Module 8

1. Module 8

1.36. Page 3

Module 8: Daily Living

Calculating Employment Insurance Premiums

Next you will investigate how Employment Insurance (EI) premiums are calculated.

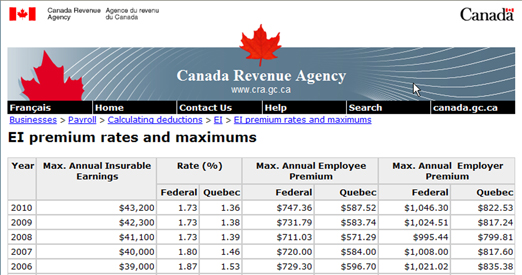

Like CCP contributions, there are maximum annual earnings on which premiums are calculated. The Canada Revenue Agency provides tables to show how premiums are calculated. These tables can be found on the CRA website. Find the tables now by searching the Internet using the following terms: “CRA-ARC EI Premium Rates and Maximums.” Again, you may have to search the CRA website to locate the actual tables.

If you look at the Canada Revenue Agency’s tables for 2010, the maximum insurable earnings were $43 200.00. But, unlike CPP contributions, there is no minimum. The contribution rate is 1.73% for employees (1.36% in Québec). Employers pay 1.4 times the employee’s contribution.

The self-employed may choose to contribute. Their contribution rate is the same as the rate for employees. However, self-employed people cannot receive unemployment benefits; they may receive maternity benefits. Unemployment benefits are voluntary for the self-employed but mandatory for employees.

Source: Canada Revenue Agency. Reproduced with permission of the Minister of Public Works and

Government Services Canada, 2010.

Example 4

Kwok and Félix both work for the same employer in British Columbia. Kwok’s annual salary in 2010 was $37 000.00, and Félix’s salary was $45 000.00. What were their EI premiums in 2010?

Solution

Kwok’s annual salary of $37 000.00 was less than the maximum insurable earnings ($43 200.00).

So,

Félix’s annual salary of $45 000.00 was more than the maximum insurable earnings of $43 200.00. In this case, use the maximum of $43 200.00 in place of Félix’s annual salary. So,

Self-Check

Self-Check

The following questions use EI rates from 2010.

SC 4. Eduarta works in Montréal. In 2010, her annual salary was $29 250.00. What were her monthly EI premiums?

SC 5. If Eduarta had worked in Saskatoon for the same salary, what would her monthly premiums have been?

SC 6. Marvin lives in the Yukon. He is paid semimonthly by his employer. His semimonthly gross pay is $1330.00. What are his semimonthly EI premiums?

Calculating Income Tax Deductions

Income tax deductions from your gross earnings are not as simple to calculate as CPP contributions or EI premiums. There is not a single rate for all earners. Tax rates increase as your income increases. Your tax also varies depending on your personal circumstance—whether you are married or single, have children or not, and so on!

When you are first hired, your employer will ask you to fill out a form. The form will help the employer decide what category you fall into. This lets your employer know how much income tax to deduct from your pay on behalf of the Canada Revenue Agency.

This form is called the TD11. TD stands for Tax Deduction. Take a brief look at a TD1 to see how the form is set up.

1 Source: Canada Revenue Agency. Reproduced with permission of the Minister of Public Works and Government Services Canada, 2010.

The TD1 form is not the only form you will complete as a new employee. You will also complete a form for the province or territory in which you are working. Once you have completed these forms, you will be assigned a claim code from 0 to 10 for federal tax as well as a claim code for provincial tax.

The claim code for a single person with no other deductions is usually Claim Code 1. A married person who supports people in addition to oneself will have a higher claim code and will not have as much deducted in tax.

Your employer has several methods to determine the tax withheld. These methods include tax tables, computerized calculations, and online tax calculators.

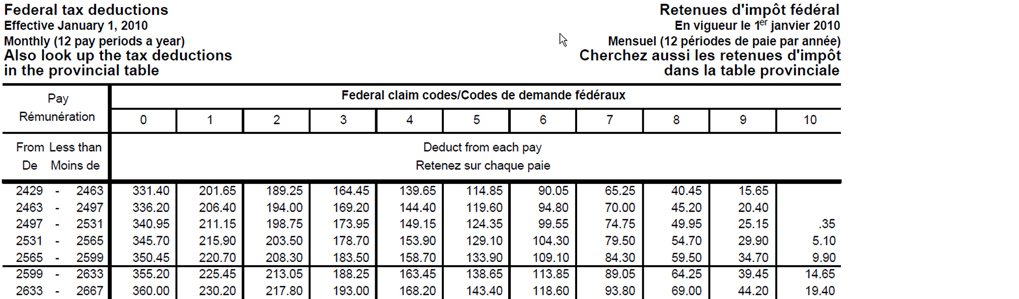

The following is a portion of the 2010 federal tax table for employees paid monthly.

