Project 3

| Site: | MoodleHUB.ca 🍁 |

| Course: | Financial Management LearnEveryware Modules |

| Book: | Project 3 |

| Printed by: | Guest user |

| Date: | Wednesday, 24 December 2025, 10:33 AM |

Description

Created by IMSreader

1. Project 3

Project 3: Closing Entries

Project Introduction

At the end of a fiscal period, a business needs to update its records and prepare its books for the next fiscal period.

In this project there will be two training sessions to complete the accounting cycle.

- Journalizing Closing Entries

- Posting Closing Entries and the Post-Closing Trial Balance

Take a look at Step 7 and Step 8 in the Interactive Accounting Cycle. Then, continue on to Training Room 1, where Sakineh will step you through how to journalize closing entries.

© Keith Wilson/shutterstock

1.1. Training Room 1

Project 3: Closing Entries

Training Room 1: Journalizing Closing Entries

Suggested Time: 160 minutes

Training Room Introduction

Before we start this training room, watch the multimedia piece titled Gurpreet’s Business.

1.2. Page 2

Project 3: Closing Entries

© Andrey Khritin/8334053/Fotolia

What Do I Need to Know?

Closing an account means transferring any balance in that account and leaving the account with a zero balance.

Temporary capital accounts are closed at the end of each fiscal period and reopened again at the beginning of the next fiscal period. The permanent capital is also updated to include changes made because of net income, net loss, and drawing for the fiscal period.

Permanent and Temporary Capital Accounts

permanent account: an account that has a balance continuing from one fiscal period to another

As mentioned in Project 2, Training Room 1, temporary capital accounts are accounts that are opened at the beginning of the fiscal period and closed at the end (i.e., revenue and expense accounts that appear on the income statement). The permanent accounts are accounts that have balances that continue on from one fiscal period to the next. The permanent accounts are the balance sheet accounts; the temporary accounts are the income statement accounts.

Permanent Accounts

- balance sheet accounts

– assets

– liabilities

– capital

Temporary Accounts

- income statement accounts

– revenue

– expenses

The following is a list of accounts. Go to Permanent and Temporary Capital Accounts. Identify the temporary accounts by dragging them into the bucket.

Income Summary Account

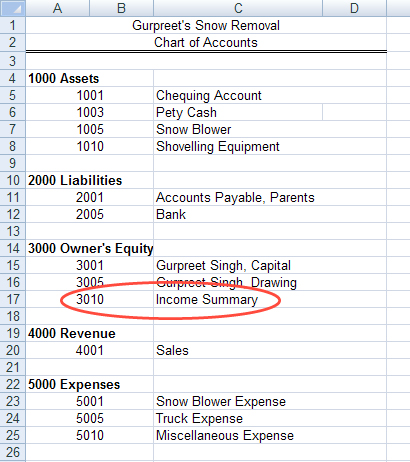

During the closing process, it is necessary to collect all the revenue amounts and all the expense amounts in one account. This account is called the income summary account. This is a temporary account that appears in the owner’s equity section of the company’s chart of accounts.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The income summary account is used only for closing the accounts of the company. The resulting balance will be either a net income, which will increase capital, or net loss, which will decrease capital. This amount will be transferred to the permanent capital account and the income summary account will be closed.

Why Is This Important?

By closing the temporary capital accounts of revenue, expenses, and drawing to zero, a business can easily compare revenue made, expenses incurred, or how much the owner withdrew from one period of time to the next.

Also, by transferring total revenue and total expenses into the income summary accounts, a summary of income incurred is created in one location and is easy to find. After the accounts are closed and posted, the permanent capital account will include any changes made from a net income, a net loss, or any withdrawals by the owner.

What Do I Need to Do?

As you learned in FIN1020, all entries must appear in the general journal before they are posted to the ledger. This is also true for the closing entries. Posting will be covered in the next training room.

