Project 1

| Site: | MoodleHUB.ca 🍁 |

| Course: | Financial Management LearnEveryware Modules |

| Book: | Project 1 |

| Printed by: | Guest user |

| Date: | Wednesday, 24 December 2025, 8:22 AM |

Description

Created by IMSreader

1. Project 1

Project 1: The Worksheet

Project Introduction

The worksheet is an informal business paper used to organize and summarize data regarding the financial condition of a business. The worksheet also helps a business prepare financial statements, as all the information is summarized in one place, usually on one page. You will understand more about this as you go through the training rooms. For a short introduction to the worksheet, go to the Interactive Accounting Cycle and click on “Step 5. Worksheet.”

In this project there are three training rooms in which you will learn about the worksheet.

- Training Room 1 shows you how to set up a worksheet and complete the trial balance.

- Training Room 2 shows you how to extend the worksheet.

- Training Room 3 shows you how to calculate a net income or a net loss.

Throughout these training rooms, you will be referred to videos and documents to help you understand the concepts covered. Remember that these helpful suggestions are available for your reference at any time in the course Toolkit.

Continue on to Training Room 1, where Sakineh, the financial trainer, will step you through how to set up a worksheet and complete the trial balance section.

1.1. Training Room 1

Project 1: The Worksheet

Training Room 1: The Trial Balance

Suggested Time: 80 minutes

Training Room Introduction

In FIN1020 you met Gurpreet Singh, who was the owner and operator of Gurpreet’s Snow Removal. He has now added lawn care to his business and has renamed it Gurpreet’s Lawn Care and Snow Removal.

Gurpreet has been busy completing the daily accounting tasks in his business. He has been journalizing entries from source documents, posting to the general ledger, and preparing a trial balance to ensure that his books are in order. It has now been a year since he first started his business.

Ravinder, Gurpreet’s cousin and an accountant, has stopped in to see how he is doing. View How Gurpreet’s Business Is Going.

Gurpreet needs to complete a worksheet for his business so that he can see if he has made a profit. Let’s see what he needs to do.

1.2. Page 2

Project 1: The Worksheet

What Do I Need to Know?

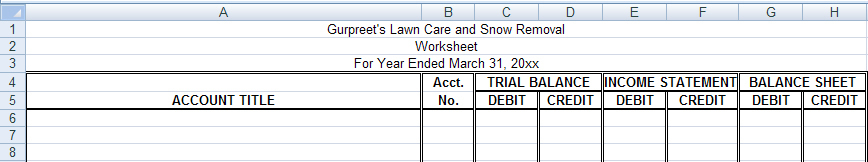

Accountants generally use an eight-column worksheet to have the space to include as much information as possible; however, a six-column worksheet will be used throughout this project to present this new concept to you as simply as possible.

This training room will concentrate on the first two columns, which are for the trial balance. You completed a trial balance at the end of FIN1020. The trial balance on a worksheet is very similar. In fact, most businesses would do the trial balance section on the worksheet to make sure that debits equaled credits in their ledger, before they would do a formal trial balance.

Like the formal trial balance, the worksheet has a heading that describes who, what, and when. The only difference is the “when” line. The worksheet will calculate the profit or loss a business has experienced for a certain period of time, called a fiscal period. This could be a month, a quarter of a year (three months), half of a year (six months), or a year. So, the fiscal period needs to be indicated in the “when” line of the worksheet.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Note: The year 20xx refers to the current year in this course.

All of the account titles, numbers, and the balances in the debit and credit columns from the general ledger are transferred into this first section of the worksheet. It is advisable to include all of the accounts (even those with no balances), so that nothing is missed.

Why Is This Important?

In FIN1020, when you completed a trial balance, you checked that all of the debits equaled the credits. It is also important to do this in the worksheet to make sure that your ledger is in balance, or that the debits equal credits, before you can determine if a profit or a loss was made by the business. You also want to make sure that all of your balances are correct before you extend them to the rest of the worksheet, which you will be doing in Training Room 2.

What Do I Need to Do?

Step 1: Open Worksheet Template, and save it in your course folder as “Gurpreet’s Worksheet.”

Step 2: Enter the heading for the worksheet for the year ended March 31, 2016. Make sure it describes the “who,” “what,” and “when.”

Step 3: Open Gurpreet’s Ledger, and save this in your FIN1030 folder as “Gurpreet’s Ledger.”

Step 4: Refer to Gurpreet’s Ledger, and copy all the account titles and account numbers into the worksheet under the Account Title and Acct. No. columns. Also copy in the last account balance in each ledger account to the appropriate debit and credit columns in the trial balance section of the worksheet. Remember to include all of the accounts, even those with no balances, so that nothing is missed.

