Unit Three- Financial Choices

3. Lesson Three: Saving Your Money

- saving money will give you more options in the future

- saving money is a wise choice for all people

- young people benefit the most from saving money

|

Introduction

|

|

|

|

What would you like to do in the future? Attend a post-secondary institution? Travel abroad? Own your own home? Own your own vehicle? Saving money now will help you have more choices in your future. In this lesson, you will learn about the many reasons to save, plus you will discover how a little money saved early in your life can mean big bucks in your future! |

Grasshopper or Ant? Spender or Saver? |

|

|

|

Have you heard the story about the carefree grasshopper and the hard-working ant? All summer the grasshopper relaxed in the sun and enjoyed the warm days while the ant worked steadily to build a home and to store food for the winter. When the winter came, the ant enjoyed a warm home and food and the grasshopper... well, you get the picture. What do you see of yourself in this tale? When it comes to handling money, are you the ant - saving for the future - or the grasshopper - enjoying the moment? Or a bit of both? |

|

|

|

Try this quiz to find out what kind of spender or saver personality you have.

1. I spend most of my money on:

2. How often do I make deposits on my savings account?

|

|

3. How often do I make withdrawals from my savings account?

4. When I get money do I:

|

|

5. When I spend my money on something big, I feel:

6. Do I lend money?

7. How often do I borrow money?

8. What would I do if I won or was given a large sum of money, say $25,000?

|

|

9. Of the following, which would I buy first?

10. How often do I discuss my money with my family?

11. Which of the following describes me best?

12. Which statement best describes me?

13. Which statement best describes my spending habits?

14. Which statement best describes my shopping habits?

Add up your score, and find out what kind of spender / saver personality you have!

|

1. |

a. 0 |

b. 1 |

c. 4 |

d. 3 |

e. 2 |

|

2. |

a. 3 |

b. 2 |

c. 1 |

d. 0 |

e. 4 |

|

3. |

a. 2 |

b. 1 |

c. 0 |

d. 4 |

e. 3 |

|

4. |

a. 4 |

b. 0 |

c. 3 |

d. 1 |

e. 2 |

|

5. |

a. 2 |

b. 4 |

c. 3 |

d. 1 |

e. 0 |

|

6. |

a. 4 |

b. 2 |

c. 3 |

d. 0 |

e. 1 |

|

7. |

a. 2 |

b. 1 |

c. 4 |

d. 3 |

e. 0 |

|

8. |

a. 1 |

b. 3 |

c. 0 |

d. 4 |

e. 2 |

|

9. |

a. 0 |

b. 3 |

c. 4 |

d. 1 |

e. 2 |

|

10. |

a. 3 |

b. 4 |

c. 1 |

d. 2 |

e. 0 |

|

11. |

a. 4 |

b. 3 |

c. 2 |

d. 1 |

e. 0 |

|

12. |

a. 2 |

b. 1 |

c. 0 |

d. 3 |

e. 4 |

|

13. |

a. 1 |

b. 3 |

c. 0 |

d. 2 |

e. 4 |

|

14. |

a. 2 |

b.1 |

c. 0 |

d. 3 |

e. 4 |

Spending / Saving Personalities |

|

|

43 - 46 points |

You have strong symptoms of being a miser. Saving money may be an obsession with you and you may be sacrificing more worthwhile things like friendship and happiness. You can control your life in better ways than stockpiling money. Having lots of money does not make a person better. |

|

35 - 42 points |

You are the very cautious saver, one who may have a tendency to be stingy. Although you may always be worrying about not having enough money for the future, money is not an obsession. However, if going without makes you unhappy now, perhaps you may want to rethink why you are saving. |

|

21 - 34 points |

You are a wise planner. You have a well-balanced attitude towards spending and saving money. You spend carefully on things important to you. You most likely have good decision-making skills too. |

|

10 - 19 points |

You are somewhat of a high roller. You spend a lot and save little. You are, however, a sharer; but sometimes you use money to make an impression on others. A frequently empty bank account means you need to look at better money management and decision-making techniques. |

|

0 - 9 points |

You are a confirmed spender. Money is easy-come, easy-go. You can be self-indulgent and usually buy on impulse. You may keep trying to get a grip on things, but nothing seems to work. Counselling on money management and decision making is a good idea for you. |

SAVINGS

The difference between the money you earn and the money you spend is called

savings.

Regardless of how little you earn, it is a good idea to begin a regular savings

program early. By doing this, you will develop the habit of saving as a regular

part of your financial planning, and will have less difficulty later.

Your savings

aid the economy

Your savings dollars aid you in satisfying your short- and long- term needs and

wants. At the same time, while you are waiting for your savings to grow, other

individuals, businesses and governments are using your dollars to fulfill their

goals. They, in turn, pay interest for the use of your money, part of which

goes to you.

Without savings from you, and thousands of people like you, financial

institutions would not have money available to lend.

Without borrowed capital funds, most Canadian businesses would not be able to

pay the costs of formation, buy the many goods and services necessary for

production, expand their operations, explore for resources, research new

products, and pay salaries to workers.

The money you save is important in the over-all economic scene.

