Project 4

| Site: | MoodleHUB.ca 🍁 |

| Course: | Financial Management LearnEveryware Modules |

| Book: | Project 4 |

| Printed by: | Guest user |

| Date: | Wednesday, 24 December 2025, 10:31 AM |

Description

Created by IMSreader

1. Project 4

Project 4: Budgeting

© Palto/shutterstock

Project Introduction

When an individual decides to go into business, assets are gathered together, money may be borrowed from the bank, equipment and supplies are purchased, a business name is created, and the business opens or is “born.”

As the business continues to operate, the owner adds records of sales, purchases, and operating costs to the financial data. These historical records are the beginning of an accounting system.

These records help answer essential operating questions such as:

- What was the sales amount in October?

- What were the utility costs in December?

- How did we perform in 20yy as compared to 20xx?

As the business matures, the next step in the growth and improvement of the accounting system is budgeting. The owner may find it helpful to compare the actual performance in 20yy with the plans that had been drawn up for 20yy.

In this project you will step through three training rooms:

- Training Room 1: Budget Planning

- Training Room 2: Preparing a Budget

- Training Room 3: Budget Analysis

Continue on to Training Room 1, where Sakineh will show you how to use all of the records you have completed as part of the accounting cycle to plan a budget.

© wrangler/13280114/Fotolia

1.1. Training Room 1

Project 4: Budgeting

Training Room 1: Budget Planning

Suggested Time: 80 minutes

Training Room Introduction

A budget is a formal financial and operating plan for a business developed for a fiscal period. Large organizations have a master budget, which summarizes all the objectives of each department in the business.

This training room will explore how to develop a budget plan, and how these plans can be used by businesses to help them to grow and prosper.

1.2. Page 2

Project 4: Budgeting

© Wojciech Gajda/2892778/Fotolia

What Do I Need to Know?

There are two basic budget periods—short-term and long-term.

A long-term budget extends over a full year. This allows the company to compare its budget performance with its actual performance over a year.

A short-term budget helps to determine how the company is doing on a more regular basis. A short-term budget may be from month to month, quarter to quarter, or even week to week. The cost of preparing a short-term budget must be considered when determining which type of budget to use, because preparing a budget is time consuming and costly.

Why Is This Important?

The main purpose of a budget is to maximize profits by being mindful of every expenditure as well as being aware of economic, customer, and spending trends.

What Do I Need to Do?

A budget provides two basic services to a business—planning and control. With careful planning and control of the business, an owner can maximize his or her profits.

Planning

Some sources of information where a business obtains information to plan budgets include:

- Company Records: Historical records help a company make predictions about the future.

- Trend Analysis: Economists analyze trends in the marketplace and advise businesses of upward and downward trends or movements in the economy. Day-to-day economics play a large role in planning a budget. Occurrences such as strikes, natural disasters, new developments, technological improvements, and changes in international trade may affect a budget.

- Experience: The experience of managers and staff is vital. They know what is effective and what is not. Managers have unique knowledge relating to the business that is not always documented, but comes from experience and business instinct. The staff works directly with the product and the customers and often has a feel for trends in the business. Business knowledge based on experience is critical when making business decisions.

When preparing a budget, the manager of a business must look back at what has already occurred in the business and look forward to project what the future will bring. The budget helps in this planning process.

Control

The budget prevents departments within a business from overspending and provides control over the operation of a business. The budget allows a manager to know exactly how many funds are available to be spent this year—there is no need to guess and accidentally overspend as a result. The budget becomes a guideline that a business tries to follow to achieve its goals.

1.3. Page 3

Project 4: Budgeting

Time to Practise

It is necessary to be aware of how various activities may affect a business and, therefore, require changes to the budget plans.

The case studies that follow will challenge you to identify how the budget is affected in each case. Complete each case study question, and check your answer.

- A large school has a master budget based on the amount of money received from the provincial government per student. Each department in the school has drawn up its own budget for the year. What would each department need to know before creating its budget?

Each department would look at what it spent in the last year, the number of students expected this year, its needs for the upcoming year, and the total amount of money it is entitled to this year. In that way, it would be able to estimate what it requires. For example, if the physical education department had purchased team uniforms last year, it would not require them this year, unless other sports equipment is needed.

- Company A has established a budget for the upcoming year. During the second month of the budget, Company B establishes a competitive business in the same area. What effect might this new business have on Company A's budget?

Answers may vary. A sample answer is given.

Company A would have to revise its budget. Perhaps its sales would decrease. Perhaps it would want to increase its advertising budget to further promote the business. If Company A is selling a product or service, perhaps it would have to reduce its prices because of the increased competition. Company A really will not know the effects of Company B until the end of the fiscal year, but Company A needs to prepare for the changes and revise its budget accordingly.

- After establishing the budget for the year, Company A discovers that it is eligible for a government grant in the amount of $100 000. What effect would this have on the budget?