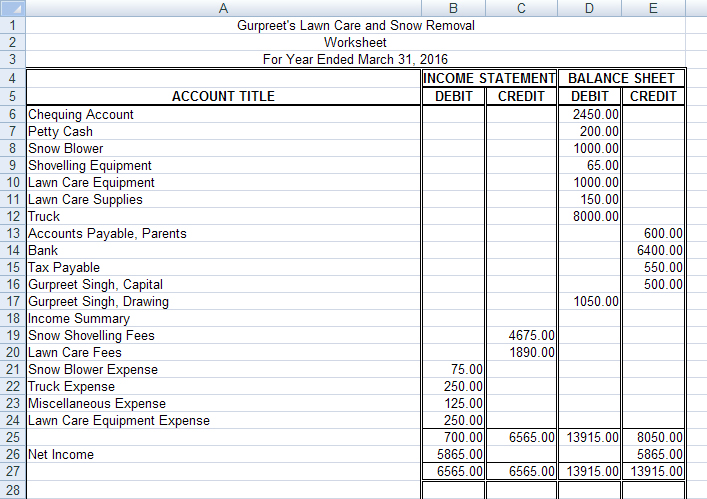

To journalize the closing entries, you need to complete the following steps using the information from the worksheet. We will use the following worksheet prepared for Gurpreet’s Lawn Care and Snow Removal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

1. Closing Revenue

The revenue account ends the fiscal period with a credit balance. Debit entries are needed to close them out or make them equal zero. The total revenue is transferred as a credit into the income summary account, so that this fiscal period’s revenue will be clearly visible and not mixed in with the capital account.

Using Gurpreet’s information from his worksheet, it is useful to create T-accounts to analyze this transaction. Go to T-accounts. Remember that T-accounts are rough ledger accounts used to help decide whether to debit or credit an account.

Notice that the total amount placed on the debit or left side of the revenue account is equal to the amount placed on the credit or right side of the income summary account. The revenue account now has a balance of zero, and the income summary account is holding the total revenue as a credit.

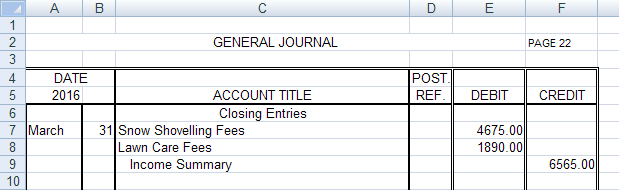

Remember that the first book to record financial information is the journal. Since this is the first closing entry, the title Closing Entries is centred in the general journal and is used as the heading of the section, which replaces the explanation or source document information.

These accounts will appear as follows in the general journal. Notice that total debits equal total credits.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

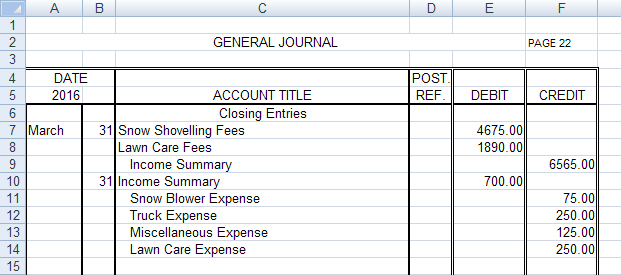

2. Closing Expenses

The expense accounts end the fiscal period with debit balances. Credit entries are needed to close them out or make them equal zero. The total expenses are transferred as a debit into the income summary account, so that this fiscal period’s expenses will be clearly visible and not mixed in with the capital account.

To see how using information from Gurpreet’s worksheet and the T-accounts needed to close the expense accounts would look, go to T-account Example 1.

The balances of all the expense accounts are now zero and the income summary account is holding the total expenses as a debit.

The expense accounts will appear as follows in the general journal. Notice that total debits equal total credits.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

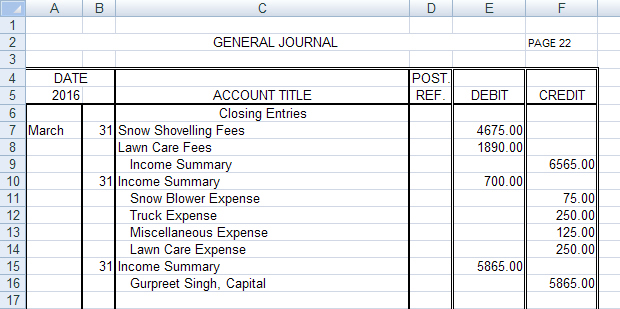

3. Closing Income Summary and Recording Net Income or Net Loss

The income summary account is a summary of the company’s income; therefore, it contains the total revenue and the total expenses for this fiscal period. The balance of the income summary account is either the net income or the net loss for the period—the difference between total revenue and total expenses.