Source: Canada Revenue Agency. Reproduced with permission of the Minister of

Public Works and Government Services Canada, 2010.

Look at the first row in this portion of the table. For employees with Claim Code 1 who make between $2429.00 and $2463.00 monthly, $201.65 is deducted in federal tax. Move across the applicable row in the table, and you will see that the higher the claim code, the lower the tax. This is also true for provincial taxes.

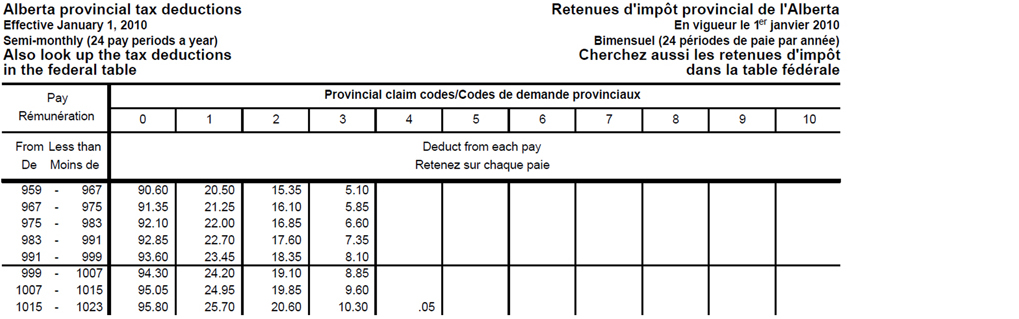

The portion of the Alberta tables shown applies to employees paid semimonthly. Again, if you go across any of the rows, you will see that the higher the claim code, the less tax that is deducted.

Source: Canada Revenue Agency. Reproduced with permission of the Minister of

Public Works and Government Services Canada, 2010.

Study this example.

Example 5

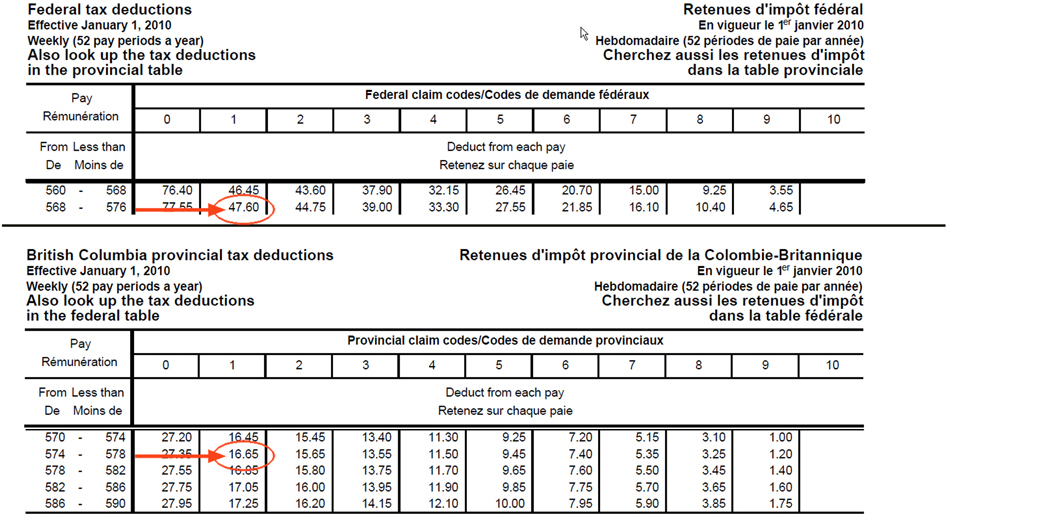

Amina works in British Columbia. Her employer has determined that her category for both federal and provincial taxes is Claim Code 1. She is paid $574.27 weekly. The 2010 tax tables shown in the solution will be used to answer the following questions. What is the federal tax deducted? What is the provincial tax deducted? What is the total tax deducted?

Solution

Source: Canada Revenue Agency. Reproduced with permission of the Minister of

Public Works and Government Services Canada, 2010.

From the tax tables, for the year 2010, the following rates apply: federal tax = $47.60 and provincial tax = $16.65. The total income tax is $64.25.

In this lesson you’ve seen CPP contributions, EI premiums, and income tax deductions calculated using tables. However, most calculations are performed by computer software, such as the Payroll Deductions Online Calculator from the Canada Revenue Agency.

For the next activity, you will need access to the Internet. You will explore net income using the Payroll Deductions Online Calculator. This calculator determines the amount of CPP contributions, EI premiums, and federal and provincial/territorial income taxes to be deducted from gross income.