Company A would want to revise its budget to take into consideration this increased capital. The company would likely distribute this money among departments to increase department budget lines. Or perhaps Company A would use the funds to pay off an outstanding mortgage with the bank or some other liability.

1.4. Page 4

Project 4: Budgeting

Time to Work

Assignment

Create a new folder in your FIN1030 Course Folder called “Project 4: Training Room 1.” All of the answers to the following questions must be saved in this folder for your teacher to mark.

Open the Budget Planning Assignment and save it in your course folder. Complete the assignment and submit it to your teacher for assessment.

1.5. Training Room Summary

Project 4: Budgeting

© Palto/shutterstock

Training Room Summary

With clear goals and a financial plan, a business will have more likelihood of success. All records must be carefully evaluated and controls put in place to reach the business goals. Some of these goals may be long term, while others may be short term. Whatever the type of budget, it must be revisited often to ensure that the budget remains valid and effective for the business.

This first budget training room introduced you to the reasons for developing a budget and showed how this document can be used for planning and control. Training Room 2 will help you develop your skills in preparing a budget.

1.6. Training Room 2

Project 4: Budgeting

Training Room 2: Preparing a Budget

Suggested Time: 80 minutes

Training Room Introduction

© 2009 Jupiterimages Corporation

You have decided that you need a plan. You are going to study more, attend classes regularly, complete all of your assignments, and attend a math tutorial class once a week. You realize that your original 70% goal is unrealistic, so you set a new goal of 60% for the next report card. You have looked at your historical information and adjusted your future expectations while setting in motion a plan to improve.

A business looks at its operation in much the same way. To collect all of its records together, a business completes budget reports. A business will decide what type of budget is needed depending on what kind of business it is, the size of the business, and what the business goals are.

People in a business prepare budget reports to chart progress, to develop a plan, and to grow and prosper.

This training room will show you how a business prepares the two most common types of budget reports: a budgeted income statement, and a cash budget.

1.7. Page 2

Project 4: Budgeting

What Do I Need to Know?

Budgeted Income Statement

© jeff Metzger/shutterstock

A budgeted income statement is a projection of a business's anticipated revenue, expenses, and net income for a fiscal period. This statement is sometimes referred to as an operating budget. To prepare this report, a business must refer to the income statement for the current fiscal period.

budgeted income statement: a projection of a business's anticipated revenue, expenses, and net income for a fiscal period

operating budget: a projection of a business's anticipated revenue, expenses, and net income for a fiscal period

cash budget: a projection of a business' expected cash receipts and cash payments for a fiscal period

Cash Budget

The cash budget is an estimate of cash, cash receipts, and cash payments. This budget helps companies maintain an adequate cash flow. For example, companies must have cash to meet monthly expense demands, such as payroll.

Cash Receipts

A company must estimate cash receipts from all sources:

- cash sales: an estimate of projected sales for the period, generally approximately 10% of sales

- collection on accounts receivable: an estimate of amounts received from customers

The cash receipts are not equal to the sales for the month, as accounts are often paid 30 days after sales. Some accounts are uncollectible (bad debts), and there are sometimes returns on some sales. These estimates will change from business to business. For example, one business may have a high rate of collection of accounts receivable because most customers promptly pay their accounts. Another business may have a low rate of collection as many customers do not pay their overdue accounts.

Once a business has operated for a period of time, calculations can be made to predict the rate of repayment. These predictions are used in budget preparations.

Cash Payments

Estimated cash payments for the budgeted period might include these items:

- Payments on Accounts Payable: The plan to pay on account for each period (e.g., per month) is important. Late payments may affect a company's credit rating and its ability to borrow money. If a company is in the business of purchasing and selling merchandise, the accounts payable will be considerably higher than for a service business.

- Payments for Expenses: A company may have ongoing selling expenses and administrative expenses. These expenses may need to be analyzed each period.

- Payments for Capital Purchases: A company will sometimes require large outlays of cash for equipment. These large expenditures need to be budgeted.

- Miscellaneous Payments: Other payments, such as payments on notes as they become due, will reduce the amount of cash a company has available.

In this course you are studying a service business, where there is no inventory to be concerned with. For example, Gurpreet’s business is a service business where he sells the service of lawn care and snow shovelling. Gurpreet has no inventory that he is purchasing to sell. If a budget were to be prepared for a merchandise business, a purchases budget would have to be included in the budgeting process. This will be discussed in future financial management courses.

Why Is This Important?

A budgeted income statement provides the company with an estimated net income based on historical records, trend analysis, and business experience. This allows the company to set goals regarding future spending, such as an expansion of the business or a relocation to attain the future projected net income.

A cash budget provides the company with a projected estimate of cash received and cash paid. This data allows the company to be aware of how much cash should be available for such things as paying back loans, taking advantage of cash discounts, or unexpected market fluctuations.

