Lesson 1

| Site: | MoodleHUB.ca 🍁 |

| Course: | Math 30-3 SS |

| Book: | Lesson 1 |

| Printed by: | Guest user |

| Date: | Sunday, 2 November 2025, 10:03 AM |

Description

Created by IMSreader

1. Lesson 1

Module 2: Number

Lesson 1: Owning and Operating a Small Business

Focus

iStockphoto/Thinkstock

Small businesses play a significant role in the Canadian economy. According to Industry Canada, as of December 2010, there were approximately one million businesses in Canada with at least one employee. Of these one million businesses, 75% had fewer than ten employees, and 55% had only one to four employees.

Would you like to create a small business and be part of that 55%? Operating your own business has many advantages, including the following:

- You get to choose the people with whom you work.

- You can follow your passion and choose what work you take on.

- You can experience the satisfaction of creating something on your own.

In this lesson you will explore the different financial calculations involved in starting and operating a small business.

Lesson Outcomes

At the end of this lesson, you will be able to

- analyze day-to-day expenses and revenue of a small business

- analyze start-up costs of a small business

- analyze the feasibility of a small business

Lesson Question

You will investigate the following question:

- How do financial decisions affect the profitability of a small business?

Assessment

Your assessment may be based on a combination of the following tasks:

- completion of the Lesson 1 Assignment (Download the Lesson 1 Assignment and save it in your course folder now.)

- course folder submissions from Try This and Share activities

- additions to Glossary Terms

- work under Project Connection

Self-Check activities are for your own use. You can compare your answers to suggested answers to see if you are on track. If you have difficulty with concepts or calculations, contact your teacher.

Remember that the questions and activities you will encounter provide you with the practice and feedback you need to successfully complete this course. You should complete all questions and place your responses in your course folder. Your teacher may wish to view your work to check on your progress and to see if you need help.

1.1. Discover

Module 2: Number

Discover

Try This 1

Ryan McVay/Photodisc/Thinkstock

Think about a small business that you either know about or would like to start. Perhaps it’s a landscaping company, a bike courier company, or a mountain guiding company. Regardless of your choice, think about the following questions:

- What products and/or services does the business sell or provide to make money?

- What expenses would the business have?

![]() Save your responses in your course folder.

Save your responses in your course folder.

Share 1

With a partner or in a group, share your results from Try This 1, and then answer the following questions.

- Did your partner's or the group's businesses have any expenses in common? If so, which expenses?

- Did the lists of expenses include any that occurred each month? If so, what were they?

![]() If required, place a summary of your discussion in your course folder.

If required, place a summary of your discussion in your course folder.

1.2. Explore

Module 2: Number

Explore

Hemera/Thinkstock

What you may have discovered in Share 1 is that regardless of the business, there are commonalities in expenses. To cover the cost of expenses, businesses sell products or services to earn revenue.

|

Expenses |

Revenue |

Definition |

money required for the business to operate |

total money earned by the business |

Common Examples |

|

|

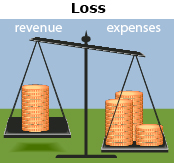

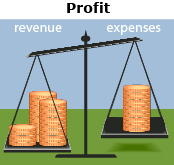

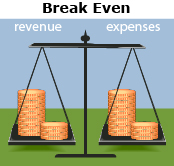

In general, businesses earn sales revenue by selling goods or services. In the course of delivering those goods or services, businesses have associated expenses. If their revenue is higher than their expenses, they make a profit; if their revenue is lower than their expenses, they incur a loss. If their revenue is equal to their expenses, they break even.

|

|

|

revenue – expenses = negative |

revenue – expenses = positive |

revenue – expenses = 0 |

In Share 1 you had a variety of expenses. These can be categorized as either fixed or variable. Fixed expenses are the same amount and occur at a regular frequency, such as the cost to rent a building per month. Variable expenses are varying amounts that may or may not occur at a regular frequency, such as fuel and repair costs for a vehicle. You may also have fixed and variable revenue. Fixed revenue could come from a long-term contract where you expect the same amount of money each month over an extended period. Variable revenue could come from a one-time contract that you do not expect to be repeated.

In the table, examples are given for these definitions as applied to a small landscaping business.

Revenue |

The landscaping business will earn money by providing landscaping services to customers. |

Expenses |

The company will have many different expenses, including

|

Profit (positive profit) |

Suppose the business had revenue of $7300 and expenses of $3900 in a month.

The profit is positive, so the company had a profit of $3400 that month. |

Loss |

Suppose the business had revenue of $5400 and expenses of $6100 in a month.

The profit is negative, so the company lost $600 that month. |

Break Even (zero profit) |

Suppose the business had revenue of $6300 and expenses of $6300 in a month.

The profit is zero, so the company broke even that month. |

Fixed Expenses |

Some fixed expenses for the landscaping company include

|

Variable Expenses |

Some variable expenses for the landscaping company include

|

Fixed Revenue |

The company has contracts with some customers to cut their lawn every week. |

Variable Revenue |

The company has some customers who ask for one-time services. |

BananaStock/Thinkstock

The way money is moving into and out of a business can be summarized by a statement of revenue and expense. A sample statement of revenue and expense for a landscaping business is shown in the following table. Notice that all the revenues are totalled and all the expenses are totalled in the statement. These totals are then used to determine the profit.

|

|||

September 2013 |

|||

Income ($) |

Expenses ($) |

||

Regular Contracts One-time Contracts |

8150 1200 |

Wages Fuel Repairs Insurance Supplies Rent |

3200 365 190 110 680 1400 |

Total |

9350 |

|

5945 |

PROFIT |

|

||

1.3. Explore 2

Module 2: Number

Read “Explore the Math” on page 287 of your textbook. In particular, pay attention to the definitions in the right margin. Notice that the statement of revenue and expense on page 288 contains similar information to the statement of revenue and expense for Ernie’s Landscaping. The difference is that the information is arranged differently.

