Project 1

1. Project 1

1.7. Page 4

Training Room 2: Analyzing Transactions

Time to Work

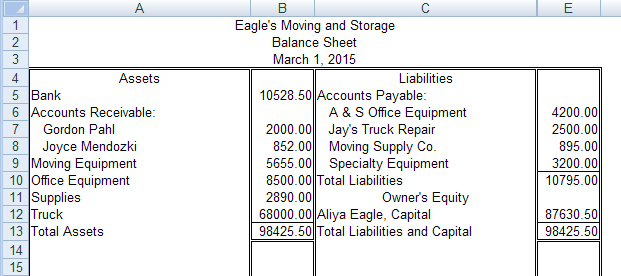

Use the following balance sheet:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

- Open T-Accounts Templates, and save it in your Course Folder as pr1-tr2-1a, or as instructed by your teacher.

Place an account title on the top of each T-account. You do not have to include accounts payable as part of the title, just the company names.

- Indicate which is the balance side.

- Place the beginning balance on the appropriate side of each T-account.

- Using the T-accounts you created, analyze the following transactions. Place the transaction number beside each amount.

- Paid for a new computer, $5000.00

- Received from Gordon Pahl, $1500.00

- Paid to A & S Office Equipment, $500.00

- Received from Joyce Mendozki, $852.00

- Owner invested money in the business, $2500.00

- Paid amount owed to Moving Supply Co., $895.00

- Received a cheque from Gordon Pahl for $300.00

- Sold old office equipment, $450.00

- Paid Specialty Equipment Co., $1000.00

- Charged a piece of moving equipment to Moving Supply Co., $400.00

- Complete a new balance sheet with the new balances, using today’s date.

Open Balance Sheet Template, and save it in your Course Folder as pr1-tr2-1b, or as instructed by your teacher.

© Stocksnapper/11643948/Fotolia

Training Room 2 Summary

This is a very important training room, because it provides you with the basics of analyzing transactions. You will build on this concept in the rest of the course, as well as completing any transactions in other courses, or in the workplace.

This room focused on the permanent accounts of assets, liabilities, and capital. The next training room shows you how to use T-accounts to analyze the temporary capital accounts of drawing, revenue, and expenses as a business continues its day-to-day activities.