Both of these reports direct a company towards making informed decisions regarding future spending to maximize profits and growth. Consistent reporting allows comparisons from fiscal period to fiscal period and allows for better planning.

© Marek/13044691/Fotolia

What Do I Need to Do?

Preparing the Budgeted Income Statement

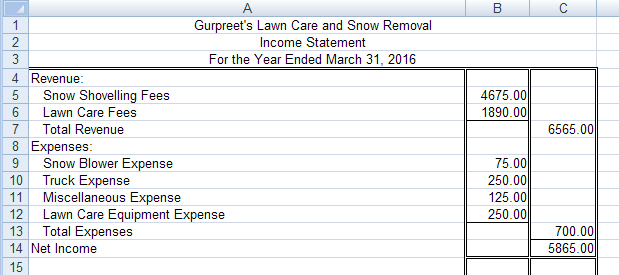

To prepare this report, which makes projections about future revenue and expenditures, you need to examine the current income statement for the company.

Have a look at Gurpreet’s income statement, which includes his present or actual financial information for the fiscal period.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Check out Gurpreet’s Plan to see what Gurpreet plans to budget for his next fiscal period.

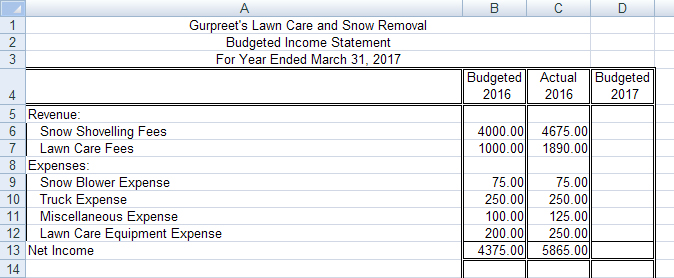

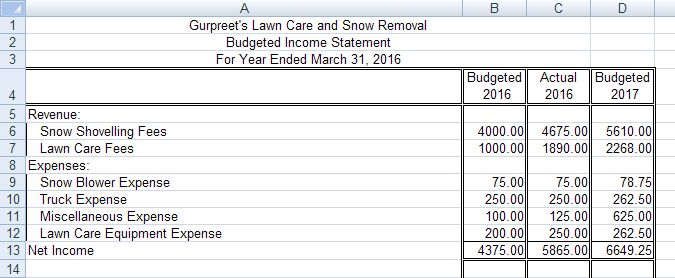

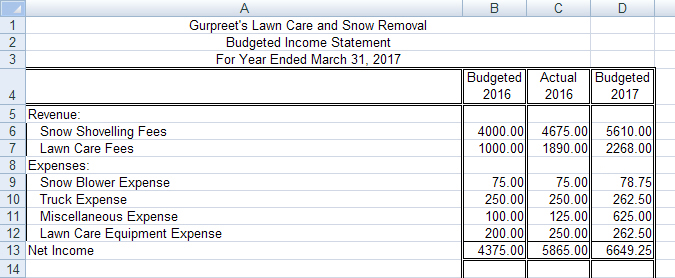

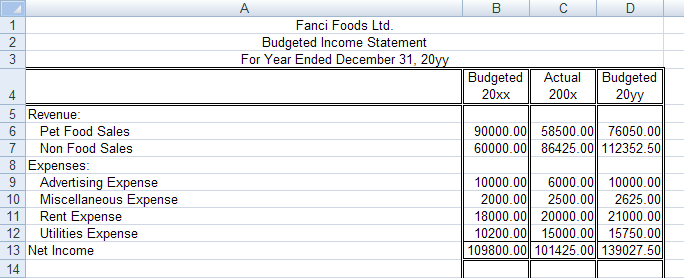

Gurpreet prepared the partial budgeted income statement which follows. Notice that the first column is what he had budgeted for and the second column is what actually happened. The actual numbers were taken directly from his current income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

The third column is for his projection, or plan, for the coming fiscal year.

With his new plan in mind, open Gurpreet’s Partial Budgeted Income Statement and complete the third column.

View Gurpreet’s Budgeted Income Statement for detailed instructions and to check your answer.

Preparing the Cash Budget

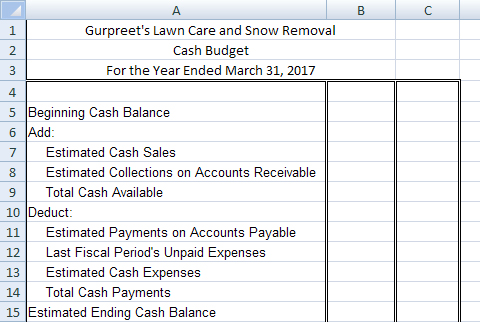

Gurpreet is busy completing his cash budget for his next fiscal period. The format of his form is shown below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