If the company had a net income, capital would be increased, resulting in a credit to capital. If the company had a net loss, capital would be decreased, resulting in a debit to capital. Remember that capital’s balance side is on the credit or right side; therefore, the credit side is the increase side and the debit side is the decrease side.

To review increase and decrease sides of accounts, refer to Analyzing Transactions. This tool is also available for your reference in the Toolkit.

To see how rough T-accounts for closing the income summary and transferring the net income to capital for Gurpreet’s Lawn Care and Snow Removal would look, go to T-account Example 2.

The income summary account for Gurpreet has a credit balance before it is closed because there is a net income. This credit balance is transferred to the capital account, which increases capital. The income summary account is debited. Debiting the income summary results in a zero balance in this account. The amount debited equals the amount credited and the accounts remain balanced.

Debit entries are always recorded first. The journal entry for the net income section will appear as follows.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

If there is a net loss, the capital account would be debited, or decreased, and income summary would be credited.

4. Closing Drawing

Drawing represents decreases in capital due to the owner withdrawing assets (usually cash) from the business for personal use during the fiscal period. You could debit the capital account directly for these amounts; however, debiting the drawings account keeps all the drawings in one account for easy reference. Finding out how much the owner withdrew from the business in the fiscal period is easily done by looking at the debit balance in the drawing account.

Tip: Drawing account begins with the letter D and is debited or has a debit balance.

Capital account begins with the letter C and is credited or has a credit balance.

The last closing entry, the drawing section, is a debit to capital that will decrease the capital account and a credit to drawing that will close the drawing account.

The rough T-accounts would be as follows:

The journal entry to close the drawing account would appear in the general journal the way that it’s shown in Gurpreet’s Closing Entries.

That completes the four journal entries necessary in the closing entries section of the journal. View Four Closing Entries.

You may refer at any time to the above diagram by opening Four Closing Entries in the Toolkit.

You may also want to refer to the Closing Entries Rubric, which includes a checklist of what belongs in the closing entries, to help you complete your practice and assignments.

There is also a Closing Entry Exemplar for your reference. These items are also available in the Toolkit.

1.3. Page 3

Project 3: Closing Entries

Time to Practise

Do as many of the following three practice questions as you need to feel confident in completing closing entries before continuing on to Time to Work, which will be submitted for assessment.

If, after completing all three practices, you are still not confident that you know how to complete closing entries, you may redo these practices or see your teacher for help.

Remember that there are four journal entries required for each practice.

- revenue

- expenses

- net income or loss

- drawing

Practice 1

Step 1: Open General Journal Template, and save it in your course folder.

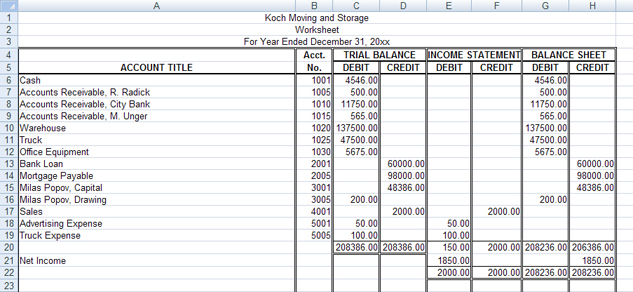

Step 2: Use the following worksheet to complete the closing entries on page three of the general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

To check your work, go to Koch Moving and Storage General Journal Answer.

If you need more practice, continue on to Practice 2 or Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

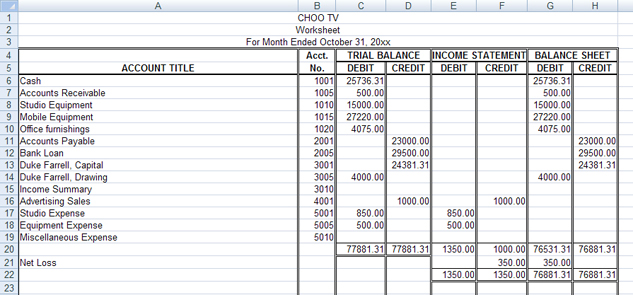

Practice 2

Step 1: Open General Journal Template, and save it in your course folder.

Step 2: Use the following worksheet to complete the closing entries on page nine of the general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

To check your work, go to CHOO TV General Journal Answer.

