Module 8

1. Module 8

1.35. Page 2

Module 8: Daily Living

Explore

Calculating Canada Pension Plan (CPP) Contributions

First you will investigate how Canada Pension Plan (CPP) contributions are calculated.

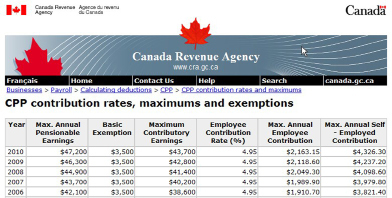

If you are between 18 and 70, work in a pensionable occupation, and do not yet receive a CPP or Québec pension, you must contribute to the Canada Pension Plan. The Canada Revenue Agency provides a table of contribution rates, maximums, and exemptions. The Canada Revenue Agency is the tax-collection arm of the Canadian government.

Go to the Canada Revenue Agency’s website now, and look at this table. To find the website, you will need to do an Internet search using the following terms: “CRA-ARC CPP Table of Contribution Rates,” and you may need to search the CRA website for the actual table. Remember that you can ask your teacher for help finding the table.

Source: Canada Revenue Agency. Reproduced with permission of the Minister of Public Works and Government Services Canada, 2010.

The following rules were applied in 2010 to determine how much CPP contributions a person must make:

-

You don’t have to pay any CPP contributions on the first $3500.00 you make (subtract $3500.00 from your gross annual income).

-

You pay 4.95% in CPP contributions on the leftover income, and your employer pays 4.95%. If you are

self-employed you pay 9.90%.

-

Once you have made $47 200.00, you have hit the maximum—no more CPP contributions will be deducted from the rest of your earnings in that year.

A table like this can be used to work through these calculations.

|

A |

gross annual income ($47 200 if income is over $47 200) |

$36 000.00 |

|

B |

exempt earnings |

–$3500.00 |

|

C |

contributory earnings (amount A – amount B) |

$32 500.00 |

|

D |

contribution rate (%) |

4.95% (9.90% if self-employed) |

|

E |

contribution rate (decimal) |

0.0495 (0.099 if self-employed) |

|

F |

annual CPP contributions (amount C × amount E) |

$1608.75 |

|

G |

monthly CPP contributions (amount F ÷ 12) |

$134.06 |

Work through the following example to see how each step in the CPP calculation is completed.

Example 1

Benny is a city employee. Benny’s gross annual income in 2010 was $36 000.00. What were Benny’s annual CPP contributions? What were Benny’s monthly contributions?

|

A |

gross annual income ($47 200 if income is over $47 200) |

$ |

|

B |

exempt earnings |

–$3500.00 |

|

C |

contributory earnings (amount A – amount B) |

$ |

|

D |

contribution rate (%) |

4.95% (9.90% if self-employed) |

|

E |

contribution rate (decimal) |

0.0495 |

|

F |

annual CPP contributions (amount C × amount E) |

$ |

|

G |

monthly CPP contributions (amount F ÷ 12) |

$ |

View the animated “Example 1 Solution: CPP Calculations.”

Example 2

If Benny were self-employed and earned $36 000.00, what would his contributions have been?

Solution

If Benny were self-employed, his annual contribution rate would be 9.90%, which is double an employee’s rate.

Note: $3217.50 = 2 × $1608.75

Example 3

June is an employee. In 2010, she earned $62 125.00. What were June’s annual CPP contributions? What were June’s monthly contributions?

Solution

|

A |

gross annual income ($47 200 if income is over $47 200) |

$47 200.00 |

|

B |

exempt earnings |

–$3500.00 |

|

C |

contributory earnings (amount A – amount B) |

$43 700.00 |

|

D |

contribution rate (%) |

4.95% (9.90% if self-employed) |

|

E |

contribution rate (decimal) |

0.0495 (0.099 if self-employed) |

|

F |

annual CPP contributions (amount C × amount E) |

$2163.15 |

|

G |

monthly CPP contributions (amount F ÷ 12) |

$180.26 |

Row A: $62 125.00 is greater than the maximum of $47 200.00. Use $47 200.00.

Row B: The first $3500.00 of earnings are exempt.

Row C: ![]()

Row D: As an employee, her contribution rate was 4.95%.

Row F:

June’s employer would contribute another $2163.15 on June’s behalf.

Row G:

Self-Check

Self-Check

The following questions use CPP rates from 2010.

SC 1. Jerome was an employee in 2010. In 2010, he earned $27 140.00. What were his annual CPP contributions? What were his monthly contributions?

SC 2. If Jerome were self-employed, what would his annual contributions be?

SC 3. Christian is paid biweekly by her employer. Her biweekly gross pay is $1230.75. What are her biweekly CPP contributions?