Project 1

1. Project 1

1.13. Page 2

Training Room 4: Journalizing Transactions

What I Need to Know

Daily Transactions

As you will recall from FIN1015, a general journal form is as follows:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

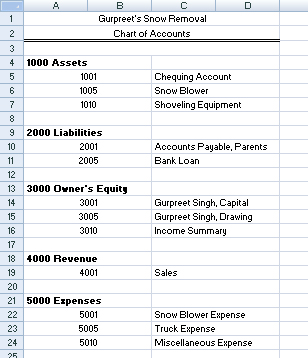

The account titles used when entering in the journal must be the same as in the chart of accounts. The following was used for Gurpreet’s Snow Removal:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

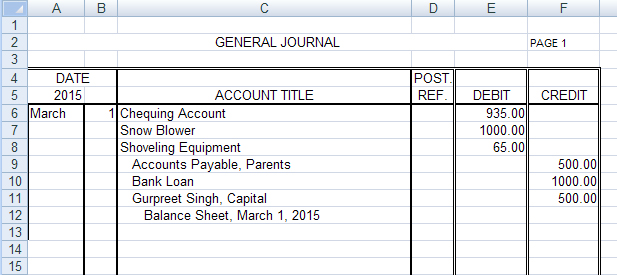

You always journalize from a source document. You have already prepared the opening entry for this business from the beginning balance sheet—the source document.

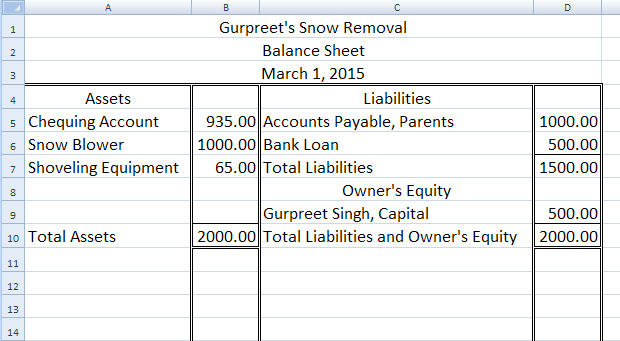

The beginning balance sheet for Gurpreet’s Snow Removal is below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

This source document (beginning balance sheet) was used to enter the opening entry below.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

© Klara Viskova/shutterstock

Why Is This Important?

The journal is a daily record of any transactions conducted by a business.

Entering the source documents correctly in the journal is critical to keeping accurate financial records, which is essential for a successful business. That is why you have spent the last two training sessions learning how to analyze transactions to be entered into this important book.

What Do I Need to Do?

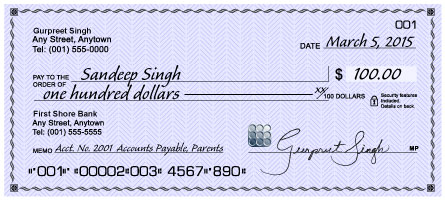

Let’s have a look at how Gurpreet would enter the transaction where he repaid his parents $100.00 of the amount that he owed them. Gurpreet wrote a cheque from his chequing account. The cheque is his source document.

© Jamey Ekins/shutterstock

In the journal, T-accounts help to determine which account gets the debit and which account gets the credit.

© 2009 Jupiterimages Corporation

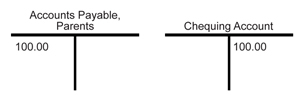

Recall that the T-accounts for this transaction were as follows:

Note that this transaction is entered right after the opening entry that you completed in FIN1015.

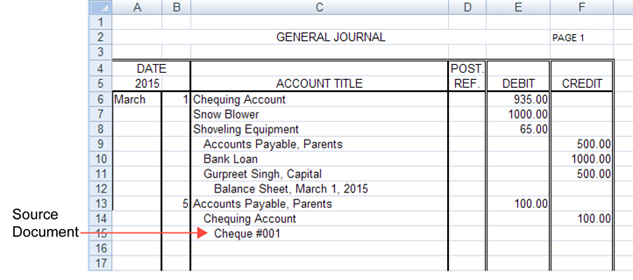

Gurpreet would enter this in his general journal as follows:

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

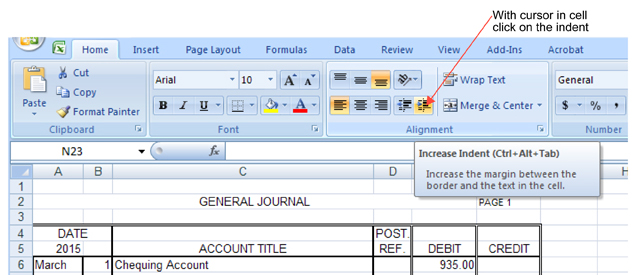

Only the day is entered in the date section, since the year and the month remain the same as the previous entry. Note that in accounting records, debit entries are always entered before credit entries. The credit is indented and the source document information is also indented, which makes it easy to read the information.

Go to “Click to view” to see instructions on how to indent in Microsoft Excel®.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.