It may be easier for you to work with both worksheets on the screen. View Viewing Side by Side for instructions on how to view these two files on the screen at the same time. If you need to access this information later, it is available in the course Toolkit.

Step 5: Add the total debits and credits, and make sure they are equal. Remember that you can select both columns and add them at the same time by using the AutoSum icon.

View Adding Multiple Columns for instructions on how to add multiple columns using AutoSum. If you need to access this information later, it is available in the course Toolkit.

Step 6: If the totals are equal, place a single line above the totals and a double line under the totals.

For instructions on how to draw these lines, view Double Ruling. If you need to access this information later, it is available in the course Toolkit.

If your totals are not equal, you have copied something incorrectly from the ledger. Check that you put the final balance in the proper debit or credit column and add again.

You can check your answers using Gurpreet’s Completed Worksheet.

If you made any errors, you need to correct them and save the corrected worksheet as you will be using it in the next training room.

1.3. Page 3

Project 1: The Worksheet

Time to Practise

There are three opportunities for you to practise. It is recommended that you complete at least Practice 1 to prepare you for your Time to Work assignment, which will be submitted for assessment. Practice 2 and Practice 3 are opportunities for further practise, if needed.

For a review of which side is the add side and which side is the subtract side, refer to Analyzing Transactions. If you need to access this information later, it will be available in the course Toolkit.

Practice 1

The numbers to complete a worksheet come from the general ledger. Open this ledger, and save it in your course folder.

Complete Practice 1 Ledger by calculating any new balances and indicating either a DR or CR balance in the indicator column.

Open Worksheet Template, and save it in your course folder.

Complete the heading of the worksheet for CHOO TV for the month ended October 31 of the current year.

Complete the trial balance section of the worksheet and save it.

If the trial balance does not balance, refer to Finding Errors. This is a very handy support on what to do when the credit and debit numbers do not match. If you need to access this information later, it is available in the course Toolkit.

Go to How the Balances Were Calculated.

If you need more practice, continue on to Practice 2.

If you are ready to do the assignments for this training room, let your teacher know and continue on to Time to Work.

Practice 2

The account titles and balances for Quick Cleaning Company are as follows:

Cash: |

3000.00 |

Hint: Sort these accounts into the appropriate types first; e.g., assets, liabilities, owner’s equity, revenue, and expenses.

Step 1: Open Worksheet Template, and save it in your course folder.

Step 2: Complete the heading of the worksheet for Quick Cleaning Company for the quarter ended March 31 of the current year.

Step 3: Give each account an appropriate account number. Use a four-digit account numbering system. For example, Cash will be 1001. Place in numerical order in the worksheet.

Step 5: Complete the trial balance section of the worksheet and save.

You can check your answers using Quick Cleaning Completed Worksheet.

If you need more practice, continue on to Practice 3.

If you are ready to do the assignments for this training room, let your teacher know and continue on to Time to Work.

Practice 3

The account titles and balances for Koch Moving and Storage are as follows:

Cash: |

4546.00 |

Hint: Sort these accounts into the appropriate types first; e.g., assets, liabilities, owner’s equity, revenue, and expenses.

Step 1: Open Worksheet Template, and save it in your course folder.

Step 2: Complete the heading of the worksheet for Koch Moving and Storage for the year ended December 31 of the current year.

Step 3: Give each account an appropriate account number. Use a four-digit account numbering system. For example, Cash will be 1001. Place in numerical order in the worksheet.

Step 4: Complete the trial balance section of the worksheet and save.

You can check your answers using Koch Moving and Storage Completed Worksheet.

If you need more practice, you may redo these practices or see your teacher for help.

If you are ready to do the assignments for this training room, let your teacher know and continue on to Time to Work.

1.4. Page 4

Project 1: The Worksheet

Time to Work

Let your teacher know when you are ready to complete the following assignments.

Create a new folder in your FIN1030 Course Folder called “Project 1 Training Room 1.” All of the answers to the following questions must be saved in this folder for your teacher to mark.

Assignment 1 requires you to complete a general ledger before completing the trial balance section of the worksheet. Assignment 2 provides the balances in the ledger for you to complete the trial balance section of the worksheet.

Refer to the Worksheet Trial Balance Rubric for a checklist to make sure you have included everything you need.

Assignment 1

Step 1: The numbers to complete a worksheet come from the general ledger. Open the Assignment 1 Ledger and save in your new folder as “Project 1: Training Room 1: Assignment 1 Ledger.”