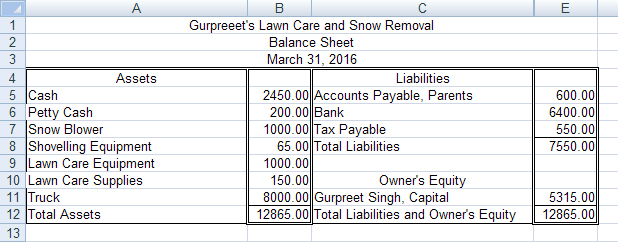

To complete this cash-budget form, Gurpreet needs to refer to his budgeted income statement and his balance sheet at the end of the last fiscal period. Both are shown.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

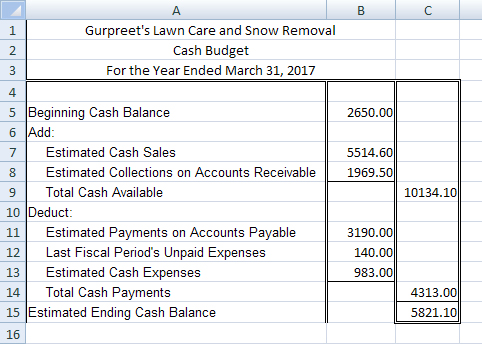

Open the Cash Budget Form, and save the form as “Gurpreet’s Cash Budget.” Complete his cash budget using the financial statements above and the information below.

There are three sections to complete on the cash budget: beginning cash, cash receipts, and cash payments. The beginning cash balance will include the petty cash from his balance sheet.

Use the following information to complete Gurpreet’s Cash Budget.

1. Cash Receipts or the Add Section of the Cash Budget

From looking at his previous revenue, Gurpreet estimates that about 70% of his customers pay cash. The other 30% are accounts receivable customers that he will collect from in the next fiscal period.

Gurpreet is estimating that he will receive cash from 30 percent of his last fiscal period in the upcoming budget period.

Hint: Estimated collections on accounts receivable = total revenue from the actual column times 0.30.

2. Cash Payments or the Subtract Section of the Cash Budget

Gurpreet has an agreement to pay his parents $50.00 per month, the bank $170.00 per month, and he will pay off tax payable in full before the end of the next fiscal period.

He still needs to pay 20% of his last budget period’s expenses. Some of these expenses were not due until the end of the first month, so Gurpreet will have to use the cash for this fiscal period. Be sure to use the actual column to calculate this.

Gurpreet anticipates that he will pay 80% of his expenses in cash for this fiscal period.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

If you did not get the same ending cash balance, you may refer to the videos below for detailed instructions. One video gives instructions on the Cash Balance and Cash Receipts calculations, and the other has information on the Cash Payments calculations.

- Cash Balance and Cash Receipts

- Cash Balance and Cash Receipts—Completing the Cash Payment or the Subtract Section

Review the following rubrics and exemplars, and apply them to the various budgets that you have just prepared before you attempt the practices or the assignments:

Budgeted Income Statement Rubric

Budgeted Income Statement Exemplar

These rubrics are available for your reference in the Toolkit at any time.

1.8. Page 3

Project 4: Budgeting

Time to Practise

Do as many of the following three practices as you need to feel confident in completing a budgeted income statement and a cash budget before continuing on to the assignment in Time to Work. This assignment will be submitted for assessment.

If, after completing all three practices, you are still not confident that you know how to complete these budgets, you may redo the practices or see your teacher for help.

Practice 1

Step 1: Open a Partial Budgeted Income Statement, and save it in your course folder.

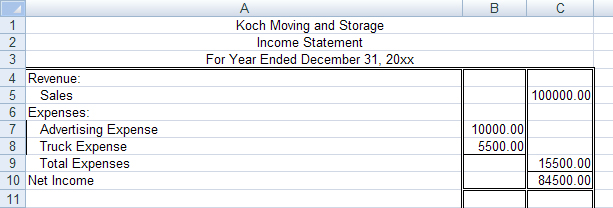

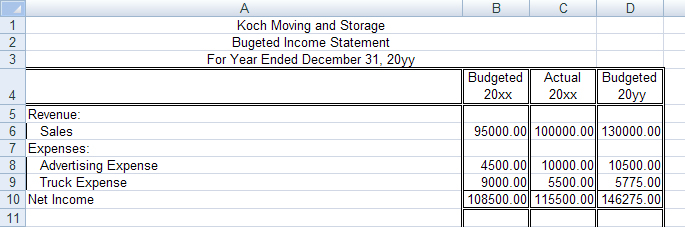

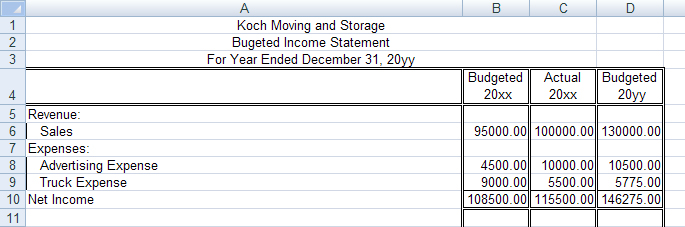

Step 2: Koch Moving and Storage projects a 30% increase in sales for the coming year and a 5% increase in expenses. The end of the fiscal period income statement for this company appears below. Complete the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

