Project 2

1. Project 2

1.12. Page 2

Project 2: Financial Statements

What Do I Need to Know?

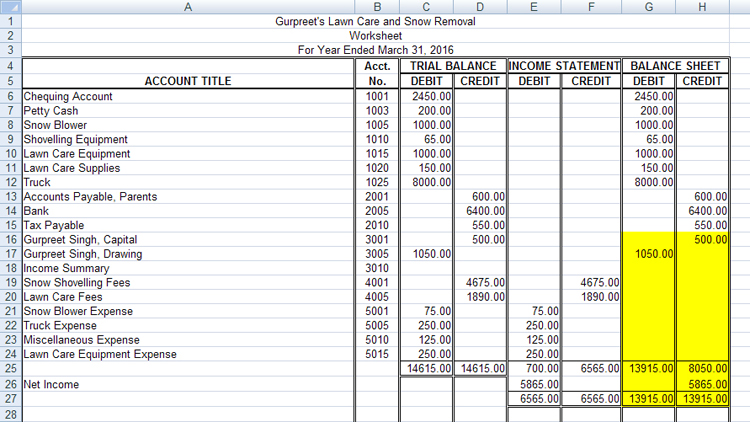

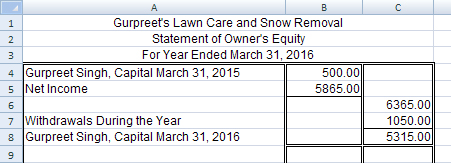

Look at this worksheet for Gurpreet’s Lawn Care and Snow Removal. The shaded portion of the worksheet is the section used to prepare the statement of owner’s equity.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Why Is This Important?

The balance sheet columns of the worksheet are the rough work needed to complete a formal statement of owner’s equity detailing the worth of the business. A business may have high profits or a high net income and still be in trouble financially. For example, if a business has excess debt, or higher liabilities than assets, the actual worth of the business would be decreasing. This statement allows a business to compare the worth of the business from one fiscal period to another with the expectation that owner’s equity or the worth of the business will increase over time. If a business was in trouble and declared bankruptcy, all of the assets would be liquidated and the creditors would have to be paid off before any money could be realized for the owner (or the shareholders, if a corporation).

What Do I Need to Do?

To complete the statement of owner’s equity you need to complete the following steps:

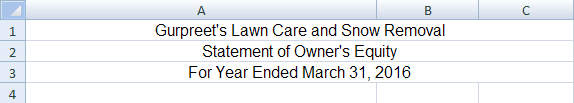

1. Heading

The name of the company is written first, then the name of the statement, and the date the statement is prepared appears last. This follows the same format as other financial statements you have completed.

- who: the name of the business

- what: the name of the statement

- when: the fiscal period of the statement

Remember that the date for this statement is for a period of time, not a single date.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Keep in mind that the date must be written in full as this is a formal statement. To review how to do this, view the Changing the Date video. This item is also available in the Toolkit.

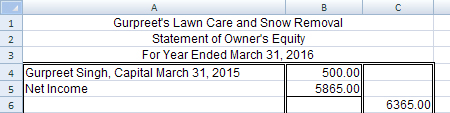

2. Adding Section

The form for the statement of owner’s equity is similar to the income statement form in that it has two columns. The first column is for the subtotals of the different sections, and the second column is for the totals only.

This section begins with the balance of the capital account at the beginning of the fiscal period and adds in any money that would increase the capital over the length of the fiscal period. In this case, Gurpreet Singh’s capital on March 31, 2015, was $500.00. This is the amount of the capital from the worksheet.

There are only two things that would increase capital: net income for the fiscal period and/or money that the owner has invested into the business (money from the owner’s personal money transferred into his or her business).

Gurpreet did not invest any money into his business during this year, but he did have a net income of $5,865.00 that needs to be added as shown below. The net income can be taken from the worksheet or from the income statement, as this is the same number. Notice that there is a total line before the total and that the total addition is placed in the second column.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

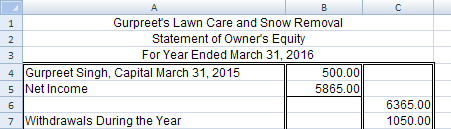

3. Subtracting Section

There are only two things that would decrease capital: a net loss for the fiscal period and/or money that the owner has withdrawn from the business.

Gurpreet did not have a net loss, but he did withdraw $1050.00, which is shown on his worksheet. Remember that when the owner withdraws money from the business, it is entered into the drawing account. Again, the total amount to be subtracted is placed in the second column.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Important Note: Notice that there is never a negative sign in accounting. Negative amounts are indicated by words, such as loss or withdrawal.

4. Ending Balance

To calculate the ending capital balance, the total in the subtract section is subtracted from the total in the add section. This amount must be the same as in the balance sheet prepared at the end of the fiscal period; therefore, the ending balance provides a good way to double-check your work.

Microsoft product screen shot(s) reprinted with permission from Microsoft Corporation.

Notice that, as in the income statement, there is a single rule before every total and a double rule to indicate that the numbers are believed to be correct and that everything is complete. Only three totals are placed in the second column:

- total additions

- total subtractions

- ending capital

You may want to refer to the Statement of Owner’s Equity Rubric, which includes a checklist of what belongs in the statement of owner’s equity when completing your practice and assignments.

There is also a Statement of Owner’s Equity Exemplar for your reference. The rubric and the exemplar are also available in the Toolkit.