Section 1

1. Section 1

1.16. Explore

Section 1: Simple and Compound Interest

Explore

In Discover you may have noticed the following differences between simple interest and compound interest.

| Simple Interest | Compound Interest |

|

|

|

|

|

|

Did You Know?

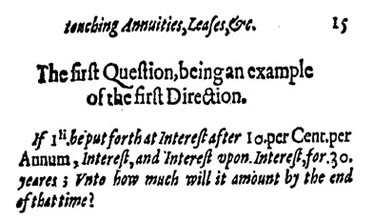

Richard Witt’s Arithmeticall Questions, published in 1613, was one of the first books in the English language that contained detailed tables and formulas for calculating both simple and compound interest. You will be using Witt’s formula for compound interest later in this lesson. To apply this formula, you will need your exponent skills! The following illustration is a question on compound interest from Witt’s book.

In Try This 1, both investments are calculated annually—for simple interest this is always the case, so time must be converted to years. However, compound interest may be paid out more than once a year, even though the interest is quoted as annual interest. These shorter periods of time where interest is paid out are called compounding periods.

Due to compounding periods, the compound interest formula is a bit more complicated than simple interest.

![]()

- A is the final amount of the investment.

- P is the principal.

- r is the annual interest rate.

- n is the number of compounding periods in a year.

- t is the term in years.

iStockphoto/Thinkstock

Example

Ravia lives in Fort Vermilion, Alberta. She has just invested $1000 in a five-year, compound interest bond. The annual interest rate is 6%, compounded annually. Use the compound interest formula to see how much her investment will be worth in five years.

Solution

| Identify the variables from the question. | P = $5000 r = 6% = 0.06 t = 5 n = 1 |

| Substitute the known variables into the compound interest formula to find the final amount of the investment (A). |  |