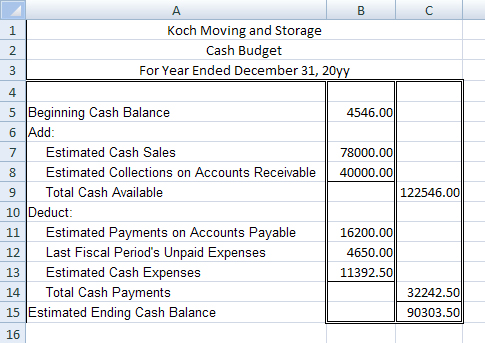

Step 3: Open Cash Budget Template, and save it in your course folder.

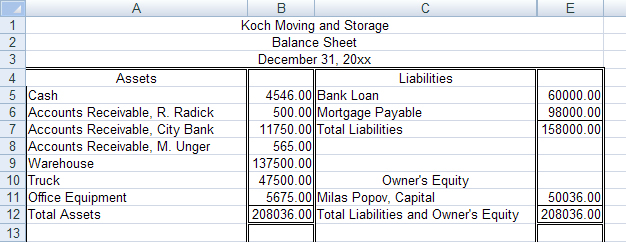

Step 4: Review the following balance sheet for this company.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

- The company estimates that about 60% of the customers pay cash. Refer to the budgeted income statement. Use the Budgeted 20yy column to calculate this number. The other 40% are accounts receivable customers from the actual fiscal period from whom cash will be collected in the next fiscal period. Use the Actual 20xx column to calculate this number.

Bank payments are $500.00 per month, and the mortgage payments are $850.00 per month.

The company will pay 30% of the last budget period’s expenses (Actual 20xx column).

The company estimates that it will pay 70% of expenses in cash for this fiscal period (Budgeted 20yy column).

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

If you need more practice, continue on to Practice 2 or Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

Practice 2

![]()

Step 1: Open a Partial Budgeted Income Statement, and save it in your course folder.

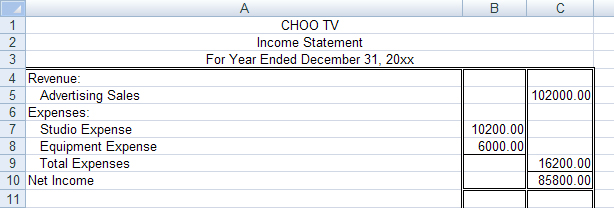

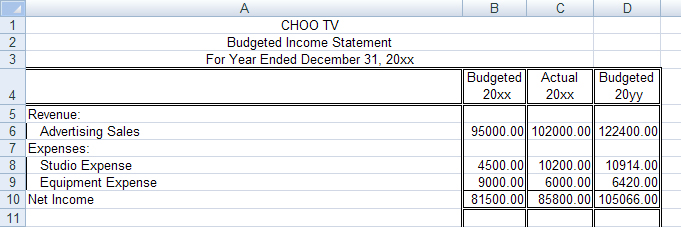

Step 2: CHOO TV projects a 20% increase in sales for the coming year and a 7% increase in expenses. The end of the fiscal period income statement for this company appears below. Complete the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

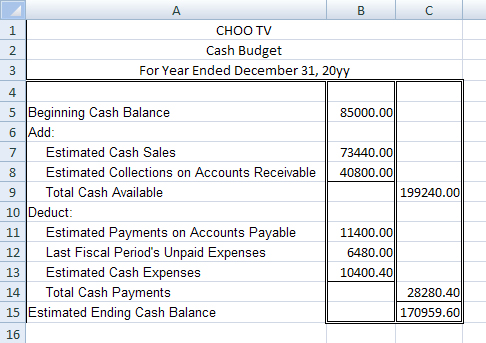

Step 3: Open the Cash Budget Template, and save it in your course folder.

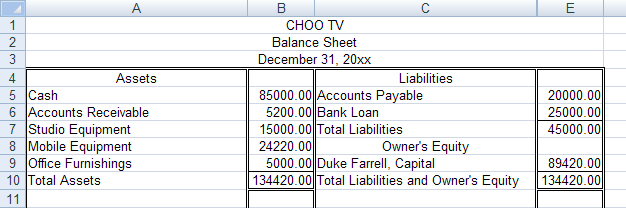

Step 4: Review the following balance sheet for this company.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

- The company estimates that about 60% of the customers pay cash. Refer to the budgeted income statement. Use the Budgeted 20yy column to calculate this number. The other 40% are accounts receivable customers from the actual fiscal period from whom cash will be collected in the next fiscal period. Use the Actual 20xx column to calculate this number.

- Accounts Payable payments are $600.00 per month, and the Bank Loan payments are $350.00 per month. Add these totals together for estimated payments on accounts payable.