Step 2: Complete this ledger by calculating any new balances and indicating either a DR or CR balance in the indicator column.

Step 3: Open Worksheet Template, and save it in your course folder as “Project 1: Training Room 1: Assignment 1 Worksheet.”

Step 4: Complete the heading of the worksheet for Mojuta Services for the month ended September 30 of the current year.

Step 5: Complete the trial balance section of the worksheet and save.

Assignment 2

The account titles and balances for Uni-Care Repairs are as follows:

Cash: |

19 067.00 |

Hint: Sort these accounts into the appropriate types first; e.g., assets, liabilities, owner’s equity, revenue, and expenses.

Step 1: Open Worksheet Template, and save in your course folder as “Project 1: Training Room 1: Assignment 2 Worksheet.”

Step 2: Complete the heading of the worksheet for Uni-Care Repairs for the year ended December 31 of the current year.

Step 3: Give each account an appropriate account number. Use a four-digit account numbering system. For example, Cash will be 1001.

Step 4: Complete the trial balance section of the worksheet and save.

1.5. Training Room Summary

Project 1: The Worksheet

© Iosif Szasz-Fabian/178720/Fotolia

Training Room Summary

In this training room you learned how to set up a worksheet and prepare the trial balance section. This is a way to help catch possible errors that may have been made in the ledger. It is important to make sure that the debits equal the credits in this section before you extend these account balances to the rest of the worksheet. If not, you may be working with incorrect numbers and this could create problems with your financial statements. The work that is completed on this worksheet is the rough work that is used to complete formal financial statements that may be submitted to the head of the company, an auditor, or a financial institution. It is important that these numbers are accurate.

Continue on to Training Room 2 to learn how to extend these account balances to the rest of the worksheet.

1.6. Training Room 2

Project 1: The Worksheet

Training Room 2: Extending the Worksheet

Suggested Time: 80 minutes

Training Room Introduction

© magicoven/shutterstock

An extension ladder is a common piece of equipment used on the fire ground. The extension allows a firefighter to reach various heights. Just as extending a ladder means to make it bigger (longer), extending the worksheet means to make the worksheet bigger (contain more information).

1.7. Page 2

Project 1: The Worksheet

What Do I Need to Know?

You need to make sure that all the balances from the ledger you developed in the first training room have been calculated correctly before you move or extend any of those numbers into this training room worksheet. Once you have confirmed the accuracy of the past numbers, you can extend these amounts into the appropriate sections of the worksheet. These numbers will either go into the income statement columns or the balance sheet columns—never into both. To see an example, view Extend the Worksheet.

The balance sheet, as you may recall from FIN1020, has three types of accounts. They are assets, liabilities, and owner’s equity, which includes capital and drawing. Only these accounts will be included in the balance sheet section.

The income statement columns will have only revenue and expense account balances.

Why Is This Important?

This information allows the calculation of a net income or a net loss, which will be done in the next training room. The information from the income statement columns will be used to complete an income statement financial statement. The information from the balance sheet columns will be used to complete a balance sheet financial statement when you complete the financial statements in Project 2.

What Do I Need to Do?

Open Gurpreet’s Worksheet, which you saved in your course folder from the last training room. Make sure that the trial balance columns are equal before you continue, as you do not want to extend wrong numbers into the other worksheet columns.

Extend the worksheet as shown in Gurpreet’s Worksheet Extended.

Important Note: Notice that in the income statement columns, total debits do not equal total credits. Also, in the balance sheet columns, the total debits do not equal the total credits. This is because the worksheet is not complete and will be continued in the next training room. Upon the completion of the worksheet, all debits will equal credits.

1.8. Page 3

Project 1: The Worksheet

Time to Practise

Complete as many of the following practices as you need to feel confident in extending the worksheet before you continue on to the assignment in Time to Work, which will be submitted for assessment.

Use the checklist in the Worksheet Extended Rubric to make sure you didn’t forget anything. The rubric is available in the Toolkit for your reference to at any time.

If, after completing all three practices, you are still not confident that you know how to extend the trial balance amounts to the rest of the worksheet, you may redo these practices or see your teacher for help.

Practice 1: CHOO TV

Open Practice 1: CHOO TV. Extend the trial balance section to the income statement and the balance sheet sections of the worksheet. Save your work in your course folder.

Check your answer by viewing CHOO TV Worksheet Extended.

If you need more practice, continue on to Practice 2 or Practice 3.

If you are ready to do the assignments for this training room, let your teacher know and continue on to Time to Work.

Practice 2: Quick Cleaning Company

Open Practice 2: Quick Cleaning Company Worksheet Extended. Extend the trial balance section to the income statement and the balance sheet sections of the worksheet. Save your work in your course folder.

