Project 1

1. Project 1

1.17. Page 2

Training Room 5: Petty Cash

© 2009 Jupiterimages Corporation

What I Need to Know

Gurpreet and Ravinder are having a conversation about petty cash. View the clip “Petty Cash” and see what Gurpreet and Ravinder are discussing.

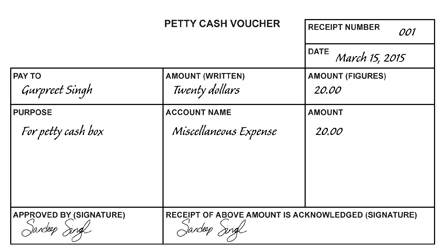

petty-cash voucher: a form showing the amount paid and other details

A voucher is placed in the petty-cash box each time cash is taken out of the box.

Ravinder referred to two GAAP principles. Do you know what they are?

Check your answer after you have thought about it.

1. The Business Entity Concept

The Business Entity Concept provides that the accounting for a business or organization be kept separate from the personal affairs of its owner, or from any other business or organization.

5. The Principle of Objectivity

The Principle of Objectivity states that accounting will be recorded on the basis of objective evidence. Objective evidence means that different people looking at the evidence will arrive at the same values for the transaction.

© 2009 Jupiterimages Corporation

Why Is This Important?

Everybody likes to do things the easiest way possible. Gurpreet was prepared to take out money whenever he needed it, without worrying about any paperwork. However, as Ravinder pointed out, this could make things more difficult for him later, if his records were questioned, and he could not remember exactly where this money went. Therefore, he has decided to avoid any future problems and set up his petty-cash fund correctly.

What Do I Need to Do?

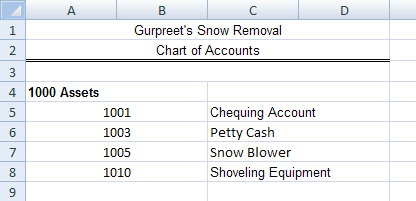

The first thing that Gurpreet did was to add the petty-cash account to his chart of accounts and open a new account in his ledger.

What kind of an account would petty cash be? All accounts have a number. What number do you think he chose for his petty-cash account?

Petty cash is money—something of value and, therefore, an asset. Any number starting with a 1 would be appropriate.

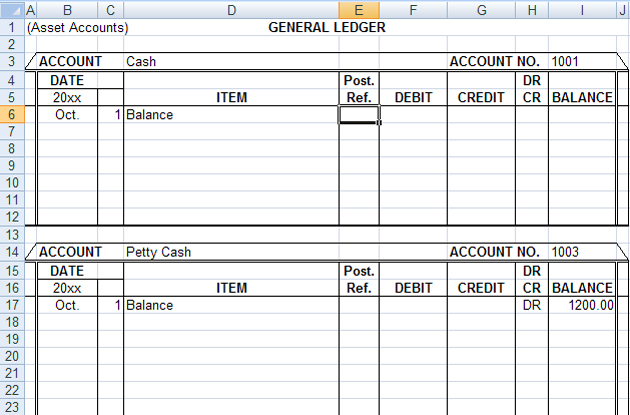

Open Gurpreet’s Ledger, update his chart of accounts, and open the Petty-Cash account.

View “Petty Cash Account Demonstration” for step-by-step instructions on how to proceed, including how to insert rows and/or copy forms into Excel®.

Does your ledger look like the following? Be sure to save this in your Course Folder. Call it Gurpreet’s Ledger to update any other ledgers that you have for him.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Establishing the Petty-Cash Fund

establishing the petty-cash fund: withdrawing cash and placing it into a petty-cash box or drawer

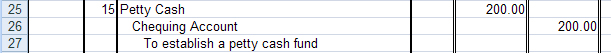

This must also be entered into the journal.

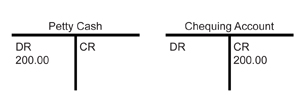

To establish a petty-cash fund, Gurpreet withdrew $200.00 from his chequing account. He felt that this would be enough money for the small purchases he may have to make during the month. What would the T-accounts for this transaction look like? Remember that a T-Accounts Template is available to you.

Open Gurpreet’s journal from your FIN1020 Course Folder (saved in Training Room 4), and journalize this transaction on page 1 of the journal. Be sure to save your work and then check your answer.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

© 2009 Jupiterimages Corporation

Once the money is put in the petty-cash box, the total will remain the same; that is, the cash, plus the vouchers, will add up to the original amount, so it never has to be established again. This is the only debit that is ever made to Petty Cash.

Gurpreet withdrew $20.00 from petty cash to purchase a lockable box to store the cash.

