Project 2

1. Project 2

1.1. Assignment 1

Project 2: Final Project

Assignment 1: Working as an Entry-Level Accounting Clerk (Suggested Weighting 35%)

© Petrafler/shutterstock

Ted Winslow, a physical education teacher at a local high school, felt his efforts to promote high standards of physical fitness were somewhat unappreciated by his students. After a long summer of contemplation, he decided to start a business of his own. With some personal savings, a bank loan, and a daring entrepreneurial spirit, the Witness Fitness Centre was born.

One nagging problem Ted faced was the bookkeeping. He was too busy to do it, and he was concerned that hiring an accountant would be too expensive. A solution was close at hand, however—you! Since you are a beginning accounting student and a friend of the Winslow family, you offered to perform the bookkeeping functions of the business in exchange for a membership with the Witness Fitness Centre! Ted, who was not totally confident with a student bookkeeper, reluctantly agreed.

What I Need to Know

The following requirements are clear:

- Ted will give you the source document(s) for each transaction.

- You will select the proper accounts to debit and credit.

- You will make an entry into the general journal.

After the transactions for September are completed

- You will post the data.

- You will prepare a trial balance.

Notice that Witness Fitness Centre uses a three-digit accounting system. You may want to print the chart of accounts for easy referral while journalizing.

CHART OF ACCOUNTS

Assets |

Owner’s Equity |

101 Bank |

301 Ted Winslow, Capital |

105 A/R Lynn Ayles |

302 Ted Winslow, Drawings |

106 A/R Betty Shantz |

Revenue |

107 A/R Laura Coburn |

401 Membership Fees |

108 A/R Judy Jurnus |

402 Drop-in Fees |

125 Supplies |

Expenses |

150 Equipment |

501 Salaries Expense |

155 Furniture |

505 Rent Expense |

Liabilities |

510 Advertising Expense |

201 Bank Loan Payable |

515 Renovations Expense |

205 A/P Jim’s Gymnastic Equipment |

520 Loan Interest Expense |

206 A/P Handyperson Hardware Ltd. |

525 Miscellaneous Expense |

207 A/P Fun ’N’ Fair Furniture Ltd. |

530 Telephone Expense |

208 A/P Outstanding Office Supplies |

535 Utilities Expense |

209 A/P Signs and Wonders Ltd. |

540 Choreography Expense |

210 A/P CWHY Radio Station |

545 Bank Charges |

211 A/P Presto Printing |

550 Bookkeeping Expense |

212 A/P Tell Telephone Company |

|

240 GST Charged on Sales |

|

245 GST Paid on Purchases |

|

Note: Ted chooses to use only the above account titles. For some accounts in the ledger, rows will need to be inserted for all the transactions to be recorded.

What Do I Need to Do?

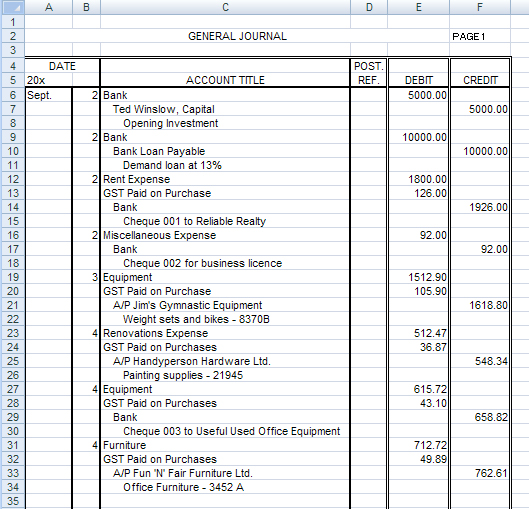

When recording the source documents in the journal, Ted would like you to put the reason for the transaction and, if possible, the cheque number, invoice number, purchase order number, and so on. The first eight entries are provided for your reference. After row 50 of your general journal, start a new page by clicking on the page 2 tab at the bottom of your form, as shown. Continue to insert as many pages as you need to complete all of the transactions. If you have any questions, consult your teacher.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Time to Work

Complete the journal entries, posting, and trial balance for “Source Documents1”. Open the appropriate accounting forms and save them in your FIN1020 Course Folder as final journal, final ledger, and final trial balance (respectively) for your teacher to mark. You may refer to any of the preceding projects and/or training rooms to complete your work.

When you are finished, complete the Audit Test, and save it in your FIN1020 Course Folder as Final Audit Test. An audit test is a sampling of numbers in your accounting records to check for accuracy.

Refer to the following rubrics for journal, posting, and trial balance to make sure you didn’t forget anything.

You might also find the following items helpful:

- Analyzing Transactions for help determining which side of the account is the increase or the decrease side

- Interactive Accounting Cycle to review any of the steps to completing your records

- Finding Trial Balance Errors if your trial balance does not balance

- Other exemplars and Excel® tips in your Toolkit.

Adapted from the Certified General Accountants Association of Alberta, School Accounting Modules.

1 School Accounting Modules published by the Certified General Accountants Association of Canada © 2008 CGA-Canada www.cga.org/canada. Reproduced with permission. All rights reserved. For updates of the CGA-Canada School Accounting Modules, check with www.cga-alberta.org.