If you need more practice, continue on to Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

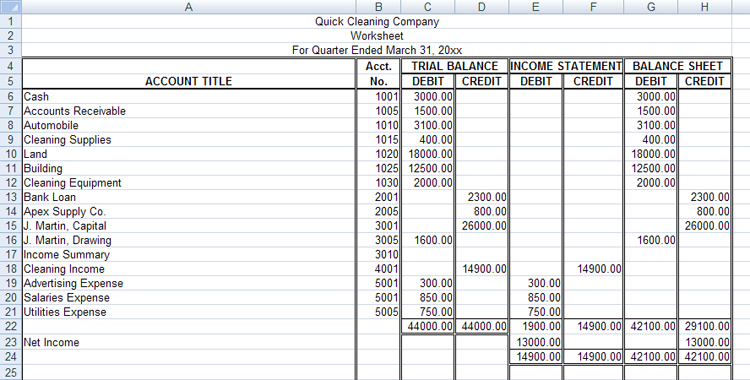

Practice 3

Step 1: Open General Journal Template, and save it in your course folder.

Step 2: Use the following worksheet to complete the closing entries on page 12 of the general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

To check your work, go to Quick Cleaning Company General Journal Answer.

If you are ready to do the assignments for this training room, continue on to Time to Work.

1.4. Page 4

Project 3: Closing Entries

Time to Work

Continue on to Assignment 1, which must be submitted to your teacher for assessment. There are also two optional assignments for this training room. Check with your teacher to see if it is necessary for you to complete them.

Create a new folder in your FIN030 Course Folder called Project 3: Training Room 1. All of the answers to the following questions must be saved in this folder for your teacher to mark.

Assignment 1

Step 1: Open General Journal Template, and save it in your course folder as “Assignment 1.”

Step 2: Use the following worksheet to complete the closing entries on page three of the general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Assignment 2 and Assignment 3 are optional assignments. Check with your teacher to see if you need to complete them.

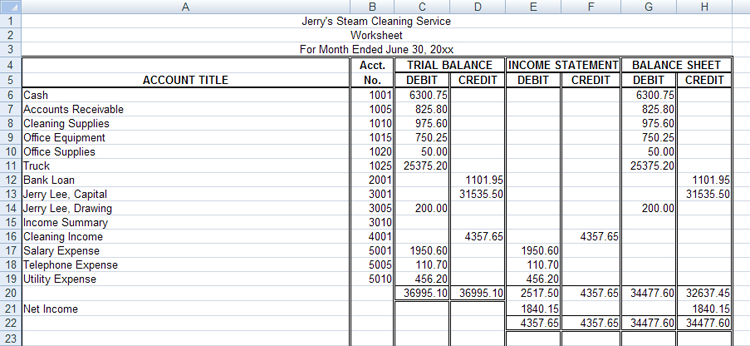

Assignment 2 (optional)

Step 1: Open General Journal Template, and save it in your course folder as “Assignment 2.”

Step 2: Use the following worksheet to complete the closing entries on page 15 of the general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

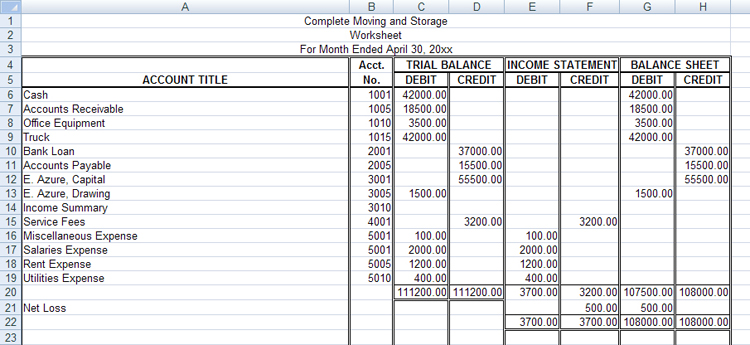

Assignment 3 (optional)

Step 1: Open General Journal Template, and save it in your course folder as “Assignment 3.”

Step 2: Use the following worksheet to complete the closing entries on page seven of the general journal.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

1.5. Training Room Summary

Project 3: Closing Entries

© Feverpitch/shutterstock

Training Room Summary

To review what you have studied in Training Room 1, answer the following questions.

- There are only four entries to close the accounts at the end of a fiscal period. Do you remember what they are?

- The following are the only four entries to close the accounts at the end of a fiscal period:

- revenue

- expenses

- net income or net loss

- drawing

- What is the purpose of closing these accounts?

