounts. Recall that the chart of accounts is similar to a table of contents at the front of a book called a ledger, which includes a list of all the account titles and the account numbers. Each account has its own page or pages identifying the financial activities in that account.

In Training Room 3: Opening Accounts, you opened each of these accounts in the ledger. This included only the account name and the account number for each account.

In this training room, you will transfer the amounts from the general journal into the accounts that you opened in Training Room 3. The transferring of any amounts from the journal to the ledger is called posting.

View the multimedia piece titled Enter and Post.

Why Is This Important?

Posting the opening entry transfers each beginning balance into the appropriate ledger account. This is similar to depositing your first amount of money into a bank account. Now the account is not only open, but there is money in it. When the business opens its doors to customers, there will be more activity in each of these accounts. The ledger brings the activities of each account together into one place so that it is easy to see how much money is in each account at any given time.

What Do I Need to Do?

Recall from the last training room that the journal is often referred to as the book of original entry because it is the first book where business transactions are recorded. Businesses may post daily from their journal or perhaps less often, depending on how many transactions they have. Always enter first and then post.

![]()

Open Gurpreet’s General Journal, and save this in your FIN1015 Course Folder.

This journal is complete with the opening entry. You are now going to post from this journal into Gurpreet’s Snow Removal Ledger.

![]()

Open Gurpreet’s Ledger, and save it in your FIN1015 Course Folder.

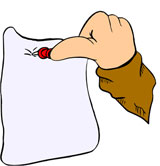

Notice that the first tab at the front of the ledger is the Chart of Accounts.

If you click on the Assets, Liabilities, Owner’s Equity, Revenue, or the Expenses tab, you will see that all of the accounts from the Chart of Accounts tab have been opened. That means that they all have an account title and an account number.

Watch the video clip titled Posting the Opening Entry for instructions on posting. Note that this instruction video is available to you to view at any time in the Toolkit under Tips and Tricks.

![]()

Gurpreet’s opening entry should now be posted into his ledger. Check Gurpreet’s Snow Removal Completed General Journal.

Check Gurpreet’s Snow Removal Completed Ledger.

1.19. Page 3

Training Room 5: Posting the Opening Entry

Time to Practise

There are two opening entries for you to practice posting to the ledger. You may choose to do one or both before you continue to your assignment in Time to Work. You will be able to self-check these practice activities.

![]()

The Posting Opening Entry Rubric is provided for reference. This rubric is also available for reference in the Toolkit whenever you like.

Practice 1: Dr. Zimmerman Medical Clinic

Open the Practice 1 Journal and the Practice 1 Ledger, and save them in your FIN1015 Course Folder.

Post the opening entry.

Practice 2: Koch Moving and Storage

Open the Practice 2 Journal and the Practice 2 Ledger, and save them in your FIN10105 Course folder.

Post the opening entry.

Tip

Does the total debits in the ledger equal the total credits? If not, check your work again to see what was posted incorrectly.

Time to Work

Complete the two assignments below when you are confident that you know how to post from an opening entry to a ledger. Be sure to save them for your teacher to mark.

Assignment 1

Open the Assignment 1 Journal and the Assignment 1 Ledger and save them in your FIN1015 Course Folder.

Post the assets only from the opening entry. Use the current year.

Assignment 2

Open the Assignment 2 Journal and the Assignment 2 Ledger and save them in your FIN1015 Course Folder.

Post the cash, truck, bank loan, and capital only from the opening entry. Use the current year.

Portfolio Submission

Include an opening entry along with the corresponding general ledger. Include the purpose of transferring these amounts into the ledger. What is the last step when posting, and why is it done last?

1.20. Page 4

Training Room 5: Posting the Opening Entry

Training Room 5 Summary

This is the last training room to prepare the accounting records to start an accounting system. Let’s review.

You now have completed setting up two books to start an accounting system. What are they?

© Bartlomiej Nowak/shutterstock

![]()

The two books are called the general journal and the general ledger.

What is the table of contents called, and which book is it in?

![]()

The table of contents is called the chart of accounts, and it is located in the front of the general ledger.

What number do the following types of accounts start with? assets? liabilities? owner’s equity? revenue? expenses?

![]()

assets—1

liabilities—2

owner’s equity—3

revenue—4

expenses—5

What accounts are called temporary capital accounts?

![]()

Drawing, income summary, revenue, and expenses are called temporary capital accounts.

Placing amounts into a journal is called making a/an _____.

![]()

Placing amounts into a journal is called making an entry.

Placing amounts into a ledger is called _____.

![]()

Placing amounts into a ledger is called posting.

![]()

Go to Summary 5 and answer the review questions.

You now have competed all of the steps necessary to set up an accounting system. Continue to the final project, where you will complete a simulation and put together a portfolio to set up the necessary books to start your own business.