Check your answer by viewing Quick Cleaning Company Worksheet Extended.

If you need more practice, continue on to Practice 1 or Practice 3.

If you are ready to do the assignments for this training room, let your teacher know and continue on to Time to Work.

Practice 3: Koch Moving and Storage

Open Practice 3: Koch Moving and Storage Worksheet Extended. Extend the trial balance section to the income statement and the balance sheet sections of the worksheet. Save your work in your course folder.

Check your answer by viewing Koch Moving and Storage Worksheet Extended.

If you are ready to do the assignments for this training room, let your teacher know and continue on to Time to Work.

1.9. Page 4

Project 1: The Worksheet

Time to Work

Continue on to Assignment 1, which you are required to submit to your teacher for assessment. There are also two optional assignments in this training room. Please check with your teacher to see if you need to do these optional assignments.

Create a new folder in your FIN1030 Course Folder called “Project 1: Training Room 2.” All of the answers to the following questions must be saved in this folder for your teacher to mark.

Refer to the Worksheet Extended Rubric in the Toolkit for a checklist to make sure you have included everything you need.

Assignment 1

Step 1: Open Assignment 1: Jerry's Steam-Cleaning Service Worksheet Extended, and save in your course folder as “Project 1: Training Room 2: Assignment 1.”

Step 2: Extend the trial balance section to the income statement and the balance sheet sections of the worksheet, rule and save.

Check with your teacher to see if it is necessary for you to do the following optional assignments.

Assignment 2 (optional)

Step 1: If you choose to complete this optional assignment, open Assignment 2: Cache Rentals Worksheet Extended and save it in your course folder as “Project 1: Training Room 2: Assignment 2.”

Step 2: Extend the trial balance section to the income statement and the balance sheet sections of the worksheet, rule, and save.

Assignment 3 (optional)

Step 1: If you choose to complete this optional assignment, open Assignment 3: Sandi’s Answering Service Worksheet Extended and save it in your course folder as “Project 1: Training Room 2: Assignment 3.”

Step 2: Extend the trial balance section to the income statement and the balance sheet sections of the worksheet, rule and save.

1.10. Training Room Summary

Project 1: The Worksheet

© Imagery Majestic/10379754/Fotolia

Training Room Summary

You have now extended the trial balance totals to the balance sheet and the income summary sections of the worksheet.

Remember that the trial balance totals are extended to either the balance sheet columns or the income statement columns, but never both.

Do you remember what accounts are extended into which column?

Assets, liabilities, and owner’s equity, including drawing, are extended to the balance sheet columns. Revenue and expenses are extended to the income statement columns.

Also, recall that the total debits do not equal the total credits in the income statement columns or the balance sheet columns at this point. Debits will equal credits when the worksheet is completed in the next training room.

Extending the worksheet is the groundwork necessary to determine whether a company made a profit or a loss and the rough work that will be used to complete formal financial statements.

Continue on to Training Room 3, where you will calculate the net income or net loss and assure that all debits equal credits to complete the worksheet.

1.11. Training Room 3

Project 1: The Worksheet

Training Room 3: Calculating Net Income or Net Loss

Suggested Time: 160 minutes

Training Room Introduction

1.12. Page 2

Project 1: The Worksheet

© Scott A. Maxwell / LuMaxArt/shutterstock

What Do I Need to Know?

To determine if a business has made a profit, called “net income,” or a loss, called “net loss,” a person needs to look at the expenses the business incurred during the same time period as revenue that was received.

If revenue is greater than expenses, the business has a net income. If expenses are greater than revenue, the business has a net loss for that fiscal period.

© Feng Yu/12372835/Fotolia

Why Is This Important?

It is important for a business to know if the money received from revenue, or sales to customers, is greater or less than the money spent to keep the business running. With this information, a business is able to try to increase profits and make some critical decisions by answering questions such as the following:

- Are there some expenses that can be lowered?

- Can sales be increased?

- Is it worthwhile to stay in business?

What Do I Need to Do?

Open up Gurpreet’s Worksheet that you saved in your course folder during the last training room.

You now need to calculate the net income or net loss and include that in the worksheet. View Calculating Net Income or Net Loss for instructions on how to do this. Complete the net income on Gurpreet’s worksheet.

Now you need to complete the worksheet by balancing all of the debits and credits before totaling and ruling the worksheet. Recall that ruling means to put the total lines in the accounting form. View Total and Rule the Worksheet for instructions. Total and rule Gurpreet’s Worksheet. Be sure to save your work before continuing to Time to Practise.

