Section 1

1. Section 1

1.38. Explore

Section 1: Personal Budgets

Explore

In Discover, you shared your answers with other mathematics students. It is possible that, depending on their personal circumstances, different students argued for different percentages of net income to be allocated to the various budget categories. A person clearing $2000 a month is not likely able to spend $1000 a month or 50% on rent. However, a person clearing $6000 may easily handle 50% on housing as this person would have $3000 of disposable income remaining.

In Explore you will examine several budgets. You will recommend changes based on spending guidelines and changing circumstances.

Most experts agree on the following guidelines. You will use this information to complete Try This 2.

SPENDING GUIDELINES

| Budget Category | Percentage of Net Income (Maximums) |

Housing (This includes rent or mortgage payments, taxes, utilities, repairs, insurance, and renovations.) |

25% to 35% |

Transportation (This includes car payments, public transit, vehicle fuel, repairs, parking, tolls, and insurance.) |

10% to 20% |

Savings |

10% |

All other spending categories include charitable donations, credit card payments, food, clothing, recreation/entertainment, cable TV and phone, medical, and personal. |

35% to 45% |

Brand X Pictures/Thinkstock

Caution: The percentages must total 100% or all disposable income.

Try This 2

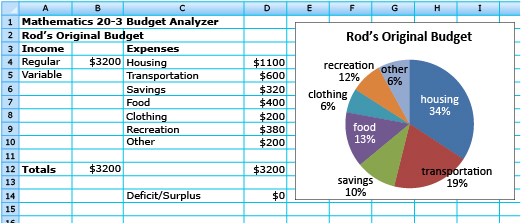

Rod is a carpenter. He has been working on a long-term project in northern Manitoba where he clears $3200 a month. He lives in an apartment and commutes to work in his new truck that he is making payments on. Rod's budget based on that income is shown. However, the project has been completed, and Rod has accepted a new job in The Pas. His net pay will be $2500. Rod must revise his budget to live within his means.

Your task is to balance Rod’s budget. You must follow the expense guidelines provided in the Spending Guidelines table. Modify Rod’s budget by

- entering new dollar values for his change in income

- making his expenses balance with his new income

Use Rod’s Budget to balance his budget.

Answer the following questions based on your modifications.

- By what amount must Rod reduce his expenses?

If you need help answering this question, review the following hints.

- In Rod’s new modified budget, the expenses need to be reduced. Suggest changes Rod could make to live within his new budget.

![]() Save your answers to your course folder.

Save your answers to your course folder.