Section 1

1. Section 1

1.37. Discover

Section 1: Personal Budgets

Discover

When you are creating a personal budget, be careful not to spend too much on any single category. If you spend too much money on one slice of pie, you will have to cut back on the other slices.

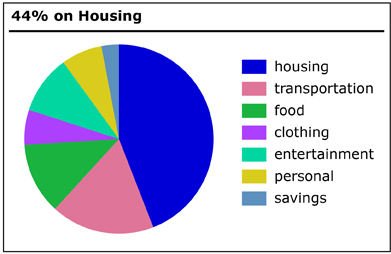

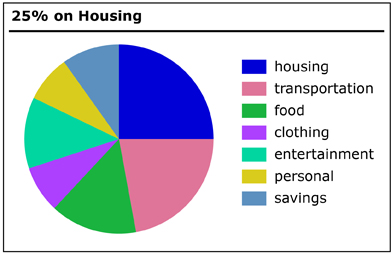

Banks and mortgage companies in Canada will not loan you money to purchase a home if your payments turn out to be more than 44% of your income. Spending 44% on housing is a serious strain on most families.

Compare the pie graphs for 44% of income spent on housing and 25% of income spent on housing.

You can see that less money going to housing means more money for other items in categories such as savings, personal, and entertainment.

Try This 1

Perform a search on the Internet to see what experts on budgeting and spending recommend as percentages of disposable income. Use search words such as “Personal Budget Guidelines” or “Personal Spending Guidelines.”

Complete the Budget Table using information you find from at least three websites. Canadian banks often include spending guidelines as percentages of income on their web pages. Add more categories if necessary.

![]() Save your table to your course folder.

Save your table to your course folder.

Share

Discuss the following questions with a classmate or with a group.

- What is similar among these guidelines?

- What is different among these guidelines?

- Why might different experts suggest different guidelines?

- Would these guidelines apply to all income levels? Why or why not?

![]() If required, save a copy of your discussion in your course folder.

If required, save a copy of your discussion in your course folder.