The company will pay 40% of the last budget period’s expenses (Actual 20xx column).

The company anticipates that it will pay for 60% of the expenses in cash for this fiscal period (Budgeted 20yy column).

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

If you need more practice, continue on to Practice 3.

If you are ready to do the assignments for this training room, continue on to Time to Work.

Practice 3

Step 1: Open Partial Budgeted Income Statement, and save it in your course folder.

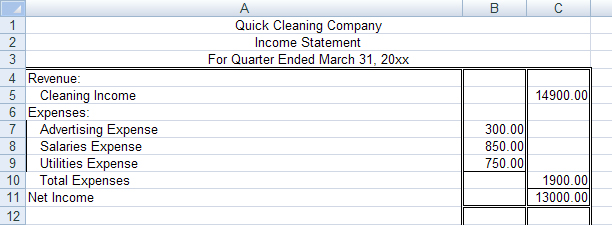

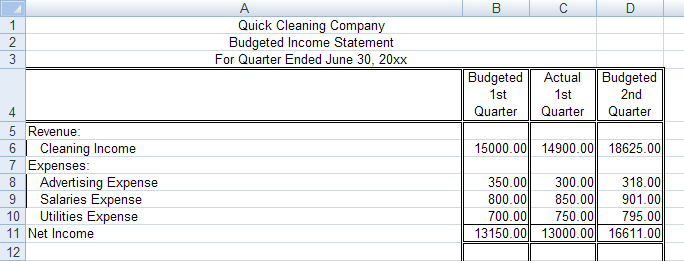

Step 2: Quick Cleaning Company projects a 25% increase in sales for the coming quarter and a 6% increase in expenses. The end of the fiscal period income statement for this company appears below.

Complete the budgeted income statement. Notice that it is for the quarter ended March 31, 20xx. The second quarter will be the next three months and will end June 30, 20xx.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

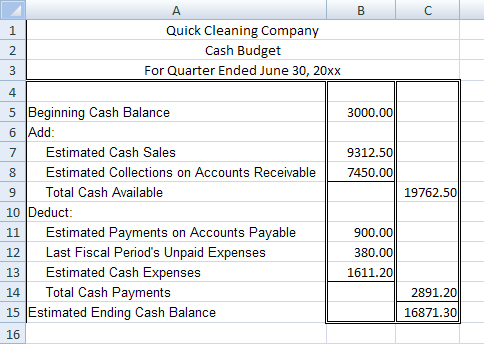

Step 3: Open Cash Budget Template, and save it in your folder. Note that the budgeted quarter, or the next three months, will end June 30, 20xx.

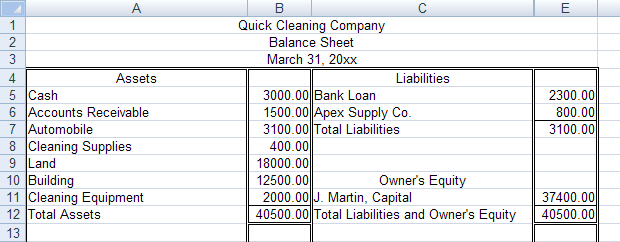

Step 4: Review the following balance sheet for this company.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 5: Complete a cash budget using the following information:

The company estimates that about 50%t of the customers pay cash. Refer to the budgeted income statement. Use the Budgeted 2nd Quarter column to calculate this number. The other 50% are accounts receivable customers from the actual fiscal period from whom cash will be collected in the next fiscal period. Use the Actual 1st Quarter column to calculate this number.

Bank Loan payments are $600.00 per quarter, and the Apex Supply Co. payments are $300.00 per quarter. Add these together for estimated payments on accounts payable.

The company will pay 20% of the last budget period’s expenses (Actual 1st Quarter column).

The company anticipate that it will pay 80% of its expenses in cash for this fiscal period (Budgeted 2nd Quarter column).

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

1.9. Page 4

Project 4: Budgeting

Time to Work

Create a new folder in your FIN1030 Course Folder called Project 4 Training Room 2. All of the answers to the following questions must be saved in this folder for your teacher to mark.

Complete Assignment 1 and submit it to your teacher for assessment. Check with your teacher to see if it is necessary to complete the optional assignment.

Assignment 1

Step 1: Open Partial Budgeted Income Statement, and save it in your course folder as “Assignment 2 Budgeted Income Statement.”

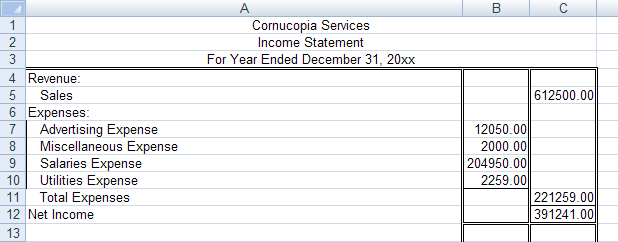

Step 2: Review the following income statement and complete the Actual column of the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 3: The owner of Cornucopia Services is projecting an increase in sales of 15% and an increase in expenses of 10% for the next fiscal period. Complete the budgeted income statement, and remember to save the statement when you have finished.