- The purpose of closing these accounts includes the following:

- A business wants to keep track of revenue and expense amounts during each fiscal period so that the business owner can compare fiscal periods. This way, the owner knows when the highest revenue is made and when the most expenses are incurred. To do this, he or she closes the accounts and starts over at zero at the beginning of each fiscal period.

- The income summary contains the total revenue, total expenses, and the net income or net loss for each fiscal period for easy reference in one statement.

- The drawing account is the owner’s expense account and is kept separate, as it is not an expense to generate revenue. By closing drawing, a record of the amount the owner is withdrawing from the business each fiscal period can be kept.

Closing the accounts allows the company to keep new records for a new fiscal period.

All entries from the journal must be posted into the ledger before these accounts will be officially closed. Continue on to Training Room 2, where Sakineh will show you how to do this.

1.6. Training Room 2

Project 3: Closing Entries

© Kalim/6690398/Fotolia

Training Room 2: Posting Closing Entries

Suggested Time: 160 minutes

Training Room Introduction

Posting the closing entries is like emptying out all of the money from an account and holding that money in another account. Now the original account is empty and ready to accept transactions for the next fiscal period.

1.7. Page 2

Project 3: Closing Entries

What Do I Need to Know?

Make sure that the total debits for the closing entries equal the total credits in the journal before posting these amounts into the ledger. Remember that the ledger holds all of the accounts for a business so that it is easy to see how much money is in each account. After posting, the revenue, expense, drawing, and income summary accounts will all be closed or equal zero. The capital account will be adjusted higher or lower, depending on whether the business made a net income or a net loss.

Why Is This Important?

If debits do not equal credits, you know you have likely made a mistake. It is important to try to eliminate any errors so that you are not posting incorrect amounts into the ledger. The balances in the ledger accounts will not be changed until these amounts are posted or placed in the ledger so that the new balances can be calculated.

What Do I Need to Do?

Posting closing entries is the same as when you posted other journal entries from the general journal into the general ledger in FIN1020.

Follow the instructions below to post Gurpreet’s closing entries from his journal into his ledger.

- Open Gurpreet’s General Journal, and save it as “Gurpreet’s General Journal” in your course folder.

- Open Gurpreet’s General Ledger, and save it as “Gurpreet’s General Ledger” in your course folder.

- View Posting the Closing Entry, and follow the instructions to post Gurpreet’s closing entries.

You can check your work when you have finished posting by clicking on the following links:

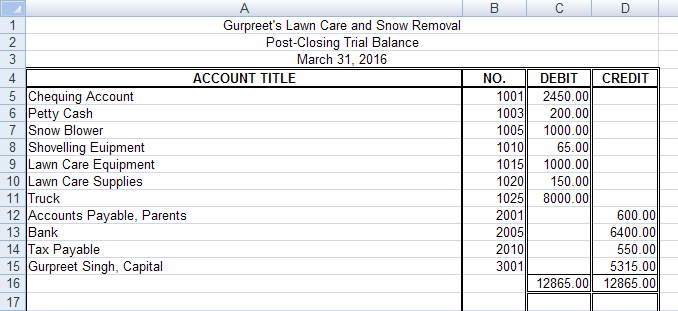

Post-Closing Trial Balance

After the closing entries have been posted and the accounts have been balanced, a trial balance is completed to test the equality of the debits and credits in the ledger. The trial balance taken after the closing entries have been posted is called a post-closing trial balance. Only accounts that are open at the end of the fiscal period are listed on the post-closing trial balance. The accounts that are left open are the assets, liabilities, and owner’s capital accounts. Those accounts with a zero balance are not included because they have been closed.

You should be familiar with completing a trial balance from FIN1020 as well as the trial balance section of the worksheet project. See if you are able to complete the post-closing trial balance for Gurpreet’s Lawn Care and Snow Removal before checking your work.

Tip: The heading must describe the who, what, and when.

Only accounts that remain open are listed.

Rule the post-closing trial balance when it is balanced.

Open a Trial Balance Form, and save it as “Gurpreet’s Post-Closing Trial Balance.”

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

When completing your practices and assignments, you may want to refer to the Post-Closing Entries Rubric, which includes a checklist of what to do when posting the closing entries. This rubric is also available in the Toolkit.

Remember that 20xx refers to the current year. Use the current year for all of the following practices and assignments.