He then completed the following petty-cash voucher to be placed in the box:

The cash box that Gurpreet purchased was $18.50. He placed the $1.50 change in the box, and stapled his receipt for the $18.50 to the voucher. He made a note on this voucher that the price was only for $18.50. The receipt stapled to the back, plus the extra $1.50 in the cash box, will verify this voucher. It is important to be very clear exactly where the money was spent.

Gurpreet wanted to go out after work with some friends, but he didn’t have time to go to the bank, so he took $50.00 from the petty-cash box.

Open the Petty Cash Voucher, and fill in the Purpose and Account Name lines.

Replenishing the Petty-Cash Fund

At the end of the month, Gurpreet goes to the petty-cash box to journalize all of the petty-cash vouchers and to replenish the amount of cash. Replenishing the petty-cash fund means removing the vouchers from the petty-cash box, and bringing the amount of cash in the box back up to the established amount—in this case, back up to $200.00.

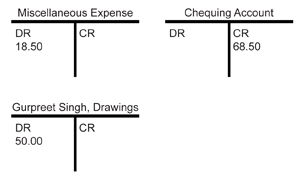

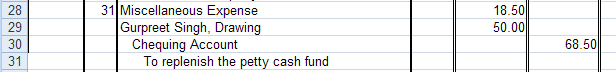

The T-accounts for these two vouchers would look like the following:

Notice that there are three T-accounts needed here, but the total debits still equal the total credits. The number of T-accounts will depend on the number of vouchers in the cash box. When Gurpreet puts the $68.50 back in the box, it will be replenished back to $200.00.

Gurpreet replenished his petty cash on March 31. Complete the journal entry for this in Gurpreet’s Journal Page 2, and compare your answer when you are finished. Be sure to save this, as you will need it in Training Room 6.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

On rare occasions, the cash in the petty-cash box, plus the vouchers, may not equal the amount of petty cash initially established. What might cause this discrepancy?

- The change from a purchase may not have gone back in the petty-cash box.

- Change may have been put in the petty-cash box, but the receipt wasn’t stapled to the voucher.

- Giving incorrect change (either too much or too little).

- Removing money from the fund without leaving a voucher.

- Theft from the fund.

- Not balancing the fund properly at the end of the previous month.

- Using the petty-cash box as a miscellaneous storage box (throwing loose change in the box).

© 2009 Jupiterimages Corporation

Every attempt should be made to have accurate records and ethical use of the petty-cash fund. The person responsible for the petty-cash box must be accountable to all money going out of it. A business would question the person responsible for the petty cash, if it was continually short of funds. This could result in a loss of job or even criminal action.

However, sometimes honest mistakes happen. If there is more cash or less cash in the petty-cash box at the end of the month, the amount must be recorded in a Cash Short and Over account, in the income or revenue section of the ledger. The nature of this account is determined by its balance at the end of the accounting period. If the account ends up with a debit balance, it appears in the income statement as an expense. If the account ends up with a credit balance, it appears on the income statement as revenue. Most often, it is an expense.

Do you know which GAAP principle is at work here?

9. The Full Disclosure Principle

The full Disclosure Principle states that any and all information that affects the full understanding of a company’s financial statements, must be included with the financial statements.

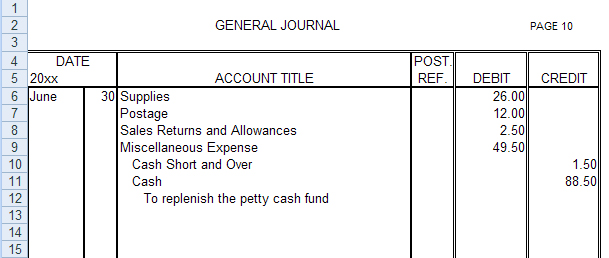

Example of a Shortage in Petty Cash

Suppose that a company has established $100.00 for its petty-cash fund, and at the end of the month, the vouchers and cash remaining in the box are not equal.

Supplies |

26.00 |

Postage |

12.00 |

Sales Returns and Allowances |

2.50 |

Miscellaneous Expense |

49.50 |

Total Vouchers |

90.00 |

|

|

Cash in Petty-Cash Box |

8.50 |

|

|

Total Cash and Vouchers |

98.50 |

In this case, there is a cash shortage. The company wants to replenish the petty cash. This company uses the title Cash for its chequing account. Do you know what the journal entry would be for this?

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Example of an Overage in Petty Cash

If at the end of the month, the total cash and vouchers added up to $101.50, there would be a cash overage of $1.50.

Do you know what the journal entry would be for this?

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

There is now $100.00 replenished in the petty-cash box.