Step 4: Open Cash Budget Template, and save it in your course folder as “Assignment 1 Cash Budget.”

The end of the fiscal period balance sheet revealed that the company had $59 000.00 in the cash account.

The company estimates that about 70% of the customers pay cash. The other 30% are accounts receivable customers who will pay cash in the next fiscal period.

Bank loan payments are $1250.00 per month, and the mortgage payments are $2500.00 per month.

The company will pay 20% of the last budget period’s expenses.

The company anticipates that it will pay 80% of its expenses in cash for this fiscal period.

Step 5: Using the budgeted income statement, complete the cash receipts section and remember to save the statement when you have finished.

Assignment 2 (optional)

Check with your teacher to see if you need to complete the following optional assignment.

Step 1: Open Partial Budgeted Income Statement, and save it in your course folder as “Assignment 2 Budgeted Income Statement.”

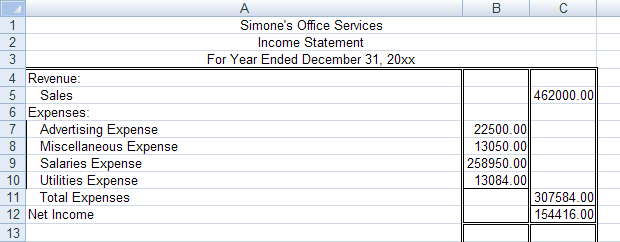

Step 2: Review the income statement below, and complete the Actual column of the budgeted income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 3: The owner of Simone’s Office Services is projecting an increase in sales of 25% and an increase in expenses of 10% for the next fiscal period. Complete the budgeted income statement, and remember to save the statement when you have finished.

Step 4: Open Cash Budget Template, and save it in your course folder as “Assignment 2 Cash Budget.”

The end of the fiscal period balance sheet revealed that the company had $45 298.00 in the cash account.

The company estimates that about 60% of the customers pay cash. The other 40% are accounts receivable customers who will pay cash in the next fiscal period.

Bank loan payments are $1050.00 per month, and the mortgage payments are $2250.00 per month.

The company will pay 20% of the last budget period’s expenses.

The company anticipates that it will pay 80% of its expenses in cash for this fiscal period.

Step 5: Using the budgeted income statement, complete the cash receipts section and remember to save the statement when you have finished.

1.10. Training Room Summary

Project 4: Budgeting

© RTimages/6986221/Fotolia

Training Room Summary

At the end of the accounting cycle, financial statements are prepared that summarize the ending account balances as well as the company’s net income or net loss at the end of a fiscal period. Companies examine these statements to prepare plans to increase net income and company growth.

Budgets are prepared reflecting past and present financial information as plans for the future. The type of budget a company prepares is dependent on the type of business and the projected plans.

In this training room you have prepared a budgeted income statement. The current or end of the fiscal period income statement is used to prepare this budget. Keeping in mind trends in sales and expenses over past fiscal periods, companies are able to anticipate a percentage increase or decrease in future fiscal periods. The budgeted income statement shows the anticipated revenue, expenses, and net income for a fiscal period. Knowing this information will assist a business in determining a plan to increase its net income.

You also prepared a cash budget in this training room. This budget consists of the anticipated cash received and paid during the next fiscal period. Companies look at the cash with which they are beginning the period and add the cash they anticipate to receive in the future, as well as the cash they expect to receive from money owed from the last fiscal period. They then project the anticipated cash that will be paid for any outstanding expenses as well as for expenses during the future fiscal period.

The projected amounts of cash received and cash paid are percentages based on the company's history. This budget helps a company maintain an adequate cash flow. Companies need to have cash flow to pay expenses such as bank loans, salaries, and utilities. It is also wise for a company to maintain a cash flow to take advantage of cash discounts and any opportunities that may arise.

© Dejan01/shutterstock

A budgeted income statement and a cash budget are the two most common types of budgets. However, various forms of these budgets as well as supporting documents can be prepared depending on the company. The more fiscal periods a company has had, the more accurate these projections will be. The more accurate these projections are, the more informed a company is when making assessments and plans to improve.

Continue on to Training Room 3 to explore how a business uses these budgets to complete a budget analysis.

1.11. Training Room 3

Project 4: Budgeting

Training Room 3: Budget Analysis

Suggested Time: 80 minutes

Training Room Introduction

© Leah-Anne Thompson/shutterstock

Once a company has established a budget, it will compare the budgeted figures, which are estimates, with the actual transactions and determine where the numbers differ. This comparison is called budget analysis. Examining where these numbers differ allows businesses to determine the value of their budgets and determine why there are differences. For example, were the budget percentages used realistic?