Why do people

save?

People save money for a number of different reasons.

• Emergencies— Have you ever heard the old saying—”Saving for a rainy day”?

Rainy days can happen to any individual, family or business. Accidents, illness

and even death can strike at any time. In addition, there are repairs to

automobiles, home repairs, appliance repairs, etc. One means of protecting

against losses caused by emergencies is insurance. But insurance doesn’t always

cover the total loss, nor does it cover all emergencies. Savings would

certainly help meet expenses during an emergency.

• Future needs— Many people save money to help pay for education. Parents set

aside money for their children’s education and other future needs. Many people

save money during their working years to provide for their needs and wants after

retirement. People save for holidays, a new car, a new home—both for the short

and the long term.

• Opportunities— Some people use their savings account to take advantage of

opportunities that may arise. These could take the form of covering the expenses

of beginning a better job elsewhere, starting one’s own business or becoming a

partner in one, purchasing real estate, and many others.

Goals

Your savings goals can be either short-term or long-term. A short- term goal is

one for the purchase of a fairly inexpensive item within a short period of

time. For example, Gerald is a Grade 12 student who will be incurring several

graduation expenses in June. In September, Gerald estimated that graduation

would cost approximately $525. His estimate included the cost of a new suit,

shirt, tie, shoes, school yearbook, graduation photo, ticket to the Senior Prom

and miscellaneous item fund.

Gerald has been saving $60 a month from his

allowance and part-time job since September. By June, he should have enough to cover graduation expenses

plus a bit to spare.

A long-term savings goal is for the purchase of an expensive item and usually requires saving for a year or more. For example, it is January, and Jay is a Grade 10 student at Southwood High School. Each year, his school plans a student trip during the March break. Next year, when Jay is in Grade 11, the trip will be to Orlando, Florida.

Jay would like to go, and his parents agree, if between them they can save the money. Jay and his parents sit down and from the information provided by the school, work out the following savings plan:

Costs:

Flight and accommodations (Cdn $1) (Includes bus transportation $543.00to and from Orlando area attractions including Disney World)

Departure tax 27.00

Service charge and tax 30.00

Meals and spending money 450.00

Allowance for price fluctuation 50.00

Total cost $1,100.00

Flight and accommodations (Cdn $1) (Includes bus transportation $543.00to and from Orlando area attractions including Disney World)

Departure tax 27.00

Service charge and tax 30.00

Meals and spending money 450.00

Allowance for price fluctuation 50.00

Savings:

From parents 400.00

From Jay 700.00

$1,000.00

Jay has a part-time job at local dry cleaners. During the school year he earns $30 per week and during the summer he earns $100 per week. He estimates that he can save $40 per week during the summer and $5.50 a week during the school year. He has calculated his savings as follows:

Savings from Jay

Summer (12 weeks x $40) 480.00

School year (40 weeks x $5.50) 220.00

Savings needed for trip $700.00

To give another example of a long-term savings goal, assume that when Jay was three years old, his parents decided to open a savings account to help cover the costs of his post-secondary education. Each month since then, they have been depositing the Family Allowance cheque into the account. By the time Jay graduates from high school, the accumulated savings, plus the interest earned, should go a long way to help defray costs should Jay decide to further his education.

• They can save it.

• They can invest it.

• They can give it away.

When people save money, they tend to hold on to it as money and earn interest. When people invest, they tend to look for other things to do with their money to enable it to grow in value more quickly. Investments can involve some kind of purchase whether it be real estate, art, stocks, or bonds.

Savings and investment choices are a form of consumer decision making. There are many options to choose from that range from starting a simple savings account to investing in mutual funds and stocks.

Mutual funds: a way of investing in which money of investors is pooled and used

to purchase a range of different stocks.

Stocks: shares of an incorporated company. People who purchase stocks own a

part of that company and will receive part of the profit.

The line between savings and investments is not as clear as some people think. In fact, except for savings which occurs in a penny jar or in a sock under a mattress, all savings are some form of investment. Money placed in any financial institution, such as a bank, is really being invested. It is being loaned to some other entity for its use, and a reimbursement is paid to the person who loaned the money. In the case of a bank, the reimbursement takes the form of interest being paid. In the case of investments, it is the dividend paid or the increase in the price of each share of the stock.

Investments can be viewed on a continuum with the most secure, the most safe, at one end and the riskiest, most chancy investments at the other end. Making a decision about where to place, or invest, money needs to take into consideration how much risk a person is willing to take with that money. “Risk” refers to the chance that the amount of money, the investment, may gain in value (through an increase in interest rates, amount of dividend, or increase in price of each share) or lose value through decrease in interest rate, decrease or lack of dividend, or a decrease in the price of each share.

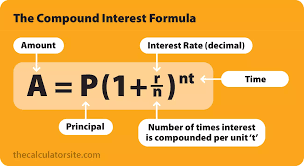

Compounding means earning interest both on your principal, or initial investment, and on the interest earned by that principal. Here’s how it works.