1.13. Page 3

Project 1: The Worksheet

Time to Practise

The Worksheet Rubric includes a checklist that you can use to make sure that you haven’t forgotten anything.

The Worksheet Exemplar is available for you to refer to as an example of a completed worksheet. Exemplars are also available in the Toolkit.

The video Calculating Net Income or Net Loss on the Worksheet instructs you on what you need to do to calculate net income and net loss. Also, view Calculating Totals and Ruling the Worksheet for further instruction. These videos are available in the Toolkit whenever you need them.

It is recommended that you complete all three of these practices, as they are all a little different and will prepare you for your assignments.

Practice 1

Open Practice 1: Final Totals, and save it in your course folder. In this practice you will find the final totals from the income statement and balance sheet of five companies. Complete each one just as you would at the bottom of a worksheet. Don’t forget to indicate whether there was a net income or a net loss. The first one has been done for you.

To check your answers, go to Final Totals.

Practice 2

Open Practice 2: Quick Cleaning Company Worksheet, and save it in your course folder. Complete the worksheet.

To check your answers, go to Quick Cleaning Company Worksheet Answer.

Practice 3

Open Worksheet Template, and save it in your course folder.

Using the following final balances for Koch Moving and Storage for year ended December 31 of the current year, complete a worksheet. Give each account an appropriate account number and list them in numerical order.

Cash: |

4546.00 |

To check your answers, go to Koch Moving and Storage Worksheet Answer.

If you need more practice, you may redo these practices or see your teacher for help.

1.14. Page 4

Project 1: The Worksheet

Time to Work

Continue on to Assignment 1, which must be submitted to your teacher for assessment. There are two optional assignments for this training room. Check with your teacher to see if it is necessary for you to complete them.

Create a new folder in your FIN1030 Course Folder called “Project 1: Training Room 3.” All of the answers to the following questions must be saved in this folder for your teacher to mark.

Remember, rubrics and exemplars are available in the Toolkit for your reference.

You can also review the videos “Calculating Net Income or Net Loss” and “Calculating Totals and Ruling the Worksheet” in the Toolkit.

Assignment 1

Open Worksheet Template, and save it as “Project 1 Training Room 3 Assignment 1.”

Using the following final balances for Sabrina’s Hairdressing Services for month ended March 31 of the current year, complete a worksheet. Give each account an appropriate account number and list them in numerical order.

Cash: |

9500.00 |

Don’t forget to save the completed worksheet and submit it to your teacher for assessment.

Check with your teacher before completing the following optional assignments.

Assignment 2 (optional)

Open Assignment 2: Jon Cheng: Barrister and Solicitor, and save it in your folder as “Project 1: Training Room 3: Assignment 2.” Complete the worksheet.

Assignment 3 (optional)

Open Assignment 3: Moe’s Movie Deliveries, and save it in your folder as “Project 1: Training Room 3: Assignment 3.” Complete the worksheet.

1.15. Training Room Summary

Project 1: The Worksheet

© 2009 Jupiterimages Corporation

Training Room Summary

This ends Project 1: The Worksheet. Answer the following questions to check your understanding.

- Where do the numbers come from for the trial balance section of the worksheet, and what is the purpose of this section?

![]()

- The numbers are from the ledger, and the purpose of the trial balance section is to ensure that total debits equal total credits in the ledger.

- Why does the trial balance section of the worksheet have to be completed before the rest of the worksheet?

![]()

- The trial balance section must be completed first to ensure that the ledger amounts are correct before extending these numbers when determining if a net income or a net loss has occurred.

- What kind of accounts are extended to the income statement section of the worksheet?

![]()

- Only revenue and expenses are extended to the income statement section.

- What kind of accounts are extended to the balance sheet section of the worksheet?

![]()

- The following accounts are extended to the balance sheet section:

- assets

- liabilities

- owner’s equity (capital and drawing)

- How do you know if a company has a net income or a net loss?

![]()

- If total revenue is greater than expenses, the company has a net income.

If total expenses are greater than revenue, the company has a net loss.

- If a company has a net income, where will the amount be entered in the income statement and the balance sheet? Will it be in the debit or credit column?

![]()

- If a company has a net income, the amount will be added to the debit column of the income statement and to the credit column of the balance sheet.

- If a company has a net loss, where will this amount be entered in the income statement and the balance sheet? Will it be in the debit or credit column?

![]()

- If a company has a net loss, the amount will be entered in the debit column of the balance sheet and in the credit column of the income statement.

The information obtained when working with the worksheet forms the foundation for the financial statements prepared by an accountant. You are now ready to use this information to complete financial statements in Project 2.