1.12. Page 2

Project 4: Budgeting

What Do I Need to Know?

This training room will show you how to prepare a statement in which the budgeted figures are compared to the actual figures, and then you eill analyze these numbers. This is called a comparative income statement.

The following is an example of a comparative income statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Notice that this business is comparing the amounts that were budgeted for the 20yy year with what the numbers actually were and indicating whether the projection was more or less than the actual amount.

Why Is This Important?

Knowing where the numbers differ from budgeted to actual allows a business to answer important questions, adjust its budget, and make business decisions regarding the company's future. For instance, refer to the comparative income statement for Simone’s Office Services. This company was projecting $5010.00 more than was actually made to prepare financial reports. The company has to take a close look at this to determine why. Perhaps the calculations were faulty, or perhaps there just isn’t a demand for financial report preparation in the current market. This data allows the company to make a decision about whether to continue to offer this service or not.

What Do I Need to Do?

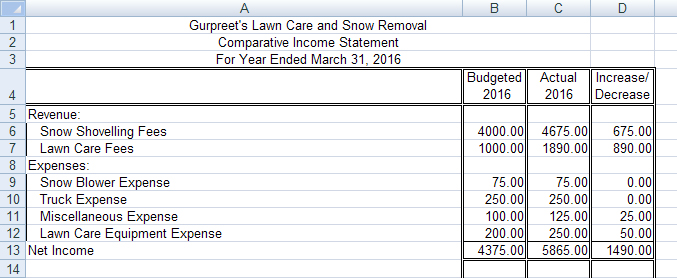

Refer to Gurpreet’s Budgeted Income Statement. This was prepared in the last training room.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Open Gurpreet’s Comparative Income Statement and save it in your course folder. Complete the Increase/Decrease column.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

After looking at this comparison, Gurpreet concluded that his budget was pretty close to his actual. He realized that he is making more revenue than he predicted, and Gurpreet is confident that his projections for 2017 are realistic.

1.13. Page 3

Project 4: Budgeting

Time to Practise

Practice 1

Step 1: Open Comparative Income Statement Template, and save it in your course folder.

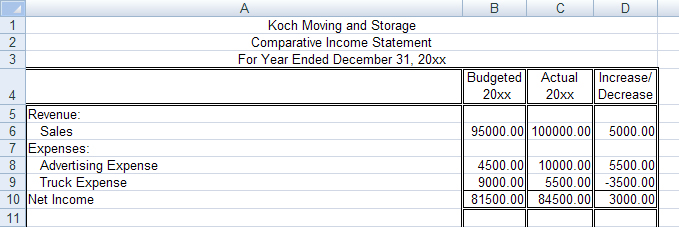

Step 2: Using the budgeted income statement below, complete a comparative income statement for Koch Moving and Storage.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 3: Refer to the comparative income statement, and analyze this statement by answering the following questions.

- This company had a substantial increase in advertising expenses. Why was the company still able to maintain a net income?

A total of $5000.00 more was generated in revenue than projected, and truck expenses were less than projected. This allowed a $3000.00 overall net income.

- Why do you think the actual amount the company had allowed for truck expenses was less than what had been budgeted for?

Koch Moving may have been anticipated a major repair that wasn’t necessary or the company’s drivers were not driving as much and didn’t need to spend as much on gas and other maintenance for the truck.

- Do you think this company should spend less on advertising? Why or why not?

Although Koch Moving had an increase in advertising expenses, the company also had an increase in revenue. This could have been a result of more advertising. The company would have to analyze where the total revenue was generated and make a decision about whether advertising costs should be reduced. The answer could be yes or no.

If more advertising means more sales, the company should not decrease advertising.

If the sales weren’t generated through the advertising, then the company should decrease advertising.

1.14. Page 4

Project 4: Budgeting

Time to Work

Create a new folder in your FIN1030 Course Folder called Project 4 Training Room 3. All of the answers to the following questions must be saved in this folder for your teacher to mark.

Assignment

Step 1: Open Comparative Income Statement Template, and save it in your course folder as Comparative Income Statement.

Step 2: Using the budgeted income statement below, complete a comparative income statement. Remember to save your completed statement.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Step 3: Open the Comparative Income Statement Analysis, and save the statement in your folder as “Comparative Income Statement Analysis.”

1.15. Training Room Summary

Project 4: Budgeting

© Norebbo/shutterstock

Training Room Summary

This is the last training room for Project 4: Budgeting. Businesses use their financial statements, which are summaries of their financial information, to develop a plan, prepare a budget, and analyze their budget. Budget analysis is a complex and detailed activity, and financial analysis is studied in detail in future financial management courses. It is hoped that this brief introduction demonstrates the value of budgeting and budget analysis.

You are now ready to work on Project 5, which is the major assignment for this course. As part of this assignment, you will complete an accounting cycle and prepare a budget analysis.