Monica begins at age 19 to invest $2000 annually

in an RRSP. She does this for eight years and receives 10%

interest compounded annually. At the end of the first year, her investment is

worth $2200 ($2000 + $200 interest). At the end of the second year, her

investment is worth $4620 ($2200 + $220 on her first year’s investment + $2000

+ $200 on her second year’s). And so on.

By the time Monica turns 40, the total of $16 000 she’s invested is worth $95 541, six times as much!

Compare this to what happens to Dan’s $2000 annual RRSP investment, which he initiates at age 27. At 40, he has invested a total of $28 000, which grows just over two times to $61 545.

Rule of 72

The Rule of 72 is a simple way to see how many years it will take to double the

money in art investment. Simply divide 72 by the annual interest rate of the

investment. Using this formula, you can very quickly calculate that a 10%

interest rate compounded annually will double your Investment in just over 7

years (72 — 10 = 72)

COMPOUNDING COMPARISON (10% RATE

OF RETURN)

Age Annual Investment Year-end Value

19 $2000 $2200

20 $2000 $4620

21 $2000 $7282

22 $2000 $10 210

23 $2000 $13 431

24 $2000 $16 974

25 $2000 $20 872

26 $2000 $25 159

27 $27 675

28 $30 442

29 $33 487

30 $36 835

COMPOUND IT- AND KNOW WHAT

YOU’RE DOING

The people who really win with their money are those who understand the power

of com pound interest. Compound interest is the money paid on the money and

interest you made the year before. That’s why the true power of compound

interest takes a few years to show itself off in its best style. For example,

if you invest $1 every year and leave it to compound, this is what happens:

FUTURE WORTH OF ONE DOLLAR INVESTED AT THE END OF EACH YEAR WITH INTEREST

PAYABLE AND REINVESTED AT THE END OF EACH YEAR

Year 1% 2% 3% 4% 5% 10%

1 1.00 1.00 1.00 1.00 1.00 1.00

2 2.01 2.02 2.03 2.04 2.05 2.10

3 3.03 3.06 3.09 3.12 3.15 3.31

4 4.06 4.12 4.18 4.25 4.31 4.64

5 5.10 5.20 5.31 5.42 5.53

So if, at the end of every year for 40 years, you put a dollar into an account

or investment that pays an interest rate of 5%, at the end of those 40 years

you get an amazing $120.80 for your efforts. Yet, $120.80 for a dollar a year

is not bad profit, considering you only invested $40. But who would bank one

dollar a year for 40 years?

The most important thing about this chart is the way you can really use it.

Let’s say you put away $8 a month - probably less than the cost of one movie.

That’s $96 a year. So at the end of the first year you will have $96. At the

end of Year Two you have $192.96 ($96 X 2.01). You get the multiplier amount from the chart that is based on a one dollar

amount and the 1% interest rate.

Let’s say that you cannot find any thing better than 1% interest. Well, by Year 5, at one movie’s worth a month, you’ll have $519.60 ($96 X 5.10) -not a bad sum of money for banking $8 a month for 5 years. You are not likely to miss the $8 each month. Just think of how much you spend a month- will $8 truly be missed?

But likely you will be able to find a savings account with better interest

-let’s say 2%. By putting away $10 a month, a total of $120 a year, you will

have saved $120 at the end of the first year. By the end of Year Two, at 2%,

you will have $242.40 (remember that the multiplier number takes into account

the fact that you have contributed another $120 in the second year).

Do the same thing - bank $10 a month for 4 years at 2%, and the total for your

efforts will be, and you will have $494.40, almost $500 savings without really

missing any big amount of money each month.

These are pretty short term amounts and investments. If you find a

savings/investment account at 5% for 5 years, and put $10 a month in it, at the

end of the term you will have $663.60. At ten years, you will have $1509.60!

Try doing the figuring yourself. Choose an amount you can bank each month. Find

the best interest-bearing account you can. Then calculate what your money will

be earning for you. You can even have the amount you have chosen to save

withdrawn directly from your chequing account and directly deposited into your

savings account each month. You can make this arrangement with your bank.

How do you get better interest rates? One way is to have the smaller amounts

that you have saved, let’s say $500 or $1000, moved into a higher

interest-bearing investment such as a GIC (Guaranteed Investment Certificate)

or Term Deposit. Usually you have to leave your money in such an investment for

a longer period of time but the interest rate is higher and your money is

working harder for you.

One loony will:

One loony will:

• roast 2 turkeys in your oven

• run your microwave oven for 12 hours

• let you play video games for 34 days, 2 hours per day

• operate a 1,500-wall portable electric heater for 10 hours

• operate your host-free (older model) fridge for two and a half days

• light 3 strings of outdoor mini-lights (25 lights per string) for 73 days, 4

hours per day

• light 3 strings of 5-watt outdoor Christmas lights (25 lights per string) for

10 days, 4 hours per day

• cook 5 batches of Boston Baked Beans in your slow cooker

• make 33 steaming loaves of bread in your bread maker

• let you watch 51 movies on your VCR/TV

• make 50 freshly-brewed pots of coffee

• run your electric drill for 50 hours

• humidify the air for 6 days

Note: This may vary from province to province

Finally, please read the attached article, "How to Save Money as a Teen."