Read “Example 1” on pages 288 and 289 for an example of classifying revenue and expenses.

Self-Check 1

![]()

- Complete “Build Your Skills” questions 2 and 3 on pages 293 and 294 of your textbook. Answer

Business owners are responsible for setting prices for their products and services. They need to strike a balance between pricing it high enough to make a reasonable profit, and low enough that customers will want to buy it.

There are a variety of games on the Internet that simulate running a simple business. One example is Hot Chocolate Express, which you will play in Try This 2.

Try This 2

Open the Hot Chocolate Express game. The goal is to accumulate as much profit as possible. Once you have completed the game, respond to the questions that follow.

- How did you maximize your profit?

- Describe some factors that influenced whether people would buy your hot chocolate.

![]() Save your responses in your course folder.

Save your responses in your course folder.

Share 2

With a partner or in a group, discuss your strategies for maximizing your profits in the Hot Chocolate Express simulation. How were your strategies similar? How were they different? Why are some strategies more profitable than others?

1.4. Explore 3

Module 2: Number

While playing Hot Chocolate Express, you saw that many factors can influence how well a business does. Some of these factors, such as the hot chocolate recipe, are in your control. Some of the factors, like the rent, are not. A real business has many more factors to account for than the simulated Hot Chocolate Express.

Read “Discuss the Ideas, Profitable Business Decisions” on page 290 of your textbook. In particular, pay attention to the variety of factors that can affect the profitability of a business. If you were creating the business you described in Try This 1, what factors would you have to consider?

Read “Example 2” on pages 290 and 291 of your textbook for a detailed example of analyzing day-to-day expenses and revenue. Consider the calculations that Sylvia must use in her analysis to figure out strategies for breaking even or making a profit. What factors may affect her profitability?

Self-Check 2

Complete “Build Your Skills” questions 1 and 5 on pages 293 and 294 of your textbook. ![]() Answer

Answer

iStockphoto/Thinkstock

Up until now, you’ve been analyzing the costs associated with running a business. However, before a business opens the owners must decide if the business is feasible, that is, if it has a chance of surviving. Once the owners are confident it will be profitable, supplies, such as tools, must be purchased.

Share 3

With a partner or in a group, share the type of business you identified in Try This 1.

- Describe why you think your business will be profitable—accounting for competitors, customers, weather, and so on.

- List what you think your start-up costs will be.

![]() If required, place a summary of your discussion in your course folder.

If required, place a summary of your discussion in your course folder.

1.5. Explore 4

Module 2: Number

Brand X Pictures/Thinkstock

When beginning a business, typically you will need to purchase some equipment or services. This start-up cost will often include some large, expensive items. For example, a gasfitter would need to purchase a truck, a pipe cutting and threading machine, and a large number of other tools, such as a pipe bender, drills, wrenches, screwdrivers, levels, a measuring tape, and saws. To purchase all of these things could be expensive. Expenses associated with the business after the start-up costs are called operating expenses.

It is also important to decide whether a new business is feasible. This means deciding whether a business is likely to be profitable. To determine if a business is feasible you should begin by asking questions such as the following:

- Will people purchase my service or products?

- Can I sell my services or products for more than it costs me to provide them?

- How much competition is there in the community in which I plan to set up the business?

Read “Explore the Math” on pages 276 and 277 of your textbook. Pay attention to the definitions of the terms in the left margin.

Self-Check 3

Complete “Build Your Skills” questions 2, 4, 7, and 8 on pages 282 to 284 in your textbook. Answer

Add the following terms to your copy of Glossary Terms:

- sales revenue

- break even

- loss

- profit

- variable expenses

- fixed expenses

- start-up cost

- operating expenses

- feasible

1.6. Connect

Module 2: Number

Complete the Lesson 1 Assignment that you saved in your course folder at the beginning of the lesson. Show work to support your answers.

![]() Save your responses in your course folder.

Save your responses in your course folder.

Project Connection

You are ready to start working on Module 2 Project: Owning and Operating a Small Business. Go to the Module 2 Project and read over all project requirements. Become familiar with what you will be doing and how you will be assessed.

Your Module 2 Project will be evaluated by your teacher using the evaluation guidelines in the Project Rubric. Read the rubric carefully. Make sure you are aware of how you will be assessed. You can print or save a digital copy of the rubric.

Go to Module 2 Project: Owning and Operating a Small Business, and complete Part 1: Choosing a Business.

![]() Save your responses in your course folder.

Save your responses in your course folder.

1.7. Lesson 1 Summary

Module 2: Number

Lesson 1 Summary

© WavebreakMediaMicro/26268708/Fotolia

Opening a small business can be an exciting endeavour, but you will need more than a good idea. First you will need to determine whether your business will be feasible in a given location. This can involve looking at many different aspects of your business and the community in which you will operate. Planning the expenses and revenues you can realistically expect for your business is also part of a successful business plan.