1.8. Page 3

Project 3: Closing Entries

Time to Practise

Complete as many of the following three practices as you need to feel confident in posting the closing entries before you continue on to Time to Work, which will be submitted for assessment.

If, after completing all three practices, you are still not confident that you know how to complete posting closing entries, you may redo these practices or see your teacher for help.

Practice 1

Step 1: Open Practice 1 Ledger, and save it in your course folder.

Step 2: Calculate the new balances for each account, and complete the indicator column on each line. Remember that this column indicates whether the balance is a debit or a credit. If there is no balance, do not put anything in this column.

Step 3: Open Practice 1 Journal, and save it in your course folder.

Step 4: Post the closing entries from the journal to the ledger.

Step 5: Open a Trial Balance Template, and save it in your course folder.

Step 6: Complete the post-closing trial balance for CHOO TV.

You can check your work by clicking on the following:

If you need more practice, continue on to Practice 2 or Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

Practice 2

Step 1: Open Practice 2 Ledger, and save it in your course folder.

Step 2: Calculate the new balances for each account, and complete the indicator column on each line. Remember that this column indicates whether the balance is a debit or a credit. If there is no balance, do not put anything in this column.

Step 3: Open Practice 2 Journal, and save it in your course folder.

Step 4: Post the closing entries from the journal to the ledger.

Step 5: Open Trial Balance Template, and save it in your course folder.

Step 6: Complete the post-closing trial balance for Koch Moving and Storage.

You can check your work by clicking on the following:

If you need more practice, continue on to Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

Practice 3

Step 1: Open Practice 3 Ledger, and save it in your course folder.

Step 2: Calculate the new balances for each account, and complete the indicator column on each line. Remember that this column indicates whether the balance is a debit or a credit. If there is no balance, do not put anything in this column.

Step 3: Open Practice 3 Journal, and save it in your course folder.

Step 4: Post the closing entries from the journal to the ledger.

Step 5: Open Trial Balance Template, and save it in your course folder.

Step 6: Complete the post-closing trial balance for Fanci Foods Ltd.

You can check your work by clicking on the following:

If you are ready to do the assignments for this training room, continue on to Time to Work.

1.9. Page 4

Project 3: Closing Entries

Time to Work

Continue on to Assignment 1, which must be submitted to your teacher for assessment. There is also an optional assignment for this training room. Check with your teacher to see if it is necessary for you to complete this optional assignment.

Create a new folder in your FIN1030 Course Folder called “Project 3 Training Room 2.” All of the answers to the following questions must be saved in this folder for your teacher to mark.

Assignment 1

Step 1: Open Assignment 1 Ledger, and save it as “Assignment 1 Ledger.”

Step 2: Calculate the new balances for each account.

Step 3: Open Assignment 1 Journal, and save it as “Assignment 1 Journal.”

Step 4: Post the closing entries from the journal to the ledger.

Step 5: Open Trial Balance Template, and save it as “Assignment 1 Trial Balance.”

Step 6: Complete the post-closing trial balance for Waterfall Hotel.

Assignment 2 (optional)

The following assignment is optional. Check with your teacher to see if you need to complete it.

Step 1: Open Assignment 2 Ledger, and save it in your course folder as “Assignment 2 Ledger.”

Step 2: Calculate the new balances for each account.

Step 3: Open Assignment 2 Journal, and save it in your course folder as “Assignment 2 Journal.”

Step 4: Post the closing entries from the journal to the ledger.

Step 5: Open Trial Balance Template, and save it as “Assignment 2 Trial Balance.”

Step 6: Complete the post-closing trial balance for Joe’s Towing Service.

1.10. Training Room Summary

Project 3: Closing Entries

© 2009 Jupiterimages Corporation

Training Room Summary

In this training room you completed the accounting cycle by posting the four closing entries:

- revenue

- expenses

- net income or net loss

- drawing

In doing so, you readied the books for the next fiscal period. The accuracy of these postings was then checked by completing a post-closing trial balance. Total debits must equal total credits.

Upon completion of posting the closing entries, revenue, expense, income summary and drawing accounts are all closed and have zero balances.

The capital account has been updated to reflect any net income or net loss and any drawing that occurred during the fiscal period. The books are now ready for the next fiscal period.

Continue on to Project 4, where you will explore how businesses use their financial statements to prepare budgets and make important financial decisions to maximize profits in the next fiscal period.